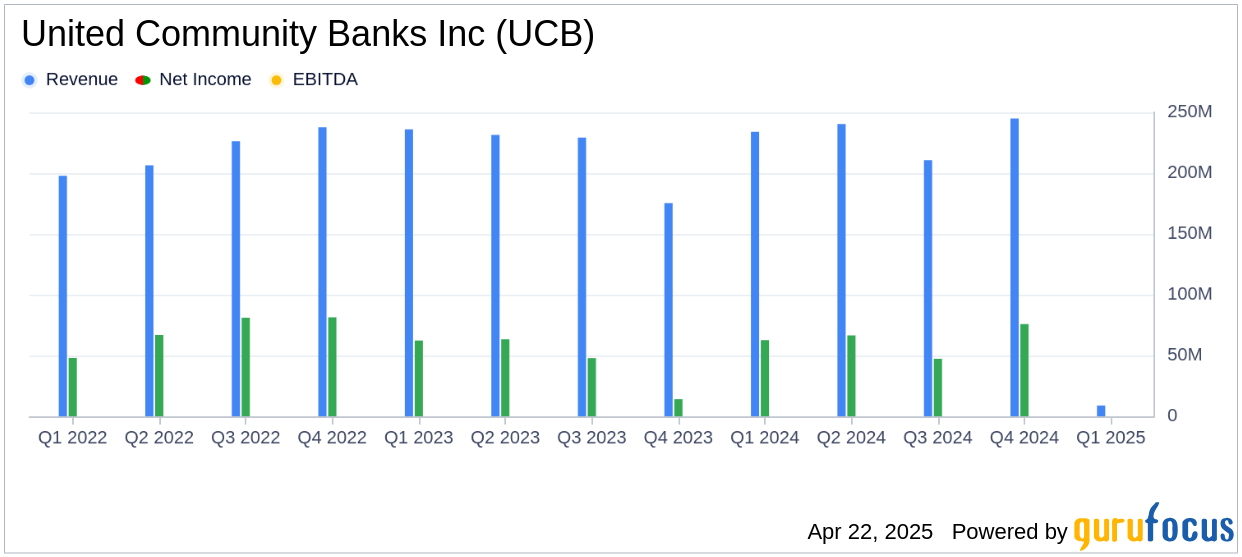

United Community Banks Inc (UCB, Financial) released its 8-K filing on April 22, 2025, reporting a net income of $71.4 million for the first quarter of 2025. The company's diluted earnings per share (EPS) stood at $0.58, surpassing the analyst estimate of $0.56. This marks a $0.07 increase from the same quarter last year, although it represents a $0.03 decrease from the previous quarter. United Community Banks Inc provides a comprehensive range of financial services across various sectors, including commercial, retail, and real estate, through its branches, online platforms, and mobile applications.

Performance and Challenges

United Community Banks Inc (UCB, Financial) demonstrated robust performance in the first quarter of 2025, driven by growth in loans and deposits. Loans increased by $249 million, or 5.6% annualized, while customer deposits rose by $309 million, or 5.4% annualized. The company's net interest margin expanded by 10 basis points to 3.36%, contributing to a $1.7 million increase in net interest income from the previous quarter. However, the company faced challenges with a $4.0 million increase in the provision for credit losses, which slightly raised the allowance for credit losses to 1.21% of loans.

Financial Achievements

United Community Banks Inc (UCB, Financial) achieved significant financial milestones, including a 3.7% year-over-year increase in total revenue, amounting to an $8.9 million improvement. The company's return on assets was 1.02%, or 1.04% on an operating basis. The return on common equity was 7.9%. The return on tangible common equity on an operating basis reached 11.2%. These achievements underscore the company's effective management of interest margins and cost controls, which are crucial in the banking industry.

Key Financial Metrics

Key metrics from the financial statements reveal a stable credit quality, with net charge-offs at 0.21% of average loans, consistent with the previous quarter. Nonperforming assets improved to 33 basis points relative to total assets, down from 42 basis points in the fourth quarter. The company's tangible common equity to tangible assets ratio increased by 21 basis points to 9.18% at the end of the quarter.

Chairman and CEO Lynn Harton stated, “The first quarter was a strong start to the year. Our teams delivered solid loan and deposit growth in what has typically been a seasonally weak quarter. We’re also excited to continue growing our presence in Florida with the recent announcement of our planned acquisition of American National Bank.”

Analysis and Outlook

United Community Banks Inc (UCB, Financial) has demonstrated resilience and strategic growth in the first quarter of 2025. The company's ability to expand its net interest margin and control expenses has been pivotal in achieving its financial targets. The planned acquisition of American National Bank is expected to further strengthen UCB's footprint in the South Florida market, potentially enhancing its growth prospects. However, the increase in provision for credit losses highlights the need for continued vigilance in credit risk management.

Explore the complete 8-K earnings release (here) from United Community Banks Inc for further details.