- Chevron's strategic acquisitions are set to boost earnings projections significantly by FY26.

- Analysts suggest a potential 24.24% upside in Chevron's stock price based on current assessments.

- Chevron Corp (CVX, Financial) is endorsed with an "Outperform" status by brokerage firms.

Chevron Corporation (CVX) continues to stand firm within Ken Fisher (Trades, Portfolio)'s portfolio, deftly navigating the complex challenges of the energy sector. Notably, Chevron's acquisition moves, such as the inclusion of Hess stakes, contribute to its promising earnings trajectory. Analysts anticipate non-GAAP EPS to surge to $10.30 by FY25 and reach an impressive $12.23 by FY26, underscoring its growth potential.

Wall Street Analysts Forecast

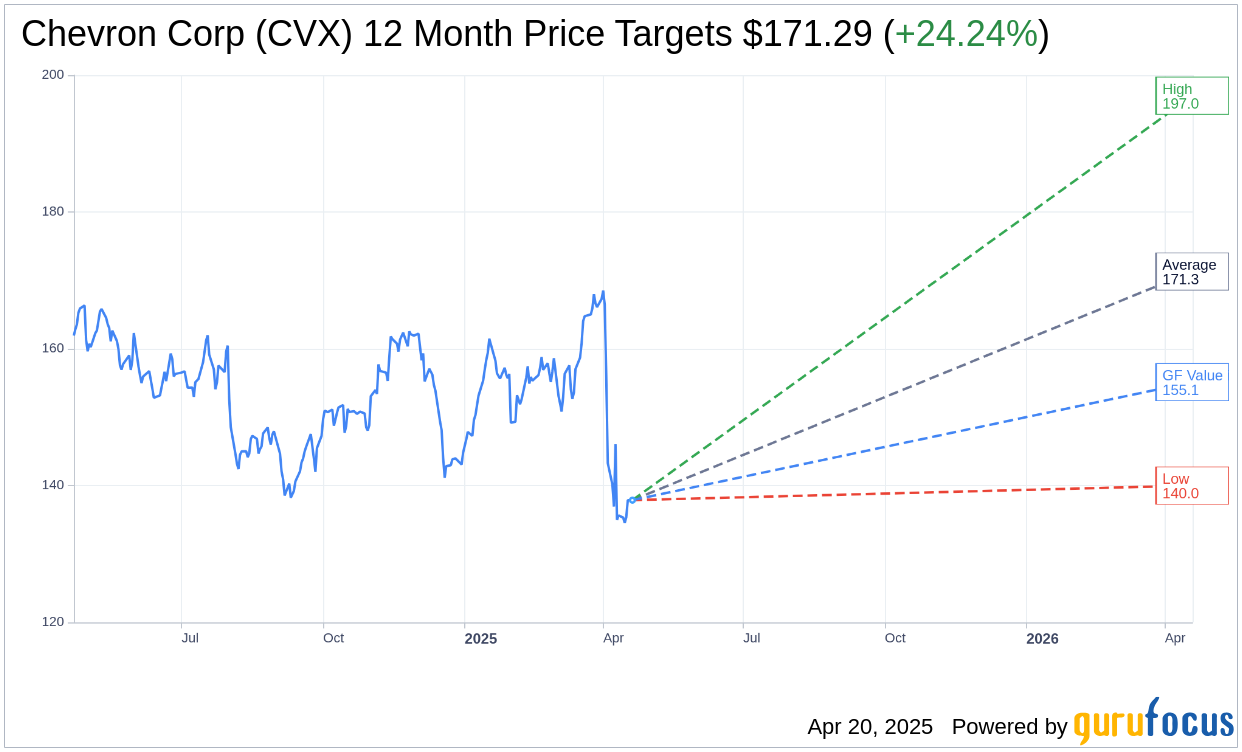

Within the predictions of 22 seasoned analysts, Chevron Corp (CVX, Financial) stands out with an average one-year price target of $171.29. Price estimates range significantly, presenting a high mark of $197.00 to a cautious low of $140.00. This average prediction forecasts a rewarding upside of 24.24% from the current trading price of $137.87. For investors seeking more comprehensive projections, detailed estimates are available on the Chevron Corp (CVX) Forecast page.

Chevron Corp (CVX, Financial) garners a consensus recommendation from 25 brokerage firms, placing it firmly in the "Outperform" category with an average rating of 2.2. This scale reflects a broad spectrum, where 1 denotes a Strong Buy and 5 signifies a Sell, highlighting confidence in Chevron's market position.

According to GuruFocus estimates, Chevron Corp's (CVX, Financial) projected GF Value within the next year stands at $155.13. This indicates a potential upside of 12.52% relative to its current price of $137.87. The GF Value metric represents GuruFocus' calculation of the stock's fair value, derived from historical trading multiples, past growth, and future performance prognosis. Further insights are readily accessible on the Chevron Corp (CVX) Summary page.