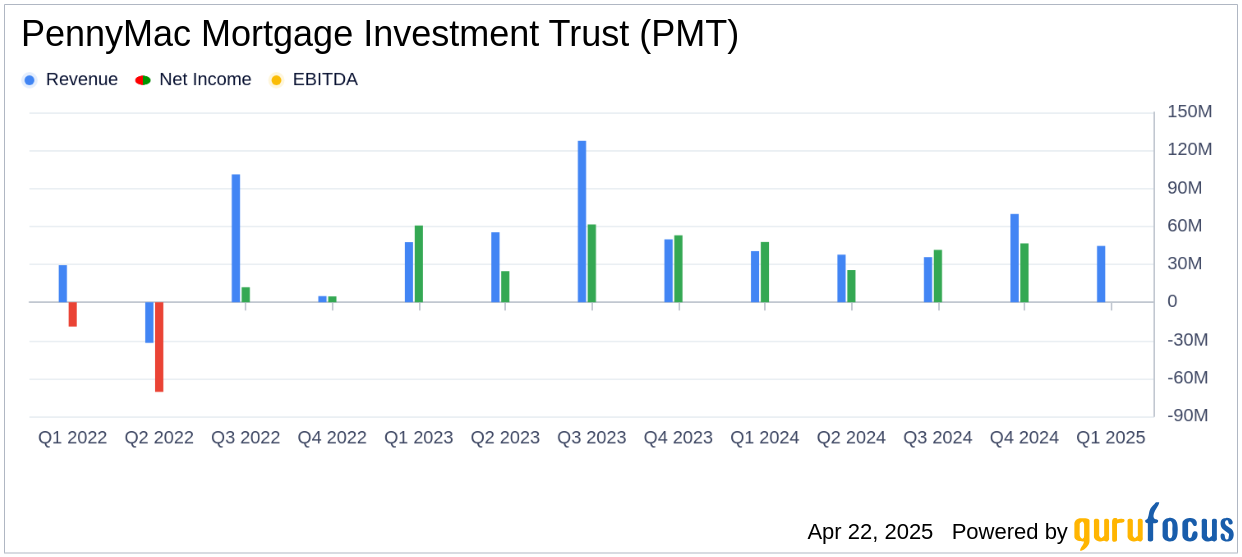

PennyMac Mortgage Investment Trust (PMT, Financial) released its 8-K filing on April 22, 2025, reporting a net loss attributable to common shareholders of $0.8 million, or $(0.01) per common share for the first quarter of 2025. This result falls short of analyst estimates, which anticipated earnings per share of $0.39. The company also reported net investment income of $44.5 million, significantly below the estimated revenue of $92.67 million.

PennyMac Mortgage Investment Trust is a specialty finance company that invests primarily in residential mortgage loans and mortgage-related assets. The company operates through three segments: correspondent production, credit-sensitive strategies, and interest-rate-sensitive strategies.

Performance and Challenges

The first quarter of 2025 presented significant challenges for PennyMac Mortgage Investment Trust, primarily due to interest rate volatility and credit spread widening. These factors led to fair value declines that offset strong levels of income excluding market-driven value changes. The company's book value per common share decreased to $15.43 from $15.87 at the end of 2024.

The company's performance is crucial as it reflects the broader market conditions affecting mortgage REITs, which are sensitive to interest rate changes. The challenges faced by PMT highlight the potential risks in the mortgage investment sector, particularly in periods of economic uncertainty.

Financial Achievements

Despite the challenges, PMT demonstrated strong access to capital markets by issuing $173 million in unsecured senior notes, which strengthened its balance sheet and extended its debt maturity profile. Additionally, the company executed three securitizations of investor loans totaling $1 billion in unpaid principal balance (UPB), retaining $94 million in investments at attractive returns.

“PMT produced strong levels of income excluding market-driven value changes in the first quarter,” said Chairman and CEO David Spector. “This strong core performance was offset by net fair value declines due to interest rate volatility and credit spread widening.”

Segment Performance

The Credit Sensitive Strategies segment reported a pretax income of $1.1 million on net investment income of $1.2 million, a significant decrease from the prior quarter's pretax income of $20.1 million. This decline was primarily due to net losses on investments, including $1.8 million of losses on PMT’s organically-created GSE CRT investments.

The Interest Rate Sensitive Strategies segment experienced a pretax loss of $5.5 million on net investment income of $19.7 million, compared to a pretax income of $25.5 million in the previous quarter. This segment faced losses from net loan servicing fees and fair value declines on MSRs due to lower interest rates.

The Correspondent Production segment generated a pretax income of $10.1 million, down from $22.5 million in the prior quarter. The segment's performance was impacted by a 20% decrease in correspondent loan production volumes.

Key Financial Metrics

PMT's net interest income for the Credit Sensitive Strategies segment totaled $1.4 million, while the Interest Rate Sensitive Strategies segment reported a net interest expense of $15.4 million. The Correspondent Production segment's revenues were $21.2 million, including net gains on loans acquired for sale of $12.3 million.

These metrics are critical for understanding PMT's financial health and operational efficiency, as they provide insights into the company's ability to generate income from its core activities and manage its expenses effectively.

Analysis and Outlook

PennyMac Mortgage Investment Trust's first-quarter results underscore the challenges faced by mortgage REITs in a volatile interest rate environment. The company's ability to navigate these challenges through strategic capital market activities and securitizations is noteworthy. However, the significant decline in net income and revenue compared to analyst estimates highlights the need for cautious optimism moving forward.

Investors and stakeholders will be closely monitoring PMT's performance in the coming quarters, particularly its ability to manage interest rate risks and capitalize on investment opportunities in a rapidly changing market landscape.

Explore the complete 8-K earnings release (here) from PennyMac Mortgage Investment Trust for further details.