Weatherford International (WFRD, Financial) has announced its first-quarter revenue figures, meeting expectations with a total of $1.19 billion. This aligns with analysts' projections, despite facing significant market challenges across various regions including Mexico, the United Kingdom, and North America.

The company's leadership, under President and CEO Girish Saligram, highlighted that the past quarter was beset by market softening, impacting activity levels. Nevertheless, Weatherford focused on elements within its control to maintain financial performance in line with forecasts.

Weatherford is navigating an increasingly complex economic landscape marked by macroeconomic issues, global trade dynamics, and geopolitical tensions, affecting customer activity levels. In response, the company is intensifying efficiency and optimization initiatives to sustain its operations and prepare for potential future uncertainties.

Although customer activity is expected to decrease this year, Weatherford remains optimistic about its ability to enhance adjusted free cash flow conversion by 2025. This outlook supports its overarching goal of capital allocation. A strategic sell-off of its Pressure Pumping business in Argentina further illustrates its commitment to shifting towards a more capital-efficient business model, enhancing liquidity ahead of potential market shifts.

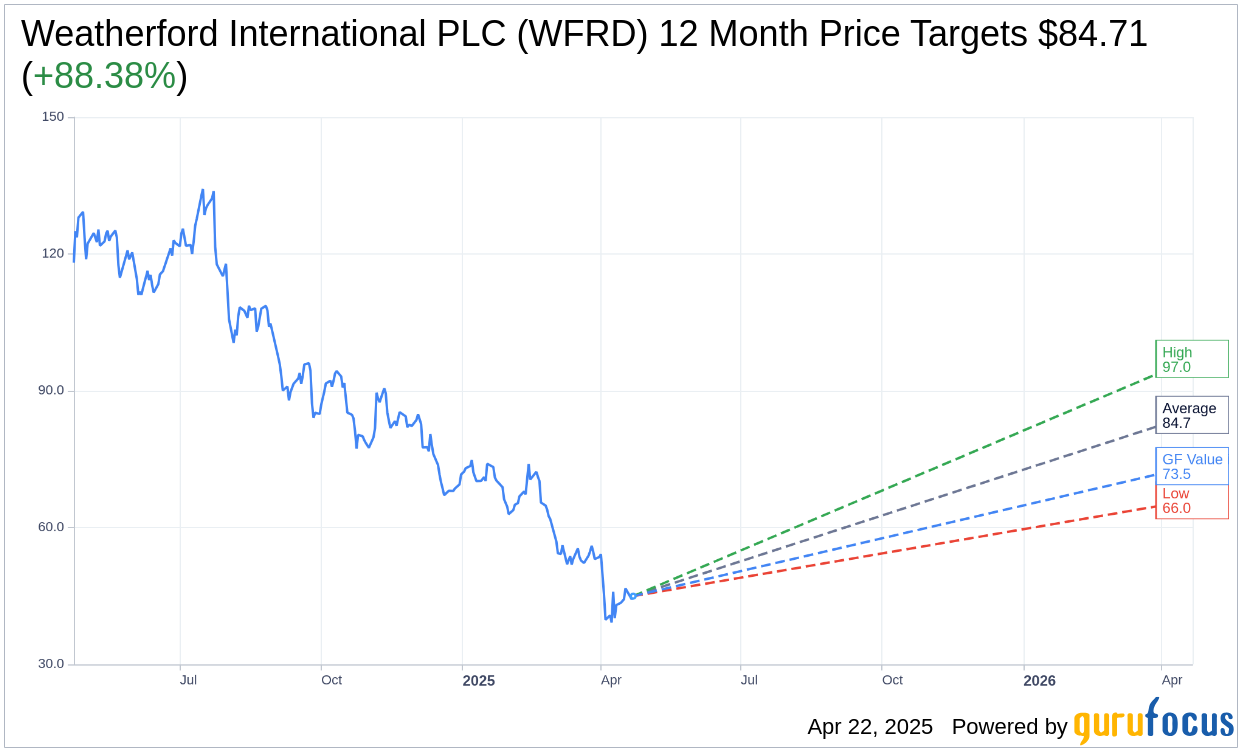

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Weatherford International PLC (WFRD, Financial) is $84.71 with a high estimate of $97.00 and a low estimate of $66.00. The average target implies an upside of 88.38% from the current price of $44.97. More detailed estimate data can be found on the Weatherford International PLC (WFRD) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Weatherford International PLC's (WFRD, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Weatherford International PLC (WFRD, Financial) in one year is $73.47, suggesting a upside of 63.38% from the current price of $44.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Weatherford International PLC (WFRD) Summary page.