Key Highlights:

- Medpace (MEDP, Financial) exceeds Q1 earnings expectations with a rise in revenue and EPS.

- Analysts project a substantial potential upside for MEDP stock.

- GF Value suggests a significant undervaluation, indicating further growth potential.

Medpace Holdings Inc. (NASDAQ: MEDP) has delivered an impressive performance in the first quarter, reporting a GAAP EPS of $3.20, which is $0.14 above analyst expectations. The company's revenue reached $558.6 million, reflecting a robust 9.3% increase compared to the previous year, and surpassing forecasts by $31.45 million. Medpace is looking ahead with optimism, projecting its 2025 revenue to be between $2.140 and $2.240 billion, alongside expected EPS ranging from $12.26 to $13.04.

Wall Street Analysts' Forecast

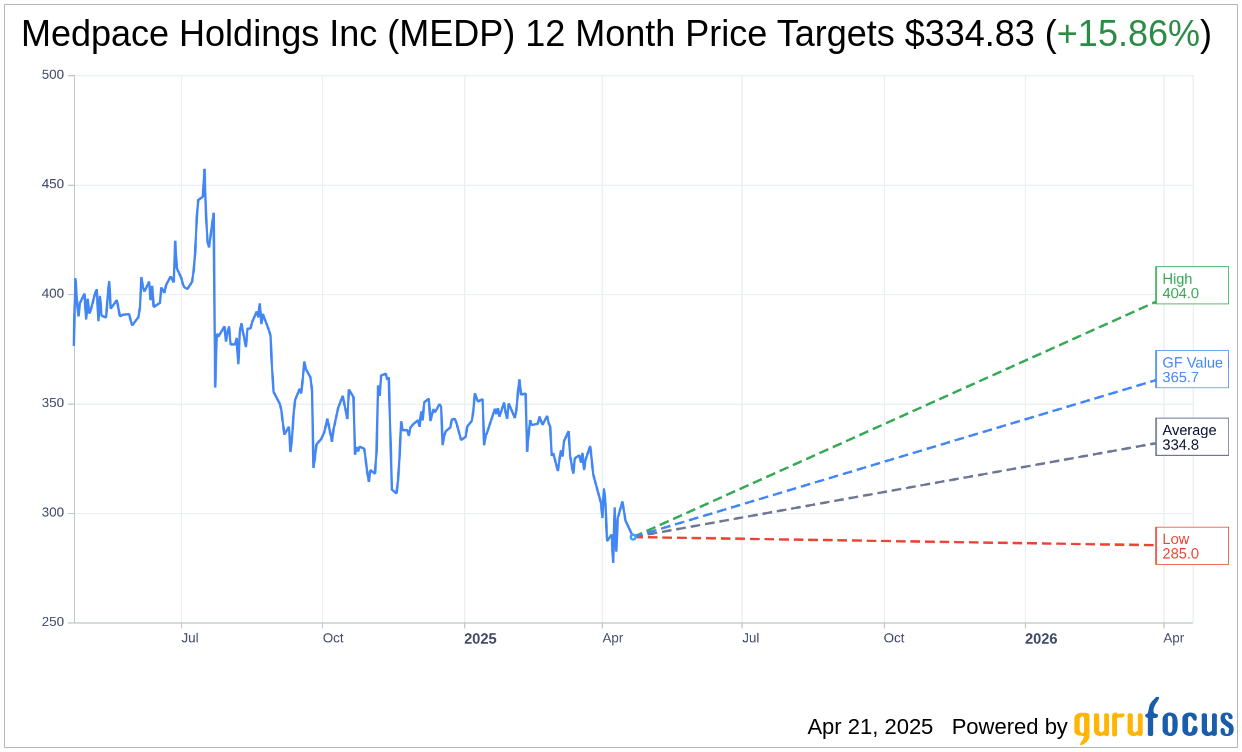

According to the price targets from 10 analysts, the average target price for Medpace Holdings Inc. (MEDP, Financial) stands at $334.83. This projection encompasses a high estimate of $404.00 and a low estimate of $285.00, implying a potential upside of 15.86% from the current price of $288.99. For a deeper dive into these projections, visit the Medpace Holdings Inc (MEDP) Forecast page.

Additionally, the consensus recommendation from 11 brokerage firms gives Medpace Holdings Inc. (MEDP, Financial) an average rating of 2.6, which corresponds to a "Hold" status. This rating system ranges from 1 to 5, where 1 indicates a Strong Buy, and 5 signifies a Sell.

GF Value Estimation

According to GuruFocus estimates, the GF Value for Medpace Holdings Inc. (MEDP, Financial) over the next year is $365.69. This valuation suggests a potential upside of 26.54% from the current price. The GF Value is GuruFocus' estimation of the fair market value of the stock, derived from historical trading multiples, past business growth, and future performance projections. For further insights, explore the Medpace Holdings Inc (MEDP) Summary page.