- Medpace Holdings, Inc. (MEDP, Financial) shows significant revenue growth despite challenges in net awards and book-to-bill ratio.

- Analysts project a promising upside for MEDP with an average price target indicating potential gains.

- The company's stock is currently rated as a "Hold," but GF Value predictions suggest a potential undervaluation.

Medpace Holdings, Inc. (MEDP) has faced some hurdles in its latest financial quarter, yet its overall performance demonstrates resilience. In the first quarter of 2025, MEDP reported a sequential and annual decline in net awards, with a book-to-bill ratio standing at 0.90. Despite these challenges, the company showed robust financial health by generating $558.6 million in revenue, marking a notable 9.3% increase from the previous year. Consequently, Medpace updated its 2025 revenue guidance to a promising range of $2.14 billion to $2.24 billion.

Wall Street Analysts Forecast

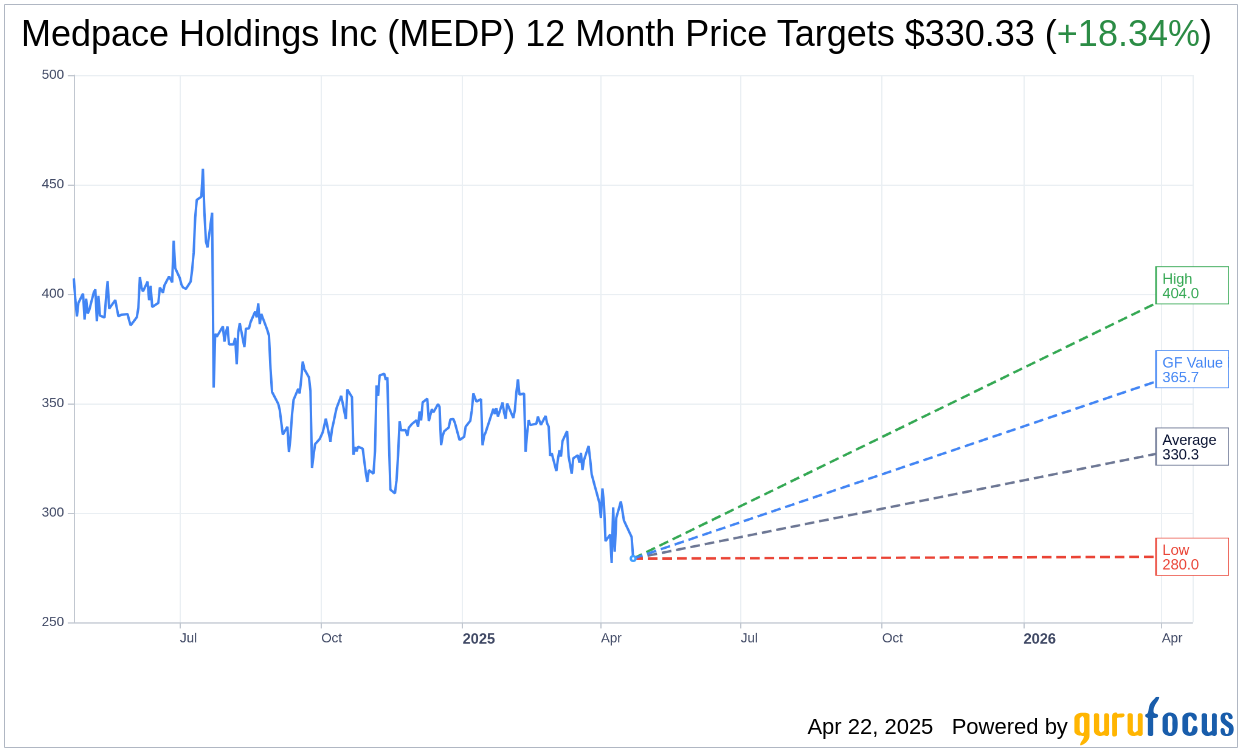

The sentiment among analysts remains optimistic for Medpace Holdings Inc (MEDP, Financial). Based on one-year price targets from 10 analysts, the average target price lands at $330.33. This reflects an estimated upside of 16.47% from the current share price of $283.63. Notably, these projections span a range, with the highest estimated target reaching $404.00 and the lowest at $280.00. Investors can explore more detailed data at the Medpace Holdings Inc (MEDP) Forecast page.

The consensus from 11 brokerage firms assigns Medpace Holdings Inc (MEDP, Financial) an average brokerage recommendation of 2.6, categorizing it as a "Hold." This rating scale, ranging from 1 to 5, provides investors with insight, with 1 representing a Strong Buy and 5 indicating a Sell.

In terms of valuation, GuruFocus estimates the GF Value for Medpace Holdings Inc (MEDP, Financial) at $365.69 for the upcoming year. This suggests a potential upside of 28.93% from the current trading price of $283.63. The GF Value metric reflects GuruFocus' assessment of the fair market value based on the stock's historical multiples, historical and projected business growth, and future performance estimates. Investors seeking more extensive data can visit the Medpace Holdings Inc (MEDP) Summary page.