Scotiabank has revised its price target for Meta Platforms (META, Financial), lowering it from $627 to $525, while maintaining a Sector Perform rating on the company's shares. This adjustment reflects a broader change in investor sentiment within the Internet sector.

Analysts indicate that stocks with exposure to China and tariffs are facing challenges, underperforming in the current market environment. In contrast, companies perceived as 'safer' investments are gaining traction among investors. This quarter, significant trends include a decline in advertising spending across most industries, a reduction in cloud demand, and a movement toward more reliable stocks.

Meta Platforms is positioned as the least preferred option within the sector by the firm, as noted by the analyst. This reflects the broader market dynamics and emerging trends affecting the Internet space.

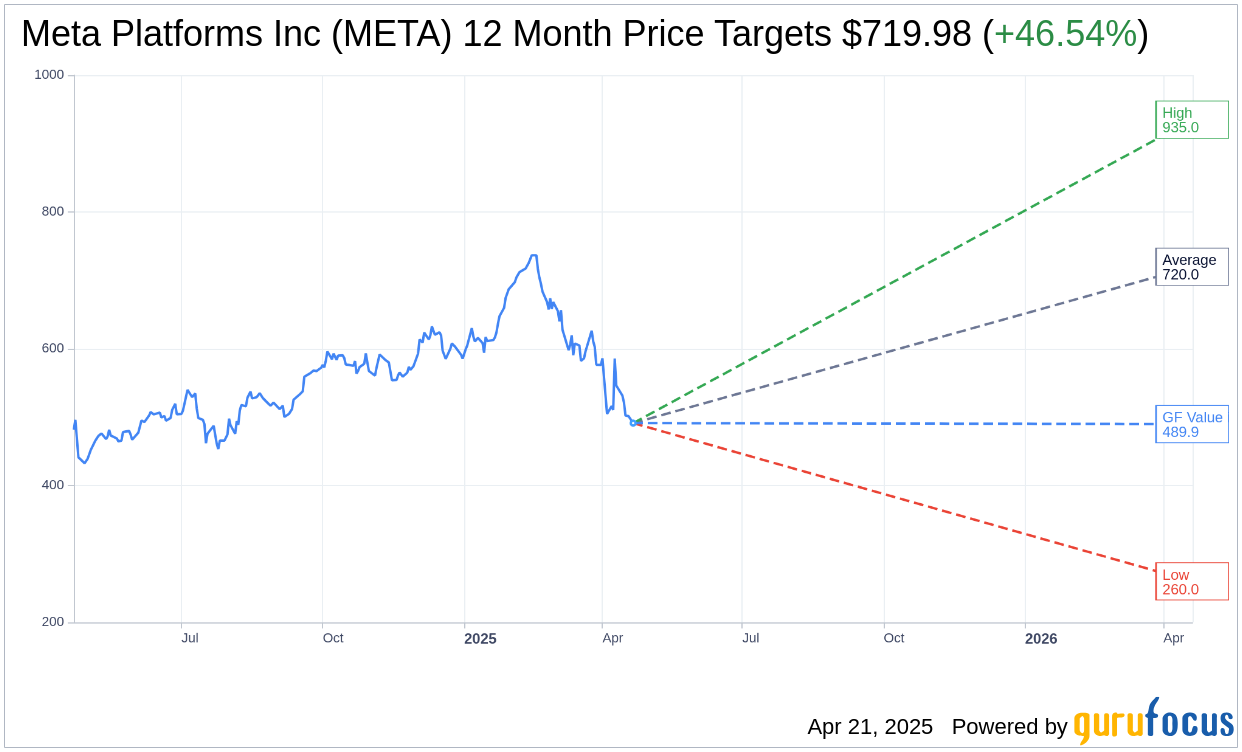

Wall Street Analysts Forecast

Based on the one-year price targets offered by 62 analysts, the average target price for Meta Platforms Inc (META, Financial) is $719.98 with a high estimate of $935.00 and a low estimate of $260.00. The average target implies an upside of 46.54% from the current price of $491.33. More detailed estimate data can be found on the Meta Platforms Inc (META) Forecast page.

Based on the consensus recommendation from 72 brokerage firms, Meta Platforms Inc's (META, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Meta Platforms Inc (META, Financial) in one year is $489.93, suggesting a downside of 0.28% from the current price of $491.325. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Meta Platforms Inc (META) Summary page.