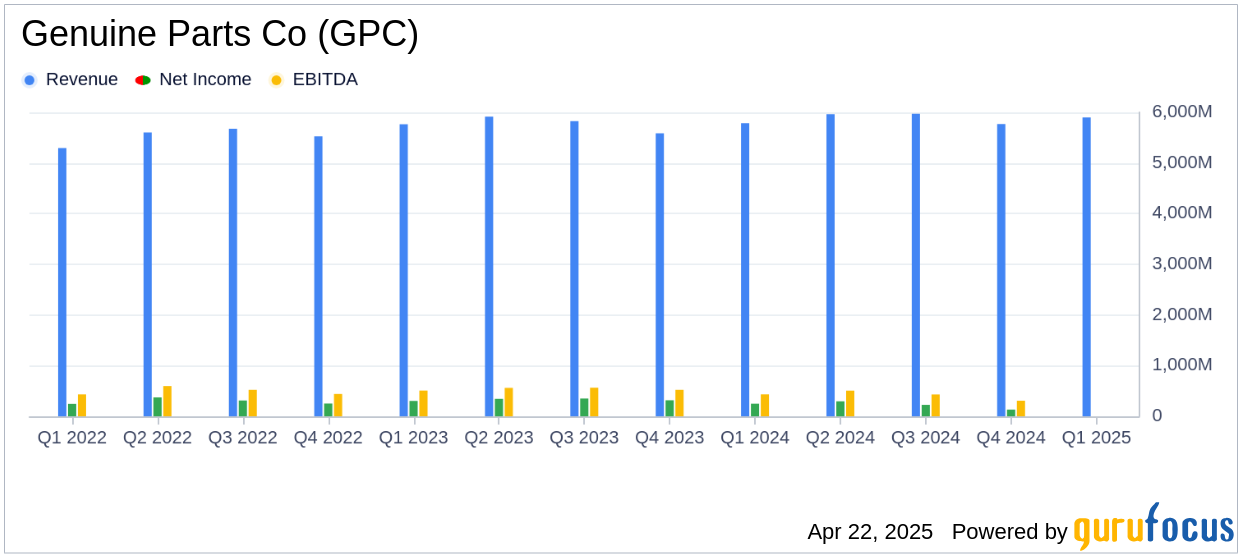

Genuine Parts Co (GPC, Financial) released its 8-K filing on April 22, 2025, detailing its financial performance for the first quarter of 2025. The company, a global leader in automotive and industrial replacement parts, reported sales of $5.9 billion, surpassing the analyst estimate of $5,831.95 million. However, the diluted earnings per share (EPS) of $1.40 fell short of the estimated $1.58.

Company Overview

Genuine Parts Co (GPC, Financial) operates in the aftermarket automotive and industrial products sectors, with approximately 60% of sales from automotive parts and 40% from industrial products. The company distributes automotive parts to a network of 9,800 global retail locations, primarily under the Napa Auto Parts brand, serving around 6,000 locations in the U.S. Its industrial segment, operating under the Motion banner, serves over 200,000 customers with products like bearings and power transmission equipment.

Performance and Challenges

Genuine Parts Co (GPC, Financial) reported a 1.4% increase in sales compared to the same period last year, driven by a 3.0% benefit from acquisitions. However, this was partially offset by a 0.8% decrease in comparable sales and a 0.8% unfavorable impact from foreign currency fluctuations. The company faced challenges from tariffs and trade dynamics, which impacted its operating landscape.

“We had a solid start to 2025, despite the tariffs and trade dynamics that are impacting the operating landscape," said Will Stengel, President and Chief Executive Officer.

Financial Achievements and Industry Importance

The company's adjusted diluted EPS was $1.75, which exceeded the analyst estimate of $1.58. This adjustment excludes a net expense of $49 million related to restructuring and integration costs. Genuine Parts Co (GPC, Financial) reaffirmed its full-year outlook, projecting revenue growth of 2% to 4% and adjusted diluted EPS between $7.75 and $8.25. These achievements are crucial for maintaining competitiveness in the Vehicles & Parts industry, where efficiency and strategic growth are key.

Key Financial Metrics

Net income for the quarter was $194 million, down from $249 million in the prior year. The company's cash flow from operations decreased by $41 million, primarily due to lower net income and changes in working capital. Free cash flow also decreased by $161 million. As of March 31, 2025, Genuine Parts Co (GPC, Financial) had $420 million in cash and cash equivalents and $2 billion in undrawn credit capacity.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Sales | $5.9 billion | $5.8 billion |

| Net Income | $194 million | $249 million |

| Diluted EPS | $1.40 | $1.78 |

| Adjusted Diluted EPS | $1.75 | $2.22 |

Segment Performance

The Automotive Parts Group reported sales of $3.7 billion, a 2.5% increase from the previous year, with a 4.1% benefit from acquisitions. However, segment EBITDA decreased by 10.7% to $286 million. The Industrial Parts Group saw a slight decline in sales to $2.2 billion, with segment EBITDA remaining stable at $279 million.

Analysis and Outlook

Genuine Parts Co (GPC, Financial) continues to navigate a challenging environment with strategic initiatives aimed at improving customer service and operational efficiency. The reaffirmation of its full-year outlook suggests confidence in its growth plans despite external pressures. The company's focus on acquisitions and strategic integration is expected to drive future performance, although challenges such as tariffs and currency fluctuations remain.

Explore the complete 8-K earnings release (here) from Genuine Parts Co for further details.