Truist Securities has revised its price target for Packaging Corp. of America (PKG, Financial), reducing it to $238 from the previous $265, while maintaining a Buy rating. This adjustment comes as market multiples have tightened recently, driven by worries about the impact of tariffs and the possibility of an economic downturn caused by weakening consumer demand. These factors have prompted analysts to reevaluate their projections, indicating a cautious stance in the face of potential market challenges.

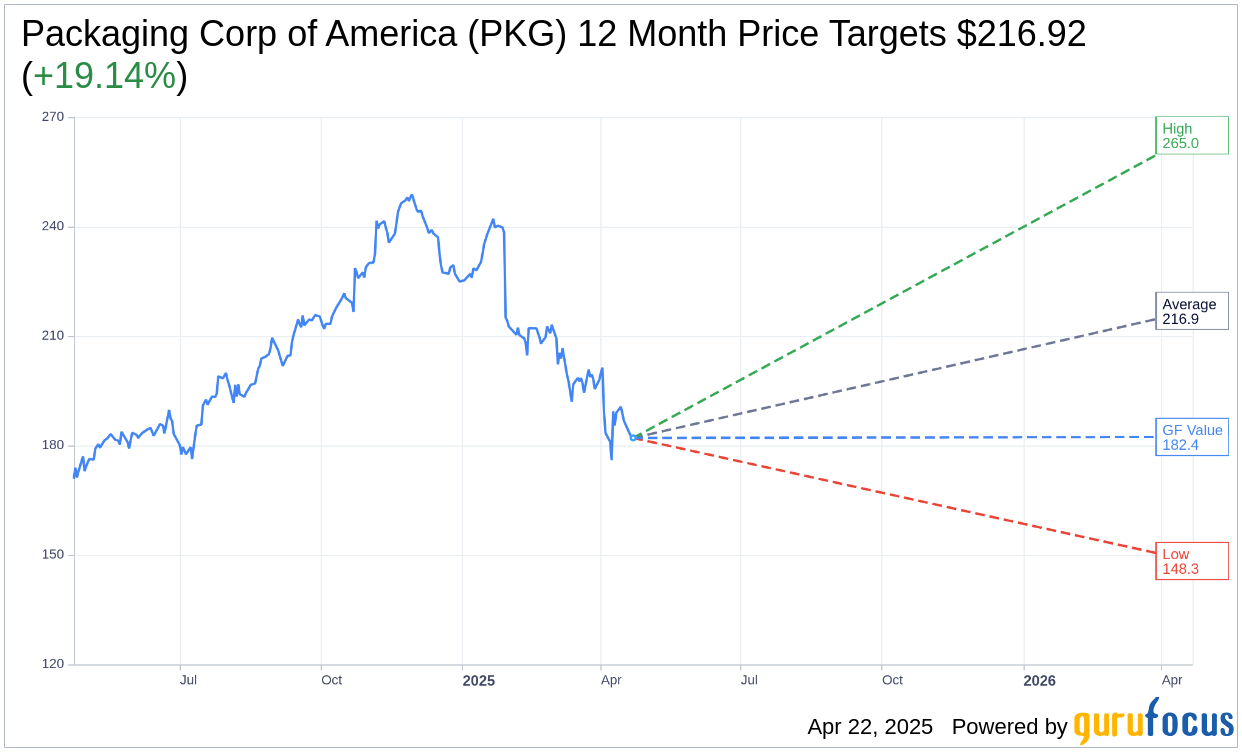

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Packaging Corp of America (PKG, Financial) is $216.92 with a high estimate of $265.00 and a low estimate of $148.34. The average target implies an upside of 19.14% from the current price of $182.07. More detailed estimate data can be found on the Packaging Corp of America (PKG) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Packaging Corp of America's (PKG, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Packaging Corp of America (PKG, Financial) in one year is $182.36, suggesting a upside of 0.16% from the current price of $182.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Packaging Corp of America (PKG) Summary page.