Unity Biotechnology (UBX, Financial) reported a decrease in its cash, cash equivalents, and marketable securities, which totaled $16.9 million as of March 31. This is a decline from the $23.2 million reported at the end of the previous year, December 31, 2024.

Despite the decrease, Unity believes that its financial reserves are sufficient to sustain operations until the fourth quarter of 2025. This strategic assessment comes as the company continues to focus on the development of UBX1325, a drug with a unique mechanism of action, which has shown promising results in improving vision in patients unresponsive to conventional treatments over a 24-week period.

The company anticipates that the forthcoming 36-week data will play a crucial role in directing future research endeavors, as emphasized by Unity's leadership. This data will help in evaluating the potential of UBX1325 and determine the next steps in its clinical development pipeline.

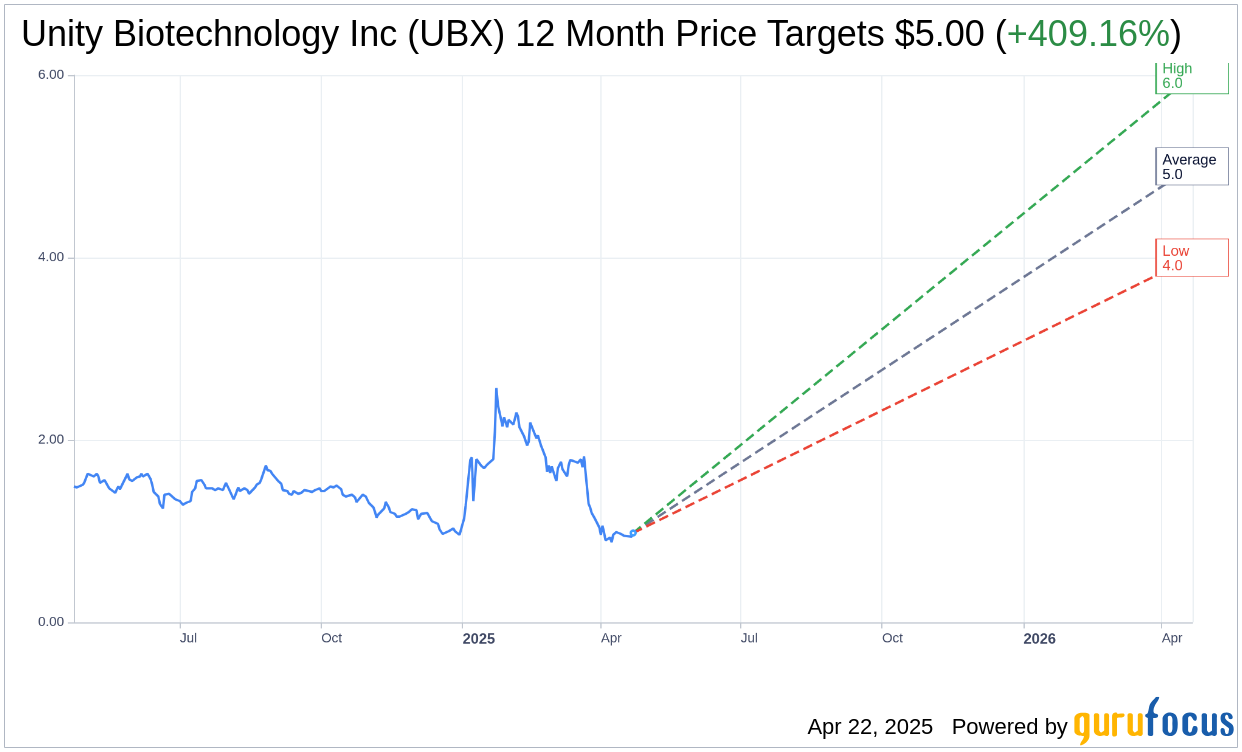

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Unity Biotechnology Inc (UBX, Financial) is $5.00 with a high estimate of $6.00 and a low estimate of $4.00. The average target implies an upside of 409.16% from the current price of $0.98. More detailed estimate data can be found on the Unity Biotechnology Inc (UBX) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Unity Biotechnology Inc's (UBX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.