Barclays has revised its outlook for Occidental Petroleum (OXY, Financial), reducing the price target from $58 to $46 while maintaining an Equal Weight rating. This adjustment comes as part of a broader first-quarter analysis into the oil and exploration sector, where significant attention is being paid to the overall economic climate.

The focus for investors will be on companies that exhibit resilience through lower break-even points and robust balance sheets, which provide a buffer against the challenges posed by a depressed oil price environment. Barclays has recently adjusted its oil price projections, setting lower expectations for the coming years. The bank now anticipates oil prices to average $60 per barrel in 2025 and $65 per barrel in 2026, expressing concerns about ongoing market uncertainties.

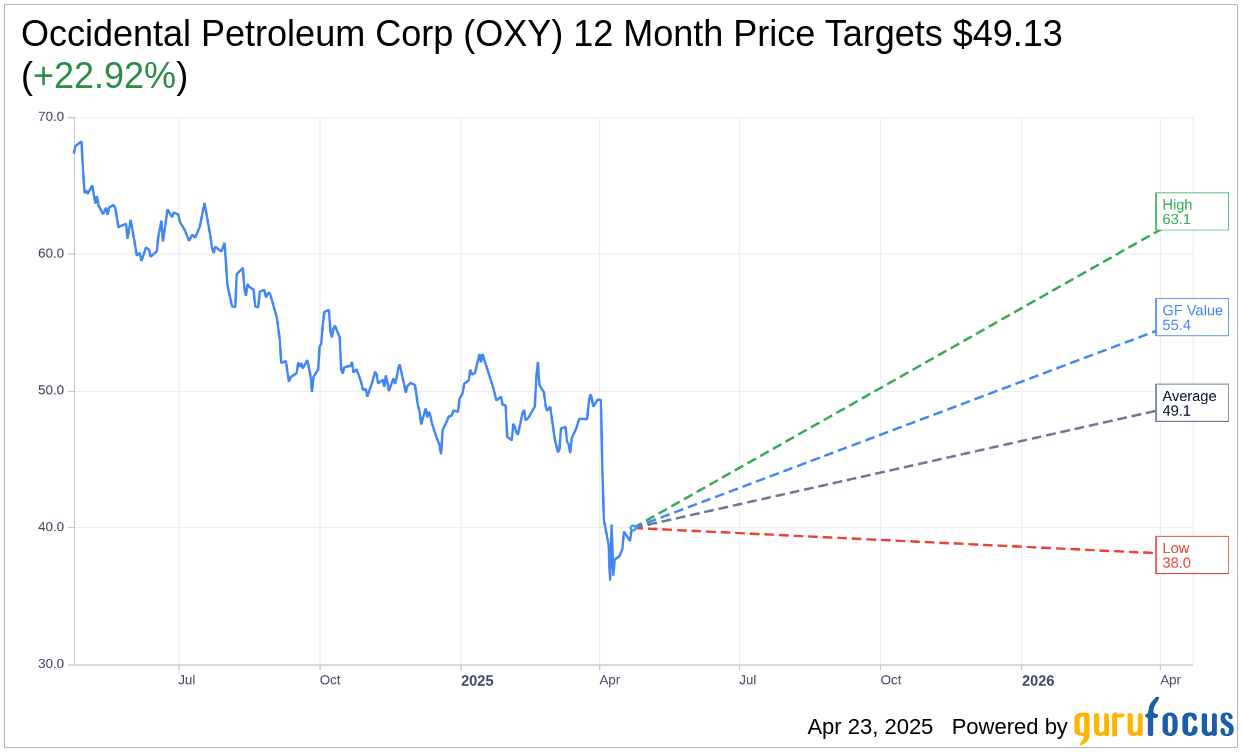

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for Occidental Petroleum Corp (OXY, Financial) is $49.13 with a high estimate of $63.11 and a low estimate of $38.00. The average target implies an upside of 22.92% from the current price of $39.97. More detailed estimate data can be found on the Occidental Petroleum Corp (OXY) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Occidental Petroleum Corp's (OXY, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Occidental Petroleum Corp (OXY, Financial) in one year is $55.38, suggesting a upside of 38.55% from the current price of $39.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Occidental Petroleum Corp (OXY) Summary page.