Key Takeaways:

- The AMD Yield Shares Purpose ETF declared a steady monthly dividend of CAD 0.20 per share, with key dates in April.

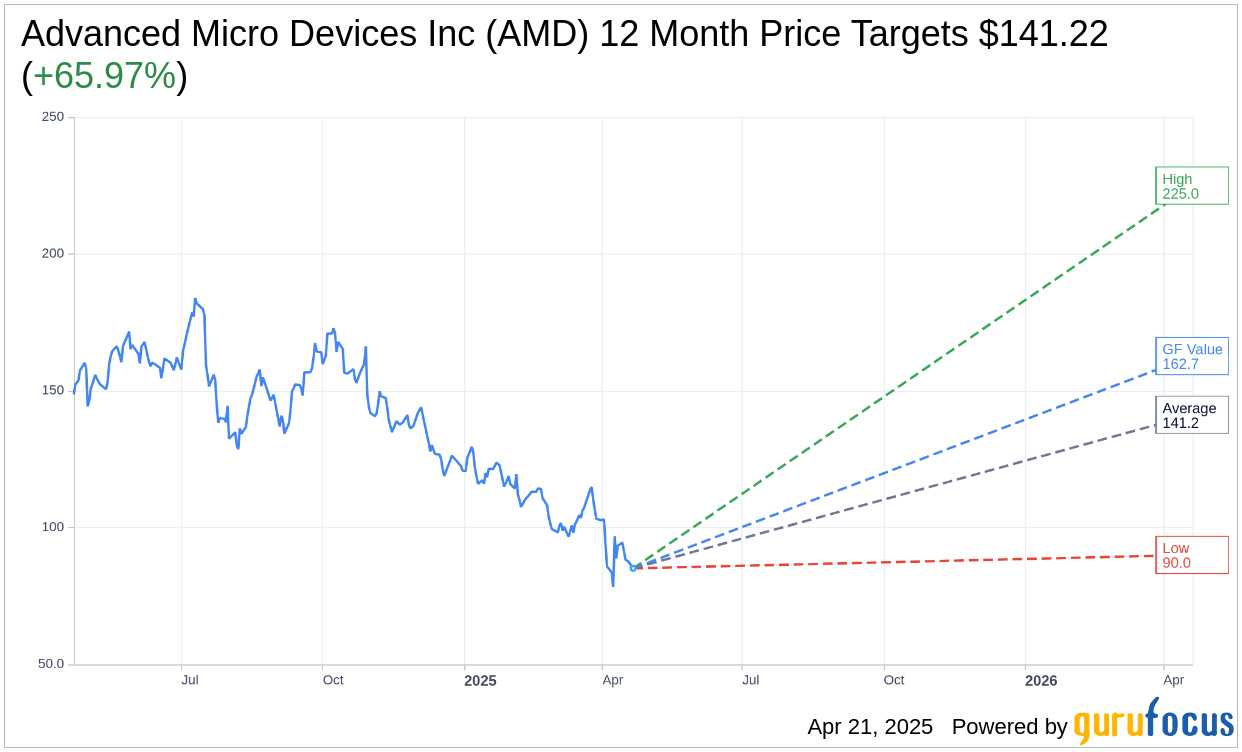

- Advanced Micro Devices Inc (AMD, Financial) has a bullish one-year target price, forecasting significant upside potential.

- Consensus ratings and GF Value estimates suggest AMD is poised for substantial growth.

Consistent Dividend Strategy of AMD Yield Shares Purpose ETF

The AMD Yield Shares Purpose ETF (YAMD:CA) has reaffirmed its commitment to shareholders by declaring a monthly dividend of CAD 0.20 per share. Investors who are on record as of April 28 will see their dividends arrive on May 2. It’s important to note that the ex-dividend date is also April 28. This announcement is in line with the ETF’s strategic goal of delivering stable income to its investors.

Wall Street's Forecast for Advanced Micro Devices Inc (AMD, Financial)

Wall Street analysts have set ambitious one-year price targets for Advanced Micro Devices Inc (AMD, Financial), with the average target price positioned at $141.22. The range varies, offering a high estimate of $225.00 and a low of $90.00. This average valuation suggests an impressive upside potential of 65.97% from the current trading price of $85.09. Investors seeking more comprehensive forecast data can explore the detailed analysis on the Advanced Micro Devices Inc (AMD) Forecast page.

Brokerage Recommendations Indicate Strong Performance

According to 50 leading brokerage firms, Advanced Micro Devices Inc (AMD, Financial) currently holds an "Outperform" status with an average recommendation score of 2.3. This rating scale ranges from 1, denoting a Strong Buy, to 5, indicating a Sell. This consensus underscores the market's positive outlook on AMD's capabilities and future growth.

Estimating Fair Value with GF Value

GuruFocus provides an insightful estimate of the GF Value for Advanced Micro Devices Inc (AMD, Financial), projecting it at $162.68 over the next year. This represents a promising upside of 91.19% from the current price of $85.09. The GF Value takes into account historical trading multiples and factors in both past and future business performance projections. For those interested in a deeper dive into AMD’s valuation and potential, further details are available on the Advanced Micro Devices Inc (AMD) Summary page.

Also check out: (Free Trial)