Oppenheimer has initiated coverage on Chicago Atlantic BDC (LIEN, Financial) with a Perform rating, marking a significant step for investors observing this financial entity. The firm projects that Chicago Atlantic BDC will achieve earnings of $1.44 per share in 2025 and $1.51 per share in 2026. These figures correspond to estimated returns on equity (ROE) of 10.9% and 11.4%, respectively, over the two years.

The financial outlook suggests that net interest income will be adequate to support the core dividend of $1.44 per share during both years. Oppenheimer is also forecasting an average ROE of 11.0% for the company. Despite this, the estimated cost of equity capital stands at 13.0%, which leads the firm to calculate a fair share value of $11.00, representing approximately 0.8 times the book value.

This assessment provides investors with a detailed view of Chicago Atlantic BDC's potential financial performance and valuation benchmarks in the coming years.

Wall Street Analysts Forecast

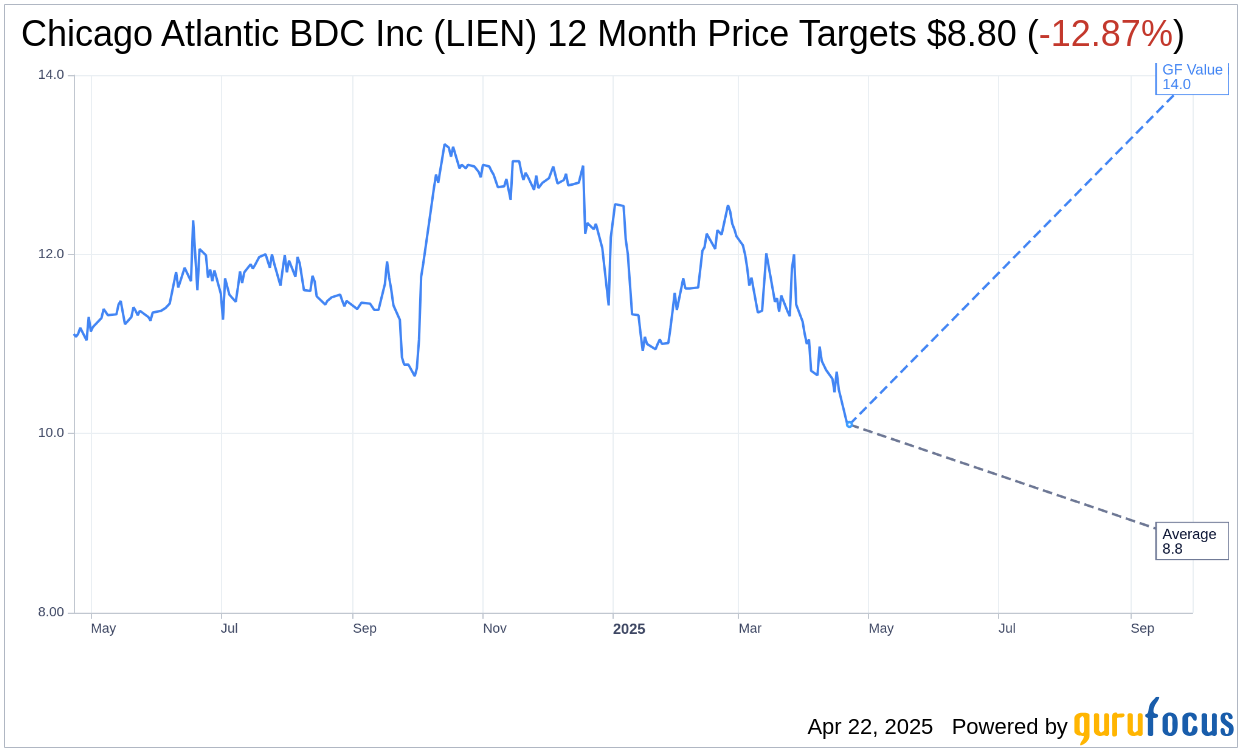

Based on the one-year price targets offered by 1 analysts, the average target price for Chicago Atlantic BDC Inc (LIEN, Financial) is $8.80 with a high estimate of $8.80 and a low estimate of $8.80. The average target implies an downside of 12.87% from the current price of $10.10. More detailed estimate data can be found on the Chicago Atlantic BDC Inc (LIEN) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Chicago Atlantic BDC Inc's (LIEN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Chicago Atlantic BDC Inc (LIEN, Financial) in one year is $13.99, suggesting a upside of 38.51% from the current price of $10.1. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Chicago Atlantic BDC Inc (LIEN) Summary page.