The Federal Trade Commission (FTC) has launched a legal action against Uber Technologies Inc. (UBER, Financial), accusing the company of engaging in unfair practices related to its Uber One subscription service. The FTC claims Uber charged users without their consent, failed to provide the advertised savings, and made it excessively burdensome for consumers to cancel their subscriptions, despite promoting a "cancel anytime" feature.

The complaint highlights several concerns, including misleading promises of a $25 monthly savings when users sign up for Uber One. According to the FTC, Uber billed customers even before the specified billing period commenced. Moreover, the cancellation process posed significant challenges, requiring users to navigate through as many as 23 screens and complete up to 32 actions just to terminate the service.

The FTC asserts that these practices breach the FTC Act and the Restore Online Shoppers’ Confidence Act. The agency is committed to protecting consumers from such misleading subscription services, emphasizing the need for straightforward and transparent cancellation policies.

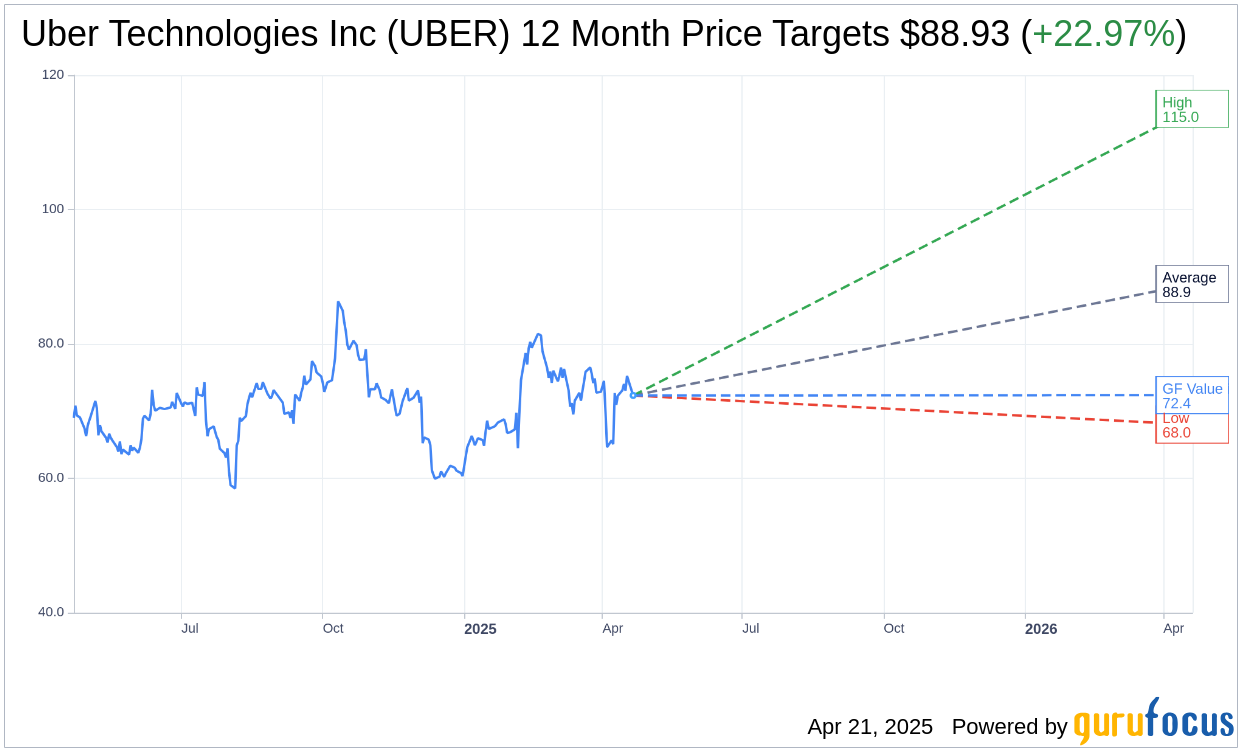

Wall Street Analysts Forecast

Based on the one-year price targets offered by 40 analysts, the average target price for Uber Technologies Inc (UBER, Financial) is $88.93 with a high estimate of $115.00 and a low estimate of $68.00. The average target implies an upside of 22.97% from the current price of $72.32. More detailed estimate data can be found on the Uber Technologies Inc (UBER) Forecast page.

Based on the consensus recommendation from 53 brokerage firms, Uber Technologies Inc's (UBER, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Uber Technologies Inc (UBER, Financial) in one year is $72.38, suggesting a upside of 0.08% from the current price of $72.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Uber Technologies Inc (UBER) Summary page.