Key Highlights:

- Ares Private Equity Fund has strategically acquired a majority stake in Epika Fleet Services to enhance service capabilities and market reach.

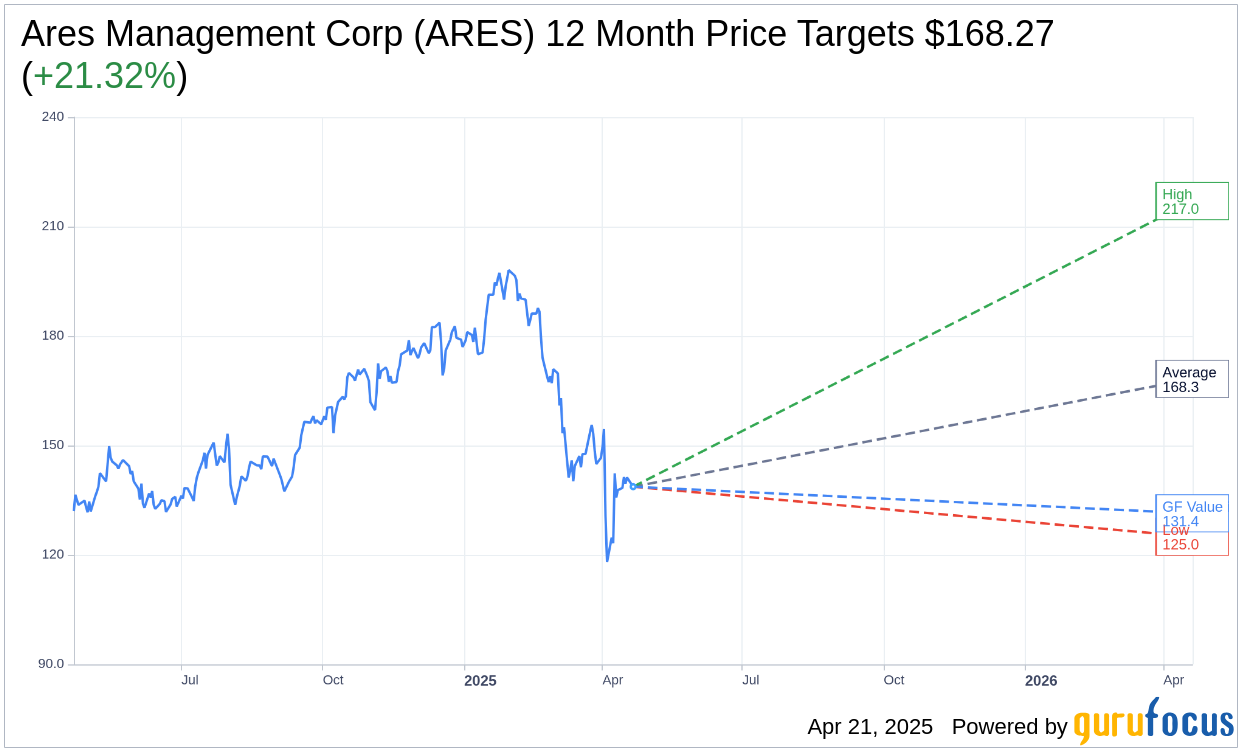

- Wall Street analysts project an average price target for Ares Management Corp (ARES, Financial) at $168.27, indicating significant upside potential.

- The GF Value estimate suggests a potential downside, reflecting the stock's current trading dynamics.

Ares Private Equity Fund's Strategic Investment in Epika Fleet Services

Ares Private Equity Fund (ARES) has successfully secured a majority position in Epika Fleet Services. This strategic move aims to expand Epika's capabilities in maintenance and repair services specifically for commercial trucking fleets. Furthermore, the investment will facilitate the company's expansion into underserved regions, broadening its market presence. As of now, the financial specifics of this deal have not been disclosed, signaling a focus on strategic growth rather than immediate financial details.

Analyst Insights: Ares Management Corp (ARES, Financial) Price Projections

According to 15 prominent Wall Street analysts, the one-year price target for Ares Management Corp (ARES, Financial) averages $168.27, with projections ranging from a high of $217.00 to a low of $125.00. This average target suggests an upside potential of 21.32% from the current trading price of $138.70. Investors seeking detailed price estimates can explore further data on the Ares Management Corp (ARES) Forecast page.

Brokerage Firm Recommendations

The consensus from 17 brokerage firms currently rates Ares Management Corp (ARES, Financial) with an average recommendation of 2.1, indicating an "Outperform" status. This rating falls on a scale from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell. Such ratings underscore a generally positive sentiment among analysts toward ARES as a potential investment opportunity.

Understanding the GF Value Estimate

From a valuation perspective, GuruFocus estimates the GF Value of Ares Management Corp (ARES, Financial) at $131.41 over the next year. This estimate implies a potential downside of 5.26% from its current price of $138.70. The GF Value is derived from historical trading multiples, past business growth metrics, and projections of future business performance. Investors can access a comprehensive analysis on the Ares Management Corp (ARES) Summary page. Understanding these metrics can aid investors in making informed decisions based on both current valuations and future growth prospects.