- Synchrony Financial announces a substantial 20% dividend increase and a major share repurchase program.

- Wall Street analysts project a significant upside for Synchrony Financial with notable investment potential.

- GuruFocus metrics suggest the stock is undervalued, promising a lucrative growth opportunity.

Synchrony Financial (SYF, Financial) has made a compelling move by increasing its quarterly dividend by 20% to $0.30 per share, resulting in a forward yield of 2.54%. This strategic decision underscores the company’s confidence in its financial health and commitment to delivering shareholder value. Furthermore, Synchrony has approved an extensive $2.5 billion share repurchase program, anticipated to last through June 2026, emphasizing its robust capital management approach.

Wall Street Analysts' Predictions

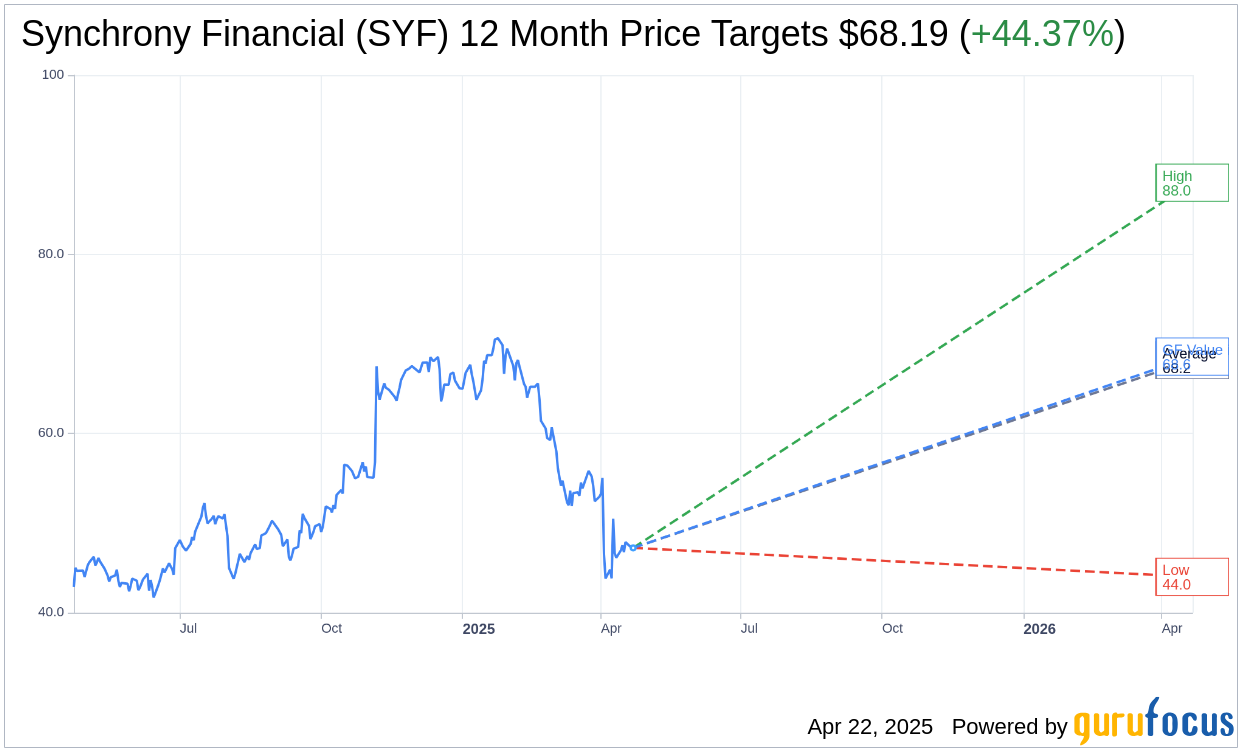

Wall Street’s top analysts present an optimistic outlook for Synchrony Financial (SYF, Financial) with a one-year average price target of $68.19. This forecast spans from a high of $88.00 to a low of $44.00, indicating a potential upside of 44.37% from the current trading price of $47.23. Such projections make SYF an attractive consideration for growth-focused investors. More comprehensive forecast details are accessible on the Synchrony Financial (SYF) Forecast page.

Brokerage Firms' Consensus

The collective assessment from 22 brokerage firms rates Synchrony Financial's (SYF, Financial) stock as "Outperform," with an average recommendation of 2.2 on a scale where 1 signifies a Strong Buy. This endorsement reflects a favorable sentiment across the investment community, reinforcing SYF’s potential as a valuable stock in your portfolio.

Evaluating GF Value and Growth Potential

According to GuruFocus, Synchrony Financial’s (SYF, Financial) estimated GF Value stands at $68.58 for the next year. This suggests a promising upside of 45.2% from its current market price of $47.23. The GF Value is derived from the stock's historical trading multiples, past business growth, and future performance forecasts. Investors can explore more detailed insights on Synchrony Financial's valuation on the Synchrony Financial (SYF) Summary page.

Synchrony Financial’s recent strategic initiatives and strong analyst endorsements position it as a compelling opportunity for investors seeking both income and growth. Its robust dividend increase and extensive share buyback program highlight its commitment to enhancing shareholder returns.

Also check out: (Free Trial)