Qualcomm's Q1 results for fiscal 2025 were actually pretty solid—it beat estimates—but the stock still dropped after hours. I think a lot of that had to do with its lowered guidance and Apple's recent announcement, which could really shake things up for Qualcomm's business going forward. On top of that, the whole market's been all over the place lately thanks to Trump-related volatility, so Qualcomm hasn't been spared. Since the start of the year, shares are down around 11.6%, while the broader NASDAQ has fallen even more—about 15.5%. Most of that pain, in my view, came from the DeepSeek sell-off, the AI bubble popping back in mid-February 2025, and the whole tariff war heating up again.

Now even though the stock's been pretty shaky, I'm still bullish. Qualcomm plays a key role in the wireless world, making chips, software, and services tied to wireless tech. Its importance grew big time when mobile phones were just taking off in the U.S., and now that market is more mature, I think the next big thing is IoT. That space looks like a strong fit for what Qualcomm already does well, and should open up a whole new growth path. What really stands out to me is how Qualcomm has been working to shift away from just handsets and move into other areas like automotive and IoT. Over the long run—say three years or more—I think this push to diversify will pay off and help it outperform the market. Right now, I see Qualcomm trading at what looks like a pretty attractive valuation, with a good bit of upside potential. Plus, it's got a decent dividend that keeps growing, which is a nice bonus while waiting for the stock to re-rate.

Diversifying Beyond Smartphones

Although Qualcomm still earns most of its revenue from the smartphone market, I'm encouraged to see the company shift its focus toward AI-inferencing chips for edge computing, IoT, and automotive use cases—areas that are growing quickly. Year-on-year, Qualcomm has cut handset revenue as a share of total sales from about 80% down to 75%, and I expect this trend to continue. This diversification should comfort investors since the main headwinds right now are threats to handset revenues. Qualcomm's view that the best place to do AI inferencing is on-device rather than in some distant cloud makes sense to me. Devices aren't always online, on-device inferencing preserves privacy, and it's more secure than sending data back and forth to the cloud.

Edge Computing: The Next Frontier

Edge computing brings storage and processing power closer to end users and devices, which matters for applications that need real-time responses. Qualcomm is already rolling out its QCT Industrial IoT product line for edge cases. On March 3rd, the company unveiled its latest X85 modem, integrating a new 5G AI processor. CEO Cristiano Amon believes the X85 could outpace Apple's in-house modem when it comes to high-performance connectivity for hybrid and agentic AI tasks. Qualcomm pegs the total edge-computing TAM at $900 billion by 2030—an estimate I find realistic given forecasts from STL Partners (48% CAGR through 2030) and Grand View Research (36.9% CAGR through 2030). Recent results back this up: QCT IoT revenue jumped 36% YoY to $1.55 billion, and I'm confident they can sustain those growth rates given the market dynamics.

Automotive Growth Engine

Another major growth driver for Qualcomm is its push into the automotive sector, where AI is also booming. Global Market Insights projects the automotive AI market will grow at a 42% CAGR from $4.8 billion in 2024 to $186.4 billion by 2034—plenty of room for Qualcomm to expand. QCT automotive revenue, though under $3.3 billion on a TTM basis, rose 61% YoY to $961 million. Importantly, Qualcomm has “landed and expanded” in infotainment and autonomy, securing a nearly $50 billion pipeline with major automakers. Their auto-stack is set to commercialize next year, which should translate into substantial revenue. Management targets the Auto segment to grow from $3 billion to $8 billion annually by FY '29, and they see the combined QCT IoT plus Auto segments reaching $22 billion by FY '29—over half of FY '24 revenues. CEO Amon believes generative AI use cases could push this even higher.

Apple Modem Loss: A Manageable Headwind

Bloomberg reports that Apple will begin phasing out Qualcomm's modem chips this year with the iPhone SE and fully switch to its own modems by 2027. Any meaningful hit to Qualcomm's top line likely won't show up until late FY 2025 or early FY 2026. I view this as a medium-term headwind rather than a “death blow,” since Qualcomm has had two years to prepare and has proactively diversified. Moreover, the global smartphone market is still expected to grow at a 7.2% CAGR from $527.5 billion in 2024 to $1.14 trillion by 2034, which should offset some loss of Apple revenue. Qualcomm's guidance has already excluded future Apple modem revenues outside existing agreements, and frankly, I expect this shift to look like an opportunity in hindsight.

[Author's workings]

Growth Outlook and Revenue Expectations

When I look at the big picture, I think Qualcomm's top line has solid upside in the near term. I expect total revenue to grow around 15% in FY25, which I feel is quite realistic, especially when you consider the company has already grown revenue at a 13.72% CAGR over the past five years—up from $23.53B in 2020 to $38.96B in 2024. From FY26 onward though, I expect the pace to slow down a bit. The new X85 modem and demand from AI inference should help, but the loss of Apple's modem business will act as a drag on overall growth. Still, I think Qualcomm can more than make up for Apple's pullout over time through its edge computing, IoT, and automotive divisions. With the autonomous autostack expected to go commercial by FY26, I believe these areas will become key growth engines. Qualcomm expects its Auto revenue to hit $8B by FY29, and IoT to reach $14B in that same year. Even assuming Apple disappears as a customer, I think the company can still manage about 2.5% annual revenue growth over the next five years. So yeah, growth may cool off a bit after FY25, but I'm optimistic that Qualcomm can keep things moving in the right direction.

Margins Remain Solid

Margins-wise, I think Qualcomm is running a tight ship. They're already operating at strong profitability levels, so I don't see huge room for improvement, but I also don't see any major downside. Right now, they're pulling in a 55.99% gross profit margin based on $22.79B in gross profit, which is up 4.04% YoY. They also generate around $0.31 in EBITDA for every dollar in revenue, which means $12.59B in EBITDA with a 30.92% margin. That's impressive, and it's backed up by the QTL segment, which has been showing stronger pricing power and better operating leverage lately. Looking ahead, I think there's potential for a little margin lift in the near term—maybe over the next year or two—as Apple's lower-margin modem business gets replaced by higher-margin segments like Auto and IoT. In the longer term (say, 6–8 years), I could see a more noticeable improvement. But overall, even if margins don't move much, they're already at pretty strong levels, and that helps reinforce my confidence in the business.

Trump Trade War Risks

In Qualcomm's case, the main risk from Trump's tariffs comes indirectly through its heavy exposure to Asia. About 62.5% of QCOM's revenue comes from China, and 75% from Asia overall, because most of its sales still come from handsets made by companies like Xiaomi, Huawei, Motorola, and Samsung. While the tariffs don't hit Qualcomm directly, they could hurt the manufacturers it supplies, who then sell phones worldwide. As Qualcomm's automotive business grows, it's worth noting that China accounts for over a third of global auto production, so Qualcomm's car revenues could also feel the pinch. Right now, I take some comfort in the fact that there's no immediate direct impact, and I tend to see these tariff threats more as political negotiation tactics than long-term economic policy—even if you might disagree politically.

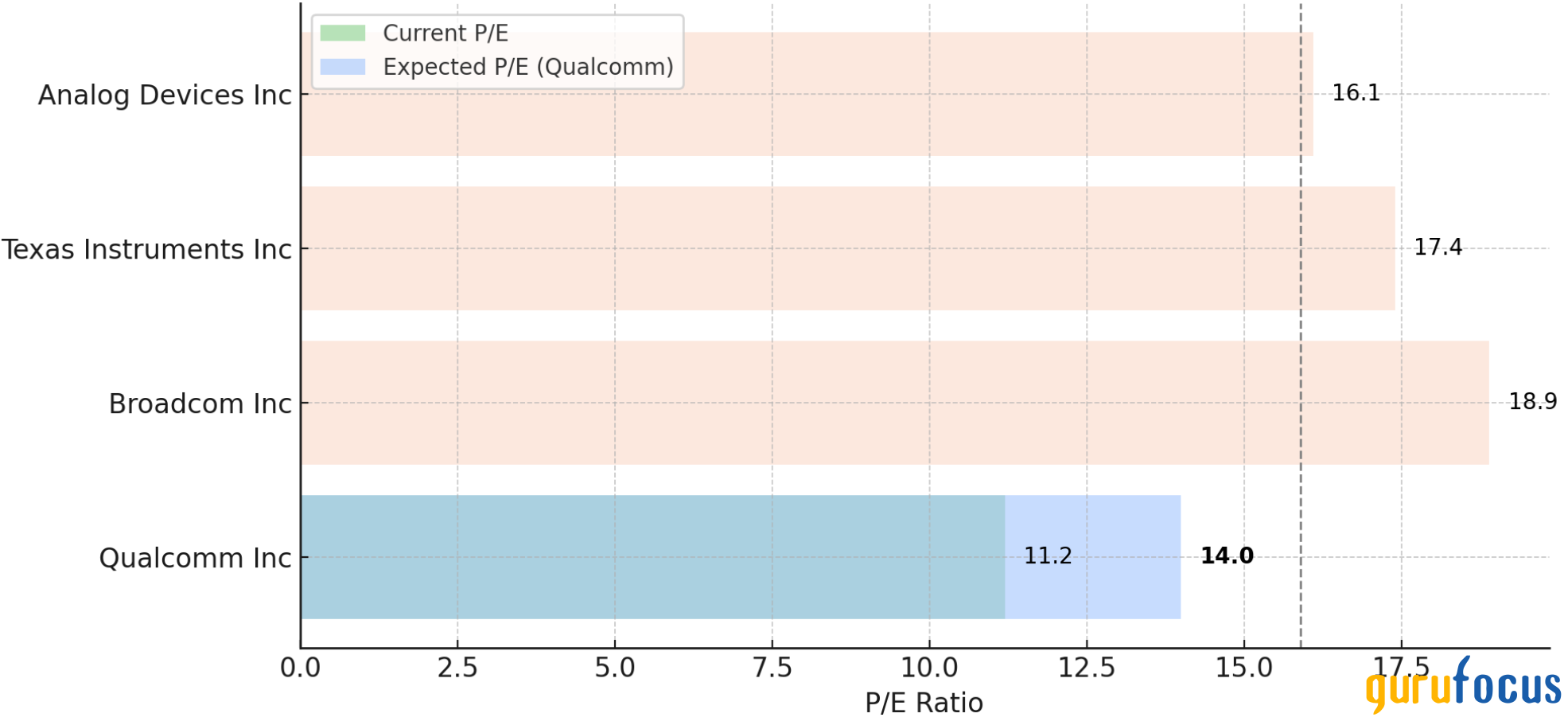

Relative Valuation

Apple's decision to build its own modem, worries about an “AI indigestion” phase, and trade-war jitters have pushed QCOM's share price down, making it look cheap today. Its 3-year forward P/E sits at just 11.2x, compared to an average of about 17.5x for peers like Texas Instruments, Broadcom, and Analog Devices. I see that cheap valuation reflecting Apple's lost business and near-term revenue volatility. But over the long haul, I expect handset revenue from other players—especially Samsung—plus growing automotive and IoT sales will smooth out swings and drive multiples higher. If Qualcomm's forward P/E re-rates to around 14x (still conservative versus peers), we'd be looking at a target near $170—about 25% upside from here.

[Author's Workings]

DCF Analysis

Even a conservative DCF supports upside. I assumed EPS grows at a 6% CAGR over the next five years (a mix of revenue gains and share buybacks), then 3% in perpetuity, with revenues rising from $43 billion in Year 1 to $54 billion in Year 5. I also modeled a modest margin expansion from 33% to 35% and used a 10% discount rate. Under these assumptions, the DCF yields a target of $167—about a 19% gain—reinforcing my thesis that Qualcomm offers an attractive risk/reward at today's prices.

Final Thoughts

In my view, Qualcomm remains a “Buy”—its stock is still undervalued, and mid-single-digit growth seems quite realistic even with Apple exiting. We're seeing AI move from giant data‑center training on broad LLMs to specialized SLMs and edge inference on phones, cars, robots, and more—and Qualcomm is perfectly positioned for that shift. I'm braced for a longer-term bear market driven by tariffs and recession fears, but I fully expect Qualcomm to be trading higher in 10–15 years. Given the pullbacks we'll see along the way, I think now is a smart time to dollar‑cost average into a position. When you consider how well Qualcomm fits into the coming Exponential Age, it's clear to me the shares are a “Strong Buy.”