- Riot Platforms secures a $100 million credit facility with Coinbase Credit.

- Analysts project a potential price increase of nearly 120% for RIOT shares.

- Current brokerage recommendations suggest an "Outperform" status for Riot Platforms.

Riot Platforms (RIOT) has recently announced a significant financial maneuver by establishing a $100 million credit facility agreement with Coinbase Credit. This strategic move will empower Riot to access capital over the next two months, which can be utilized for strategic initiatives and general corporate purposes. The one-year term loan is backed by a portion of Riot's bitcoin holdings.

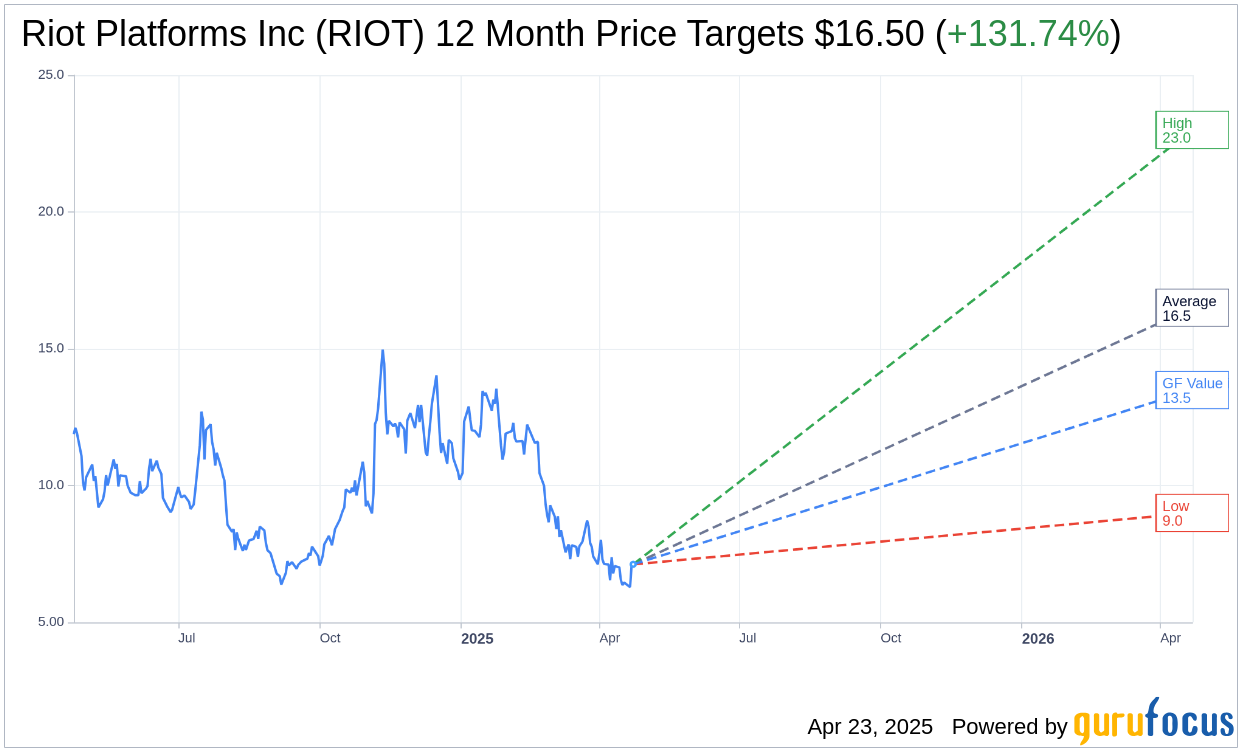

Wall Street Analysts Forecast

According to projections by 13 analysts, Riot Platforms Inc (RIOT, Financial) is anticipated to reach an average price target of $16.50 within a year, with high and low estimates pegged at $23.00 and $9.00, respectively. This average target represents a substantial upside potential of 119.96% from the current trading price of $7.50. Investors seeking in-depth projections can explore the Riot Platforms Inc (RIOT) Forecast page for more detailed data.

The consensus from 16 brokerage firms positions Riot Platforms Inc (RIOT, Financial) at an average recommendation of 1.9, which corresponds to an "Outperform" rating. The recommendation scale ranges from 1, indicating a Strong Buy, to 5, suggesting a Sell.

According to GuruFocus estimates, the estimated GF Value for Riot Platforms Inc (RIOT, Financial) in the coming year is $13.49. This estimate suggests a potential upside of 79.84% compared to the current price of $7.5012. The GF Value is a calculated figure representing the stock's fair value based on historical trading multiples, past business growth, and future business performance predictions. For additional insights, visit the Riot Platforms Inc (RIOT) Summary page.