Vertiv Holdings Co (VRT, Financial) has projected its second-quarter revenue to be in the range of $2.33 billion to $2.38 billion, significantly surpassing market expectations of $2.27 billion. The anticipated growth reflects the company's robust performance amidst complex market dynamics.

In addition to revenue projections, Vertiv forecasts an adjusted operating margin of 18% to 19% for the same period. This projection underscores the company's commitment to operational excellence and its high-performance culture that drives results. Over the past three years, Vertiv has made significant operational and commercial improvements, strategically positioning itself to navigate through market challenges, including the current tariff environment.

The company is experiencing increased demand, particularly within the artificial intelligence infrastructure sector. Despite this growth, Vertiv sees itself in the early stages of fully realizing its potential. The leadership team remains focused on execution and enabling clients to stay ahead amid rapid market changes. This focus is expected to generate substantial long-term value for shareholders as the market continues to evolve and expand.

Wall Street Analysts Forecast

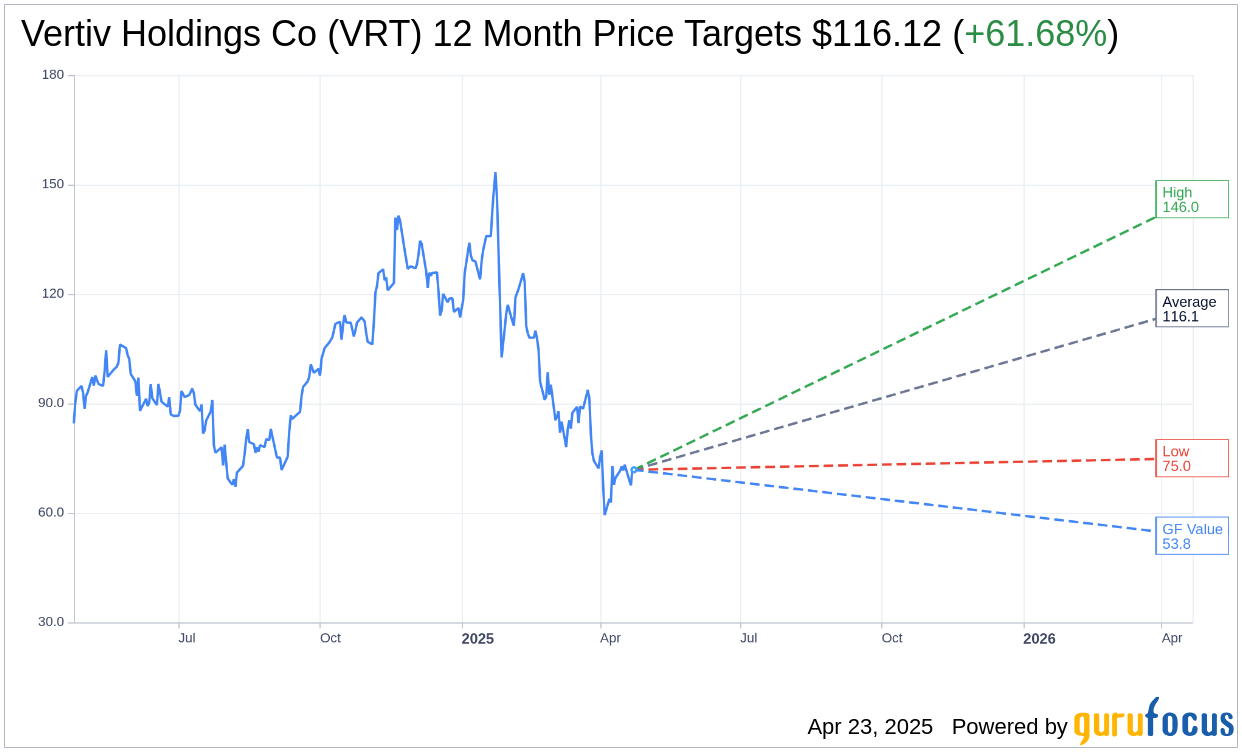

Based on the one-year price targets offered by 20 analysts, the average target price for Vertiv Holdings Co (VRT, Financial) is $116.12 with a high estimate of $146.00 and a low estimate of $75.00. The average target implies an upside of 61.68% from the current price of $71.82. More detailed estimate data can be found on the Vertiv Holdings Co (VRT) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Vertiv Holdings Co's (VRT, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Vertiv Holdings Co (VRT, Financial) in one year is $53.77, suggesting a downside of 25.13% from the current price of $71.82. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Vertiv Holdings Co (VRT) Summary page.