Raymond James has revised its price target for Bath & Body Works (BBWI, Financial), reducing it from $46 to $37, while maintaining an Outperform rating for the company's stock. The adjustment reflects anticipated challenges in the upcoming earnings season for the beauty, personal care, and household product sectors.

The firm cites a slowdown in sales, particularly in the United States, with similar trends emerging in Europe and Latin America. This deceleration is linked to cautious consumer spending on everyday necessities, influenced by economic factors and changing market dynamics.

Retailers are reportedly shifting their focus to product categories vulnerable to tariff-related cost increases. This strategic pivot is seen as a response to minimize potential financial impacts, as the market faces broader economic uncertainties.

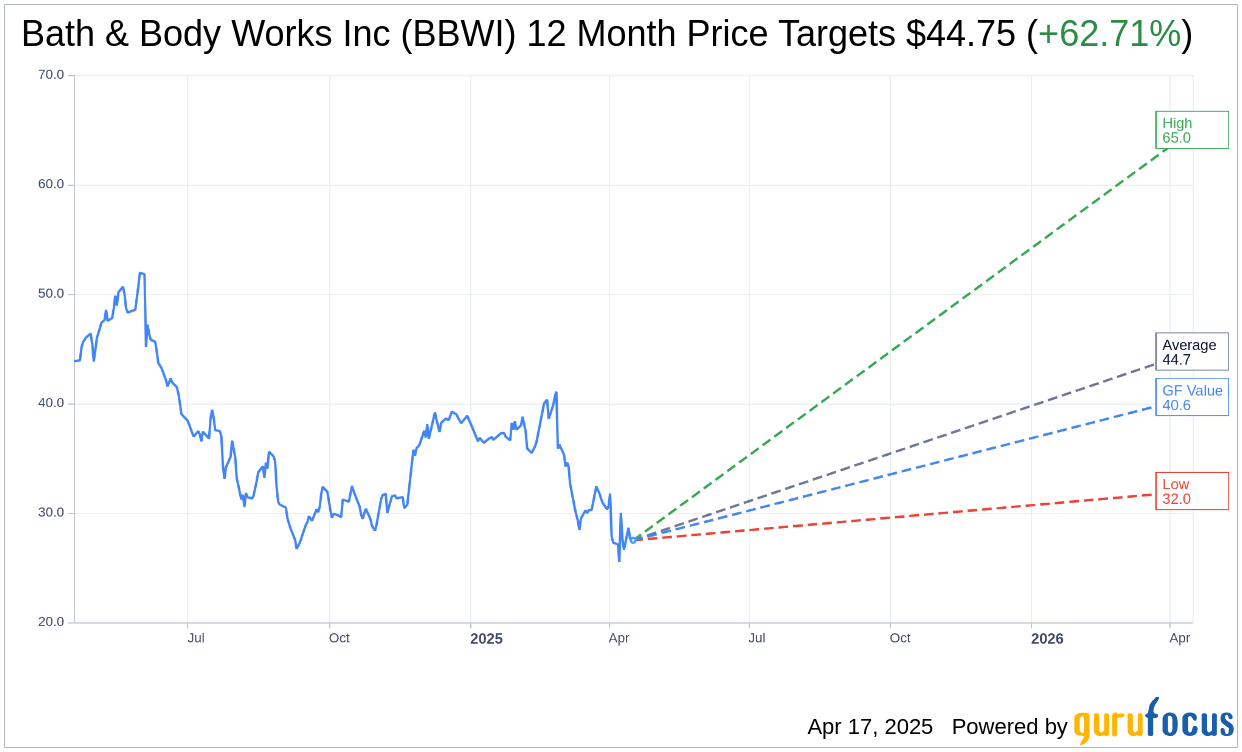

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Bath & Body Works Inc (BBWI, Financial) is $44.75 with a high estimate of $65.00 and a low estimate of $32.00. The average target implies an upside of 62.71% from the current price of $27.50. More detailed estimate data can be found on the Bath & Body Works Inc (BBWI) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Bath & Body Works Inc's (BBWI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bath & Body Works Inc (BBWI, Financial) in one year is $40.60, suggesting a upside of 47.64% from the current price of $27.5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bath & Body Works Inc (BBWI) Summary page.