Key Takeaways:

- Tilray Brands (TLRY, Financial) is considering a reverse stock split to comply with Nasdaq guidelines.

- The company holds a robust cash balance and has significantly reduced its debt.

- Analysts forecast a potential significant upside for TLRY shares.

Tilray Brands (TLRY) has unveiled plans for a reverse stock split, proposing ratios from 1-to-10 to 1-to-20. This move aims to align with Nasdaq's requirements and enhance its strategic footing. Additionally, Tilray reports a strong cash reserve exceeding $248 million, coupled with a substantial $76 million debt reduction anticipated in fiscal 2025. However, these announcements initially triggered a premarket share decline of 5.8%.

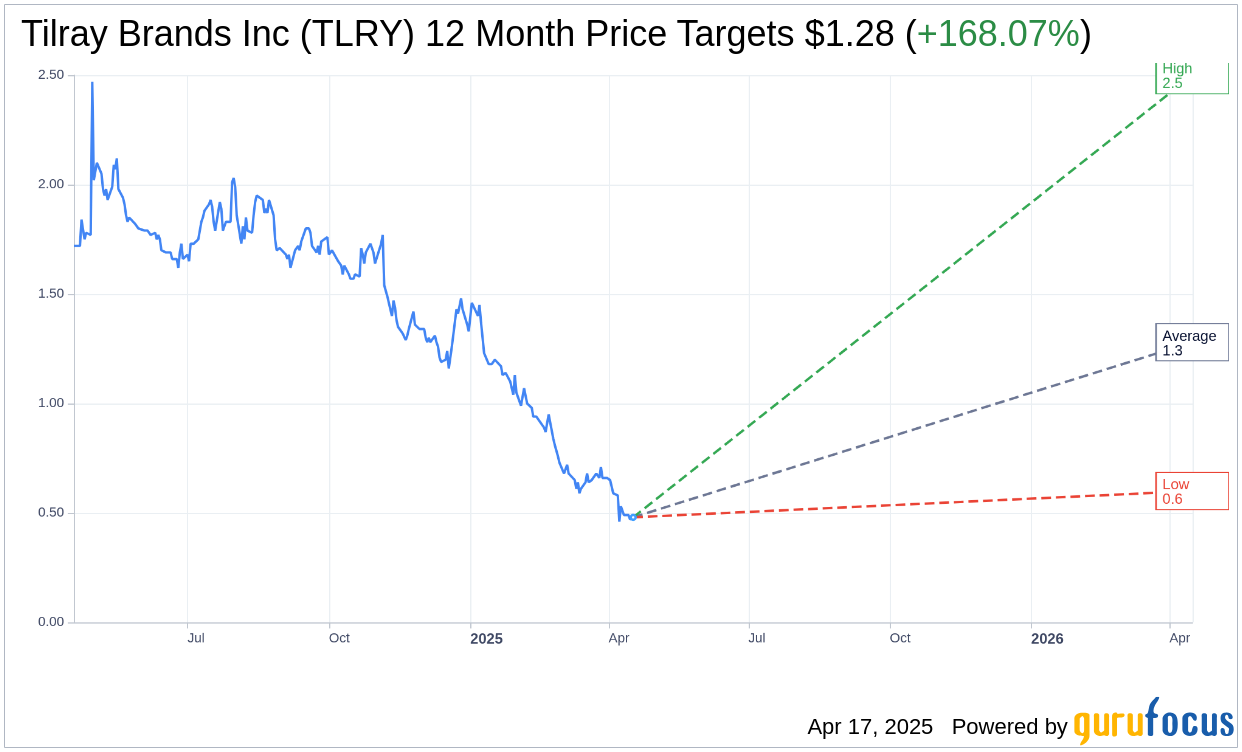

Wall Street Analysts' Forecast

Analyzing the insights of 11 analysts, the average one-year price target for Tilray Brands Inc (TLRY, Financial) is estimated at $1.28, with projections ranging between a high of $2.50 and a low of $0.60. This forecast suggests a potential upside of 168.07% from the current trading price of $0.48. For a deeper dive into the estimates, visit the Tilray Brands Inc (TLRY) Forecast page.

In terms of investment stance, the consensus from 12 leading brokerage firms positions Tilray Brands Inc (TLRY, Financial) with an average recommendation of 2.7, which translates to a "Hold" status. The rating is interpreted on a scale from 1 (Strong Buy) to 5 (Sell).

Examining GuruFocus metrics, the anticipated GF Value for Tilray Brands Inc (TLRY, Financial) in the coming year stands at $1.92. This figure indicates a potential upside of 303.53% from its present value of $0.4758. The GF Value is GuruFocus's estimate of a stock's intrinsic worth, calculated through historical trading multiples, prior business growth, and future performance projections. Further information is accessible on the Tilray Brands Inc (TLRY) Summary page.