Pega Systems Inc. (PEGA, Financial) has reported impressive financial results for the first quarter of 2025, significantly exceeding market expectations. The company achieved a revenue of $475.6 million, far surpassing the consensus estimate of $357.0 million. This success underscores the impact of its innovative offerings and strategic focus.

Pega's CEO, Alan Trefler, credited the strong performance to the transformative capabilities of PegaGenAI. This advanced solution has revolutionized the company's interaction with clients, assisting them in fast-tracking their digital and legacy transformation initiatives. The integration of AI solutions has been a cornerstone of Pega's strategy, enabling clients to achieve their goals more efficiently.

Moreover, the firm experienced accelerated growth in its Annual Contract Value (ACV) and achieved record levels of free cash flow during the quarter. According to Ken Stillwell, Pega's COO and CFO, these outcomes highlight the advantages of their subscription-based model. Operating under the "Rule of 40" framework, Pega aims to balance accelerated growth with profitability, ensuring that the company can return capital to its shareholders in a sustainable manner.

Overall, Pega Systems continues to demonstrate its capability to drive significant value for both clients and shareholders through its innovative technology solutions and strategic financial management.

Wall Street Analysts Forecast

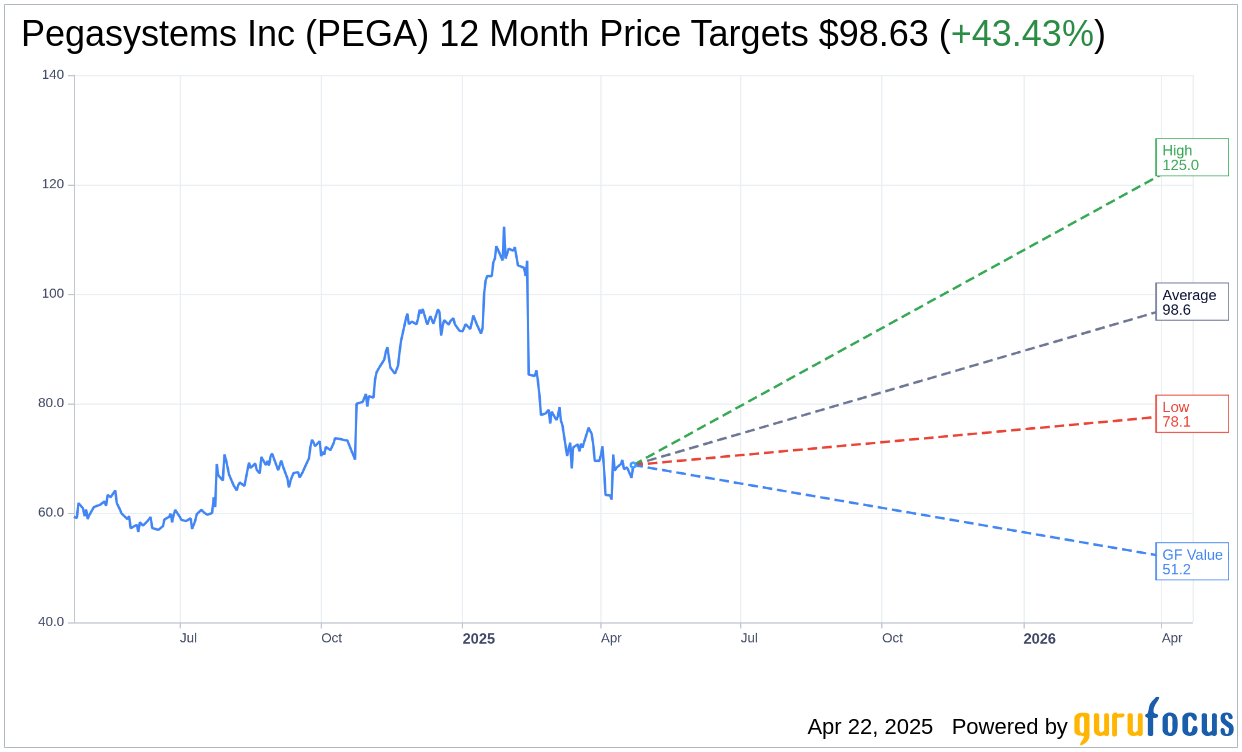

Based on the one-year price targets offered by 12 analysts, the average target price for Pegasystems Inc (PEGA, Financial) is $98.63 with a high estimate of $125.00 and a low estimate of $78.12. The average target implies an upside of 43.43% from the current price of $68.76. More detailed estimate data can be found on the Pegasystems Inc (PEGA) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Pegasystems Inc's (PEGA, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Pegasystems Inc (PEGA, Financial) in one year is $51.16, suggesting a downside of 25.6% from the current price of $68.76. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Pegasystems Inc (PEGA) Summary page.