Regeneron Pharmaceuticals, Inc. (REGN, Financial) has initiated a significant expansion of its manufacturing capabilities through a strategic partnership with Fujifilm Diosynth Biotechnologies. The agreement will enable Regeneron to nearly double its large-scale manufacturing capacity in the United States, utilizing Fujifilm's state-of-the-art biopharmaceutical facility located in Holly Springs, North Carolina.

The collaboration involves a substantial investment of over $3 billion and spans a decade, with technology transfer processes starting immediately. This move is part of Regeneron's broader strategy to enhance its biologics production efficiency and meet growing demand for its commercial medicines.

In addition to this new partnership, Regeneron is heavily investing in its New York State operations. The company is in the midst of a $3.6 billion expansion at its Tarrytown campus, which will result in the creation of 1,000 high-skill jobs and significant enhancement of research and preclinical manufacturing facilities. Moreover, Regeneron is building a new fill/finish manufacturing site in Rensselaer, New York, and has acquired over one million square feet of property in Saratoga Springs, New York, to support production activities and potentially expand manufacturing capabilities.

Overall, Regeneron's planned and ongoing investments in New York and North Carolina are poised to exceed $7 billion, reflecting its commitment to bolstering its infrastructure and production capacity in key U.S. locations.

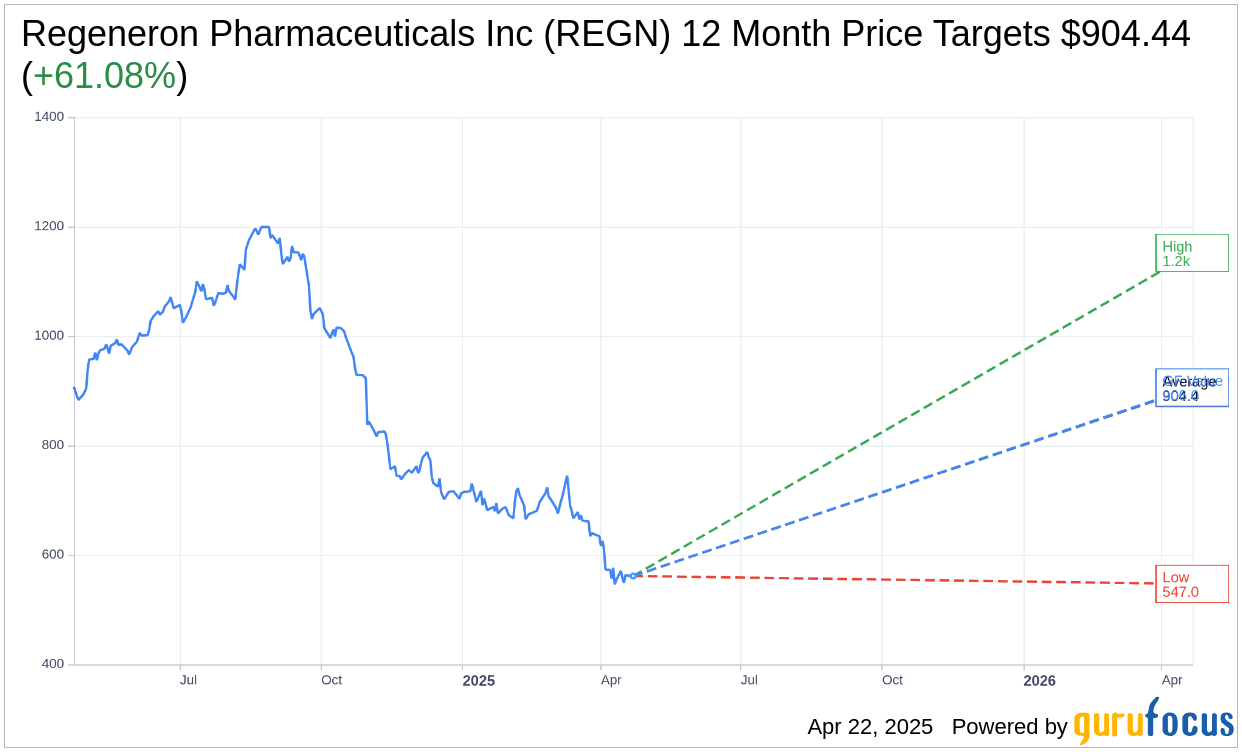

Wall Street Analysts Forecast

Based on the one-year price targets offered by 25 analysts, the average target price for Regeneron Pharmaceuticals Inc (REGN, Financial) is $904.44 with a high estimate of $1,152.00 and a low estimate of $547.00. The average target implies an upside of 61.08% from the current price of $561.49. More detailed estimate data can be found on the Regeneron Pharmaceuticals Inc (REGN) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Regeneron Pharmaceuticals Inc's (REGN, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Regeneron Pharmaceuticals Inc (REGN, Financial) in one year is $905.96, suggesting a upside of 61.35% from the current price of $561.49. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Regeneron Pharmaceuticals Inc (REGN) Summary page.