Omnicom Media Group, the media services segment of Omnicom (OMC, Financial), is streamlining its worldwide influencer marketing efforts by aligning them under the Creo brand. This strategic move embeds the "influencers as a media channel" framework as a central component of the company's global approach to influencer marketing.

With this consolidation, Omnicom aims to enhance client offerings across all markets by leveraging Creo's pioneering data partnerships within the influencer landscape. This initiative addresses the challenges of achieving business results and effective measurement in a fragmented market.

Creo's strategy utilizes data from Omni, Omnicom's open operating system supporting all its agencies, to enhance creator discovery and improve planning and measurement precision. This integrated approach aims to forge stronger, more direct connections between creators and consumer actions, ultimately enhancing the effectiveness of influencer strategies for Omnicom's clients.

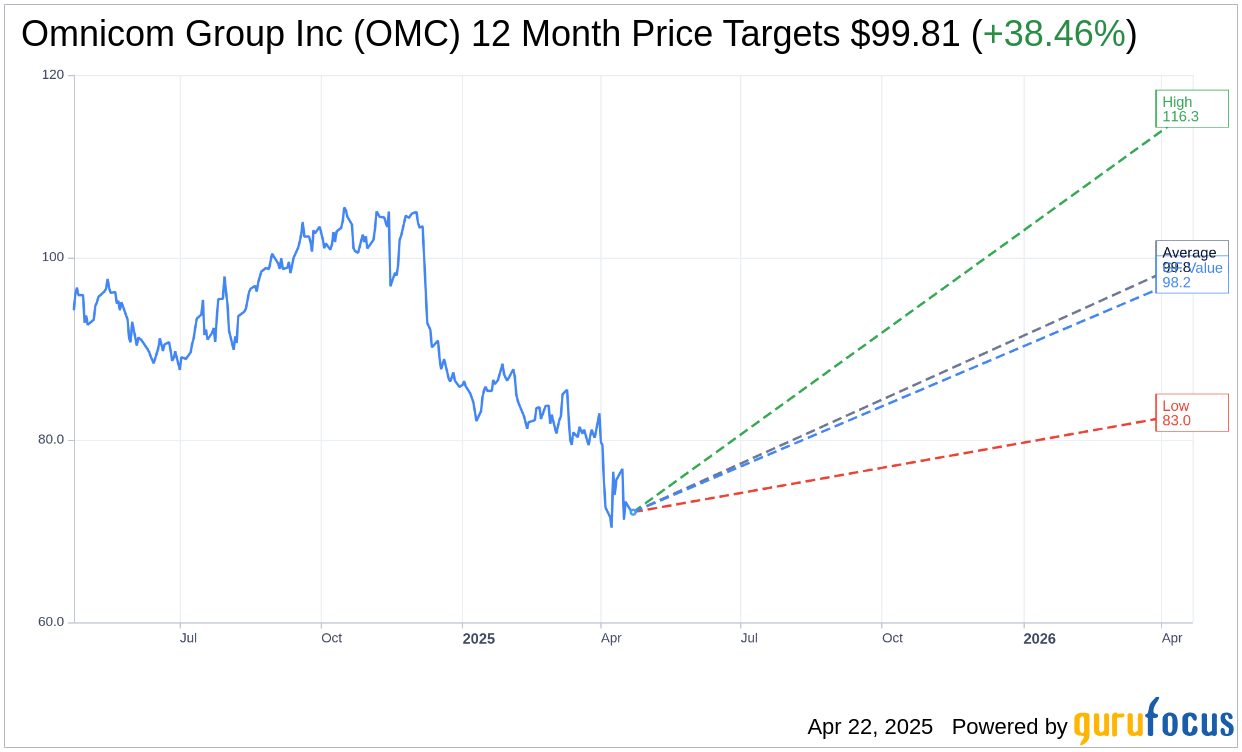

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Omnicom Group Inc (OMC, Financial) is $99.81 with a high estimate of $116.33 and a low estimate of $83.00. The average target implies an upside of 38.46% from the current price of $72.09. More detailed estimate data can be found on the Omnicom Group Inc (OMC) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Omnicom Group Inc's (OMC, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Omnicom Group Inc (OMC, Financial) in one year is $98.15, suggesting a upside of 36.15% from the current price of $72.09. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Omnicom Group Inc (OMC) Summary page.