Gilead Sciences (GILD, Financial) received an upgrade from Cantor Fitzgerald, as analyst Carter Gould raised the stock's rating from Neutral to Overweight. Gould, who recently assumed coverage of Gilead, also increased the price target significantly from $100 to $125.

The positive outlook for Gilead is attributed to key developments in its HIV treatment portfolio. Particularly, the clinical progress and upcoming launch of lenacapavir are seen as pivotal factors driving the stock's re-rating over the latter half of 2024. Additionally, the company is expected to see continued success with its Biktarvy product, further contributing to its market share in the HIV treatment space.

Looking forward, the analyst forecasts substantial growth in HIV franchise sales, supported by these developments. This growth is anticipated to lead to a considerable expansion of profit margins over a multi-year period from 2025 to 2030. Gilead's strategic advancements in its product offerings appear poised to sustain its upward momentum in the coming years.

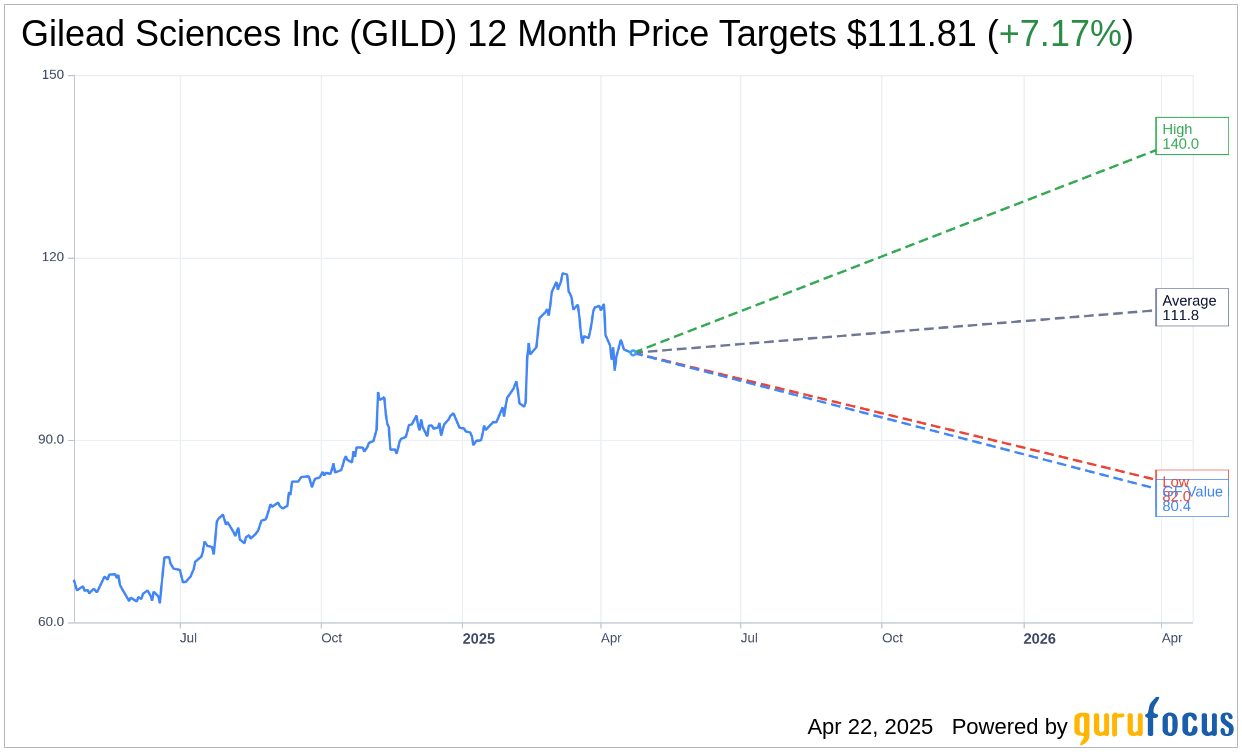

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for Gilead Sciences Inc (GILD, Financial) is $111.81 with a high estimate of $140.00 and a low estimate of $82.00. The average target implies an upside of 7.17% from the current price of $104.33. More detailed estimate data can be found on the Gilead Sciences Inc (GILD) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, Gilead Sciences Inc's (GILD, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Gilead Sciences Inc (GILD, Financial) in one year is $80.44, suggesting a downside of 22.9% from the current price of $104.33. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Gilead Sciences Inc (GILD) Summary page.