Adidas (ADDYY, Financial) has announced a robust performance for the first quarter, showcasing a notable 17% rise in revenue from its brand, excluding the previous year's Yeezy sales, when assessed in currency-neutral terms. This growth was fueled by significant advances across all markets and distribution channels.

The company also achieved a 0.9 percentage point enhancement in its gross margin, reaching 52.1%. This improvement underscores the brand's ability to navigate a challenging economic landscape effectively.

Adidas recorded an operating profit of EUR 610 million, which corresponds to an operating margin of 9.9%. These figures reflect the company's strong market position and its promising potential for future growth.

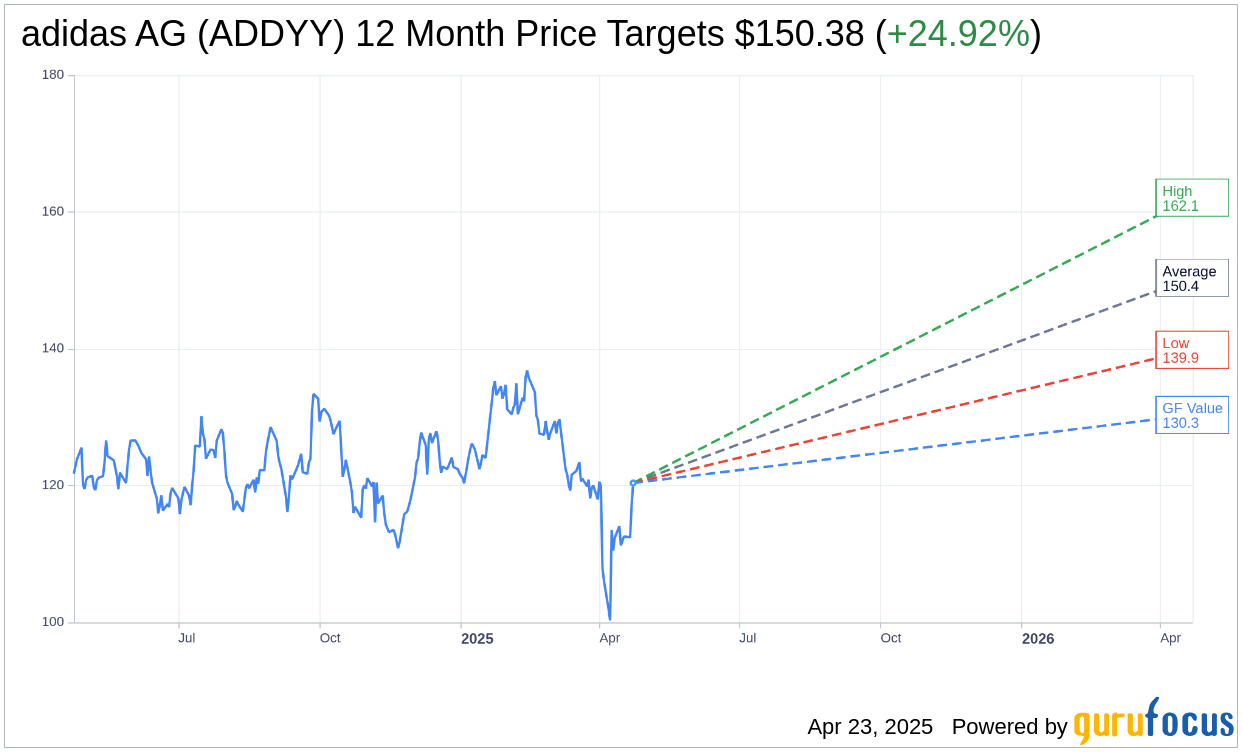

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for adidas AG (ADDYY, Financial) is $150.38 with a high estimate of $162.09 and a low estimate of $139.86. The average target implies an upside of 24.92% from the current price of $120.38. More detailed estimate data can be found on the adidas AG (ADDYY) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, adidas AG's (ADDYY, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for adidas AG (ADDYY, Financial) in one year is $130.33, suggesting a upside of 8.27% from the current price of $120.375. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the adidas AG (ADDYY) Summary page.