Investment firm Susquehanna has revised its price target for Devon Energy (DVN, Financial), lowering it from $52 to $41 while maintaining a Positive rating on the stock. This adjustment reflects updated expectations for future oil prices and broader market trends.

Susquehanna has decreased its 2025 oil price projection to approximately $68 per barrel and adjusted its long-term forecast for 2026 to $67 per barrel. These changes come in response to tariff impacts, which have diminished global demand forecasts and contributed to a decline in oil prices at the start of the second quarter. Additionally, growing concerns over a potential recession have exerted further downward pressure on oil values.

Moreover, the global oil market is responding to significant supply shifts as OPEC+ begins to reverse its 2.2 million barrels per day of voluntary production cuts this April. The return of this supply is anticipated to introduce additional challenges to the market dynamics.

Wall Street Analysts Forecast

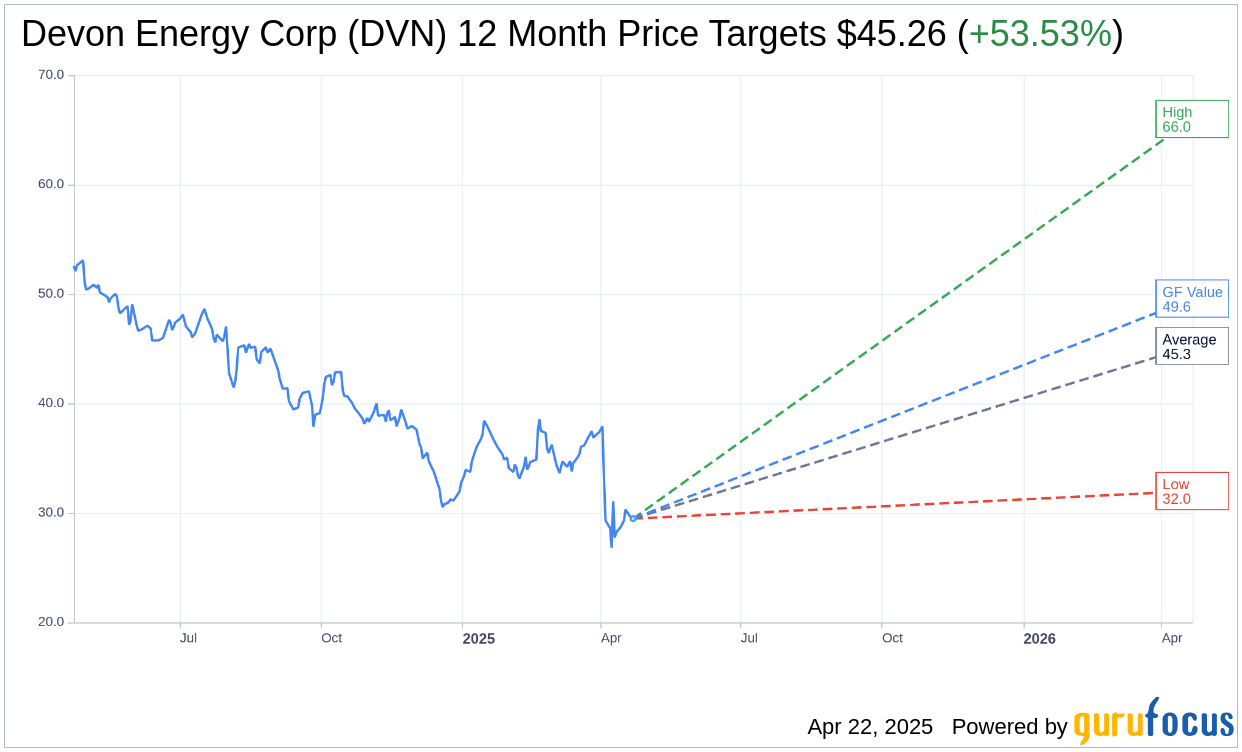

Based on the one-year price targets offered by 29 analysts, the average target price for Devon Energy Corp (DVN, Financial) is $45.26 with a high estimate of $66.00 and a low estimate of $32.00. The average target implies an upside of 53.53% from the current price of $29.48. More detailed estimate data can be found on the Devon Energy Corp (DVN) Forecast page.

Based on the consensus recommendation from 31 brokerage firms, Devon Energy Corp's (DVN, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Devon Energy Corp (DVN, Financial) in one year is $49.59, suggesting a upside of 68.22% from the current price of $29.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Devon Energy Corp (DVN) Summary page.