Key Highlights:

- MSCI Inc. reports a strong Q1 performance with a significant boost in retention rate.

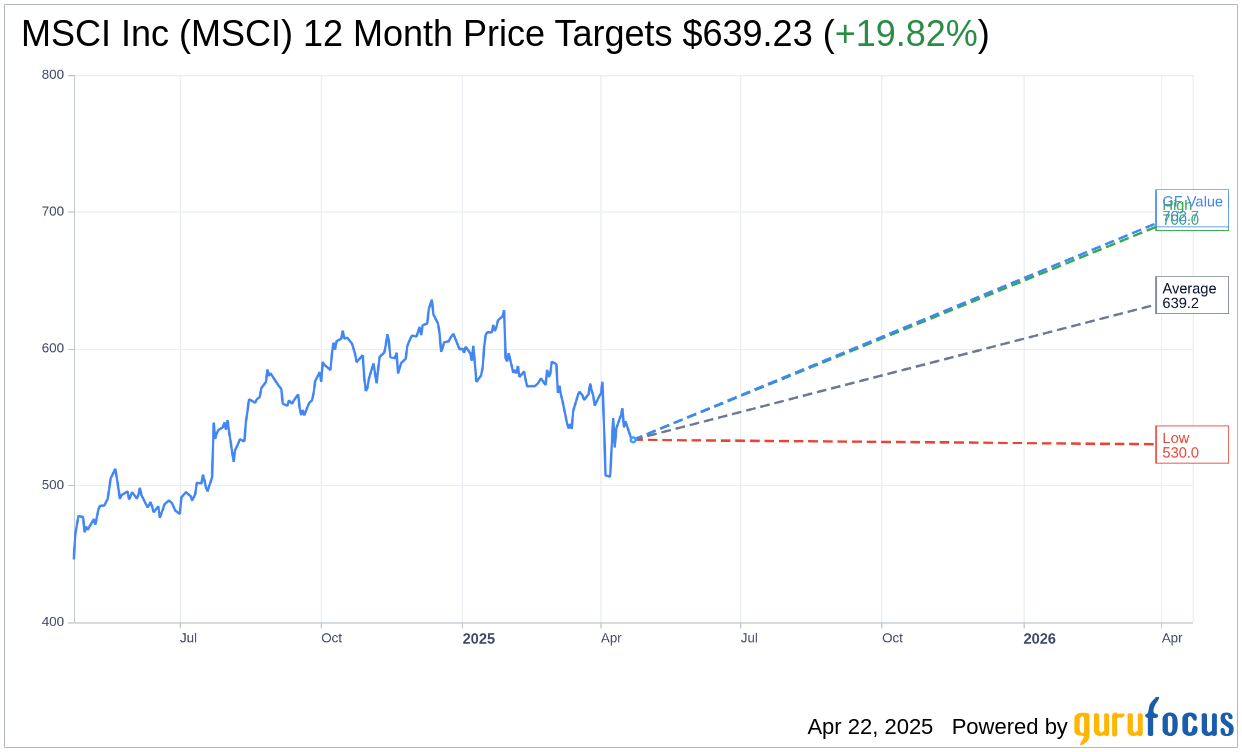

- Analysts suggest a potential 19.82% upside from the current stock price.

- GuruFocus projects a 31.72% upside based on the GF Value estimate.

Strong Quarterly Performance Bolsters Investor Confidence

MSCI Inc. (MSCI, Financial) impressed the market with its Q1 financial results, reporting a non-GAAP EPS of $4.00, exceeding analyst expectations by $0.10. The company's revenue performance was robust, climbing to $745.8 million, marking a 9.7% year-over-year increase. This growth reflects MSCI's strategic initiatives and market demand for its services. The firm showcased operational efficiency with an impressive operating margin of 50.6% and an adjusted EBITDA margin of 57.1%. A noteworthy highlight of this quarter is the enhanced retention rate, which rose to 95.3%, up from 92.8% the previous year, indicating strong customer loyalty and satisfaction.

Wall Street Analysts Forecast

Wall Street analysts remain optimistic about MSCI Inc.'s future, with 13 analysts providing one-year price targets. The average target price is $639.23, with projections ranging from a low of $530.00 to a high of $700.00. This average target price suggests a potential upside of 19.82% from the current trading price of $533.48. For deeper insights, investors can access the full data set on the MSCI Inc (MSCI, Financial) Forecast page.

Analyst Recommendations Indicate Positive Momentum

Based on a consensus from 19 brokerage firms, MSCI Inc. holds an average brokerage recommendation of 2.3. This rating is well within the 'Outperform' range, signifying strong market confidence. The recommendation scale used by analysts ranges from 1 (Strong Buy) to 5 (Sell), further highlighting MSCI's favorable positioning in the market.

GuruFocus Analysis: GF Value Estimation

With input from GuruFocus, MSCI Inc. is estimated to reach a GF Value of $702.69 in the coming year, translating to a prospective upside of 31.72% from its current price of $533.48. The GF Value is carefully calculated, taking into account the historical trading multiples of the stock, along with both past and projected business growth metrics. Investors seeking further details and analysis can explore the MSCI Inc (MSCI, Financial) Summary page for more comprehensive information.