In its first quarter of 2025, (ticker) outperformed expectations by reporting a revenue of $18.3 million, surpassing the anticipated $15.58 million. The company's tangible book value per share was recorded at $10.78, highlighting its strong financial position.

The Common Equity Tier 1 (CET1) capital ratio stood at 12.27%, reflecting the company's robust capital adequacy. Notably, the net interest margin saw an increase of eight basis points, reaching 2.49% compared to the previous quarter, marking the third consecutive quarter of growth in net interest income.

The company attributes this growth to its diversified core deposit base and strategic management of funding costs. Core deposits rose by $70.2 million, a 4.5% increase, accounting for 70% of the total deposits. Meanwhile, the loan-to-deposit ratio saw a decline to 89.3%, indicating improved financial health. Furthermore, average funding costs decreased by four basis points during the quarter.

(Ticker) plans to continue leveraging its liability-sensitive balance sheet to sustain its net interest margin growth while maintaining a disciplined approach towards funding costs. This strategic focus is expected to further bolster the company's financial performance in the coming quarters.

Wall Street Analysts Forecast

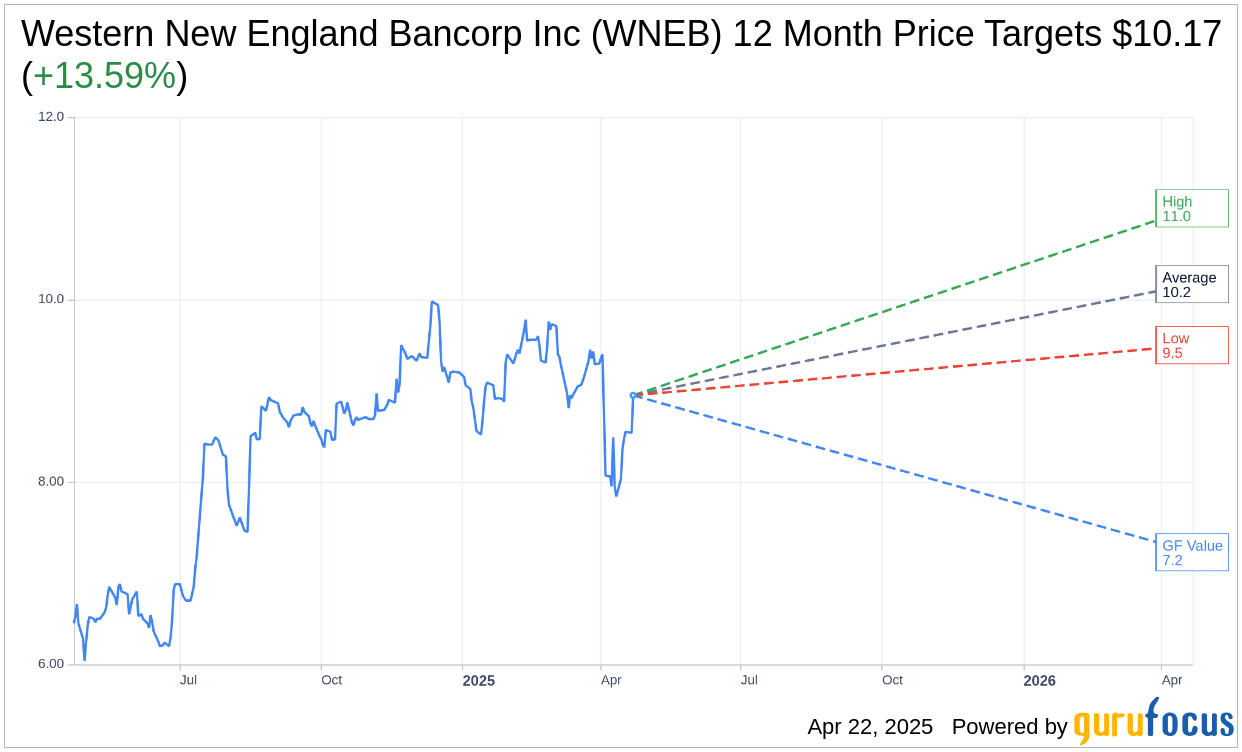

Based on the one-year price targets offered by 3 analysts, the average target price for Western New England Bancorp Inc (WNEB, Financial) is $10.17 with a high estimate of $11.00 and a low estimate of $9.50. The average target implies an upside of 13.59% from the current price of $8.95. More detailed estimate data can be found on the Western New England Bancorp Inc (WNEB) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Western New England Bancorp Inc's (WNEB, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Western New England Bancorp Inc (WNEB, Financial) in one year is $7.23, suggesting a downside of 19.22% from the current price of $8.95. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Western New England Bancorp Inc (WNEB) Summary page.