- Amphenol Corp (APH, Financial) is expected to surpass Q1 expectations due to robust AI integration.

- Analysts predict potential stock price growth with an average target suggesting a 21.47% upside.

- GuruFocus estimates indicate a slight downside according to its GF Value calculation.

Amphenol Corp (APH) is poised to outperform in the first quarter, driven by its successful integration of artificial intelligence within its operations and consistent strength in the military and aerospace sectors. In a challenging macroeconomic climate, Baird recognizes Amphenol’s resilience in navigating these complexities. Current analyst projections point to earnings per share of $0.52 alongside revenue of $4.3 billion.

Wall Street Analysts Forecast

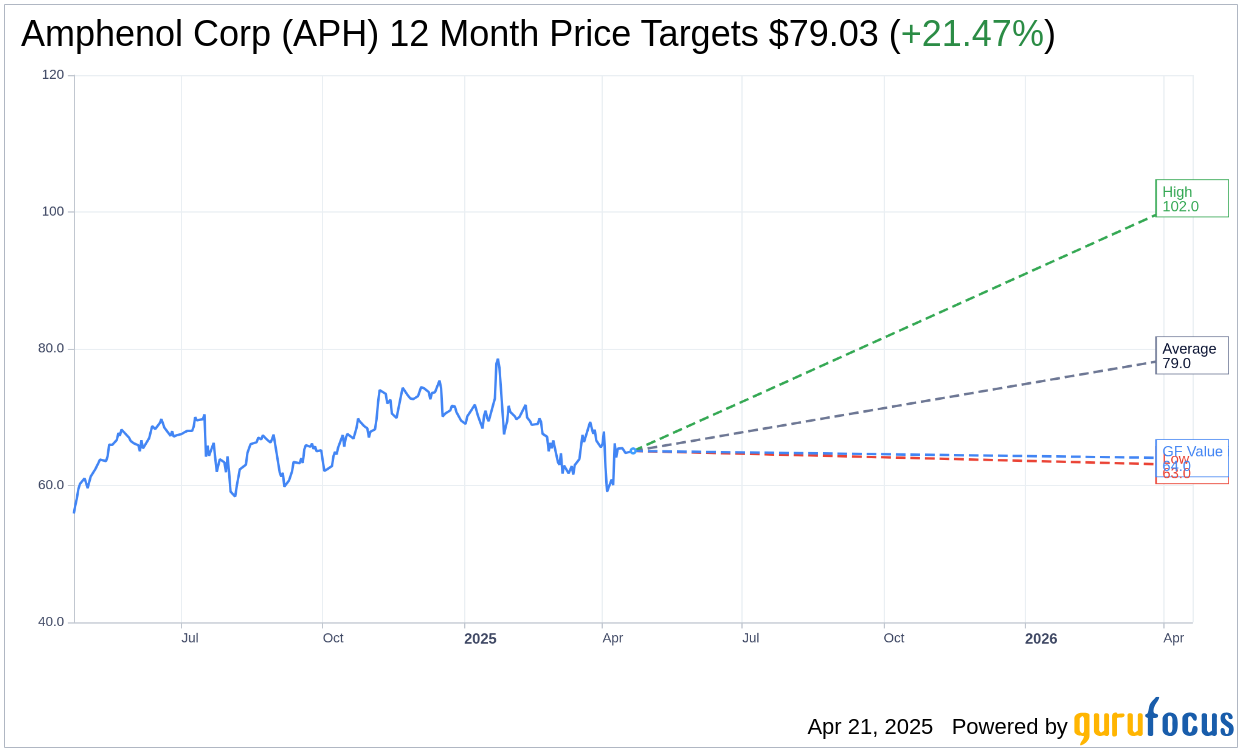

Amphenol Corp (APH, Financial) has garnered attention from 15 analysts who present a range of one-year price targets. The consensus average target is $79.03, with forecasts peaking at $102.00 and dipping to a low of $63.00. This average target suggests a promising upside potential of 21.47% from the current price of $65.06. For more in-depth analysis, visit the Amphenol Corp (APH) Forecast page.

In terms of stock recommendations, a consensus from 19 brokerage firms rates Amphenol Corp (APH, Financial) at 2.3, which translates to an "Outperform" recommendation. This scale ranges from 1 (Strong Buy) to 5 (Sell), placing Amphenol well within favorable territory.

GuruFocus Valuation Analysis

According to GuruFocus estimates of the GF Value, Amphenol Corp (APH, Financial) is evaluated at $64.00 in one year, slightly under the current trading price of $65.06. This projection indicates a minor downside of 1.63%. The GF Value reflects what the stock’s fair trade value should be, based on historical trading multiples and anticipated business performance. For further detailed insights, refer to the Amphenol Corp (APH) Summary page.