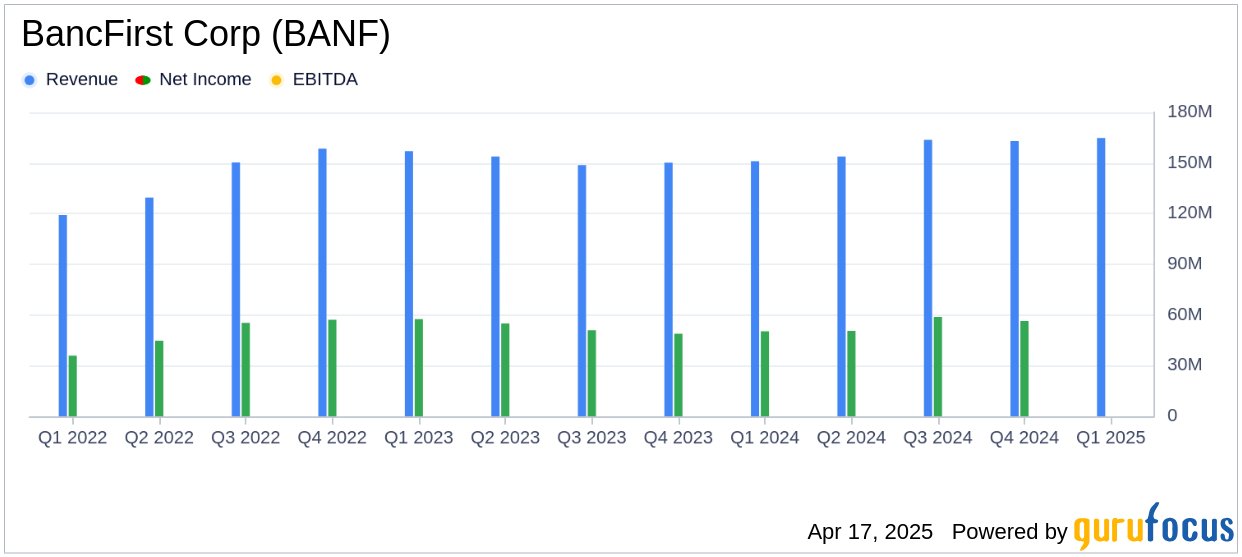

On April 17, 2025, BancFirst Corp (BANF, Financial) released its 8-K filing for the first quarter of 2025, reporting a net income of $56.1 million, or $1.67 per diluted share. This performance exceeded the analyst estimate of $1.58 per share. The company's revenue for the quarter was not explicitly stated, but the net interest income increased to $115.9 million, indicating a positive trend compared to the previous year.

Company Overview

BancFirst Corp is a financial services holding company based in Oklahoma, providing a wide range of banking services through its subsidiaries, including BancFirst metropolitan banks, BancFirst community banks, Pegasus Bank, and Worthington Bank. These entities offer traditional banking products such as commercial and retail lending, deposit accounts, and specialty services like small business lending, mortgage lending, trust services, and more.

Performance and Challenges

BancFirst Corp's net income for Q1 2025 was $56.1 million, up from $50.3 million in the same quarter of 2024. The net interest income rose to $115.9 million from $106.1 million, driven by higher loan volumes and growth in earning assets. However, the net interest margin remained steady at 3.70%. The provision for credit losses decreased significantly to $1.6 million from $4.0 million in the previous year, reflecting improved credit conditions.

Financial Achievements

The company's noninterest income increased to $49.0 million, up from $44.9 million in Q1 2024, with growth in trust revenue, treasury income, sweep fees, and insurance commissions. Despite these gains, noninterest expenses rose to $92.2 million, partly due to a $4.4 million expense related to the Volcker rule and increased salaries and benefits.

Key Financial Metrics

As of March 31, 2025, BancFirst Corp's total assets were $14.0 billion, an increase of $483.7 million from December 31, 2024. Loans grew by $69.6 million, totaling $8.1 billion, while deposits increased by $408.2 million to $12.1 billion. The company's stockholders' equity rose by $51.6 million to $1.7 billion. Notably, nonaccrual loans decreased slightly to 0.70% of total loans, and the allowance for credit losses remained unchanged at 1.24%.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Income | $56.1 million | $50.3 million |

| Net Interest Income | $115.9 million | $106.1 million |

| Noninterest Income | $49.0 million | $44.9 million |

| Noninterest Expense | $92.2 million | $82.8 million |

| Total Assets | $14.0 billion | $12.6 billion |

Analysis and Commentary

BancFirst Corp's performance in the first quarter of 2025 demonstrates resilience and growth, particularly in net interest income and noninterest income. The company's ability to maintain a stable net interest margin amidst market volatility is noteworthy. However, the increase in noninterest expenses, driven by regulatory compliance and rising employee costs, poses a challenge.

BancFirst Corporation CEO David Harlow commented, “The Company continues to perform fundamentally well; however, the current bond and equity market volatility presents a unique backdrop. The ultimate impact on our region’s economy, our customers and, thus, credit quality remains to be seen. We are cautious in our outlook for the remainder of the year with the likelihood of an economic slowdown increasing and, as a result, our reserve for credit losses as a percentage of loans is unchanged from year-end 2024.”

Overall, BancFirst Corp's strong earnings performance and strategic growth in assets and deposits position it well in the banking sector, although careful navigation of market challenges will be crucial moving forward.

Explore the complete 8-K earnings release (here) from BancFirst Corp for further details.