- Evercore ISI favors Texas Instruments (TXN, Financial) and Microchip Technology (MCHP) for their competitive advantages.

- TXN’s lean chip inventories and MCHP’s attractive valuation are key factors for optimism.

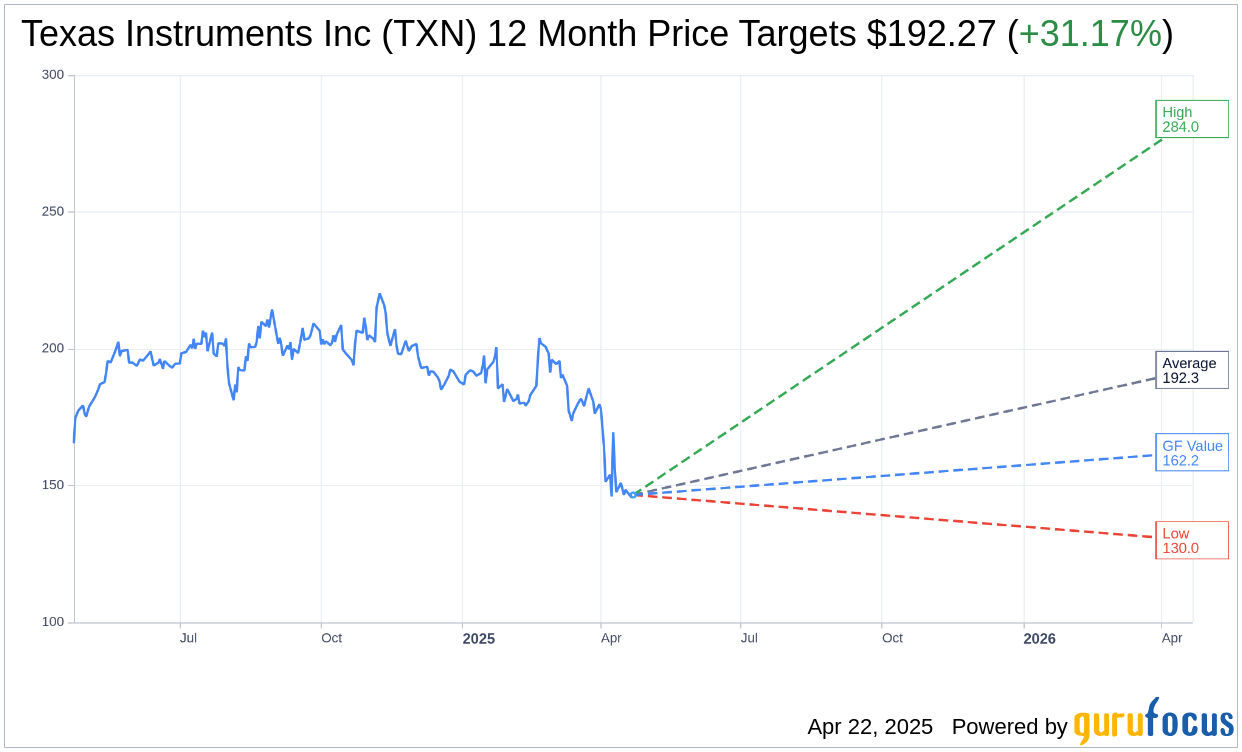

- Analysts anticipate significant upside potential for TXN with price targets indicating robust growth.

Evercore ISI's Strategic Preferences

With the earnings season on the horizon, Evercore ISI has spotlighted Texas Instruments (TXN) and Microchip Technology (MCHP) as preferred players in the analog semiconductor sector. Their analysis underscores TXN's efficient inventory management and MCHP's appealing market valuation, leading to a positive outlook with Outperform ratings. The firm has set ambitious price targets: $148 for TXN and $39 for MCHP, reflecting their confidence in both companies.

Wall Street Analysts' Projections

According to projections from 27 market analysts, the average one-year price target for Texas Instruments Inc (TXN, Financial) is set at $192.27. This forecast suggests a remarkable potential upside of 31.17% from the current trading price of $146.58. Analysts have placed high and low estimates at $284.00 and $130.00, respectively, showcasing varied perspectives on the stock’s potential.

Brokerage Firm Insights

The consensus among 36 brokerage firms points to a moderate stance with an average recommendation of 2.8, depicting a "Hold" status for TXN. This average rating, situated on a scale from 1 (Strong Buy) to 5 (Sell), signifies a cautious yet stable outlook from the investment community.

GuruFocus Valuation

On the valuation front, GuruFocus provides an estimated GF Value for TXN at $162.17 over the next year. This valuation indicates a potential gain of 10.64% from its current price of $146.58. The GF Value reflects a comprehensive estimate of the stock's fair value, derived from historical trading multiples, past growth trajectories, and future business prospects. For more nuanced insights, investors can explore the Texas Instruments Inc (TXN, Financial) Summary page on GuruFocus.