Canaccord analyst John Newman has adjusted the price target for Regeneron Pharmaceuticals (REGN, Financial), decreasing it from $170 to $150. Despite this revision, the firm maintains a Hold rating on Regeneron's shares. The decision to lower the target reflects a more cautious outlook on the company's revenue growth and profit margin expansion prospects.

This conservative stance comes in the wake of Regeneron's acquisition of the 908 devices asset, which is expected to have a dilutive effect. Additionally, potential challenges related to tariffs and ongoing pressures in capital purchasing are also influencing the revised forecast. These factors are contributing to a less optimistic view of the company's financial trajectory in the near term.

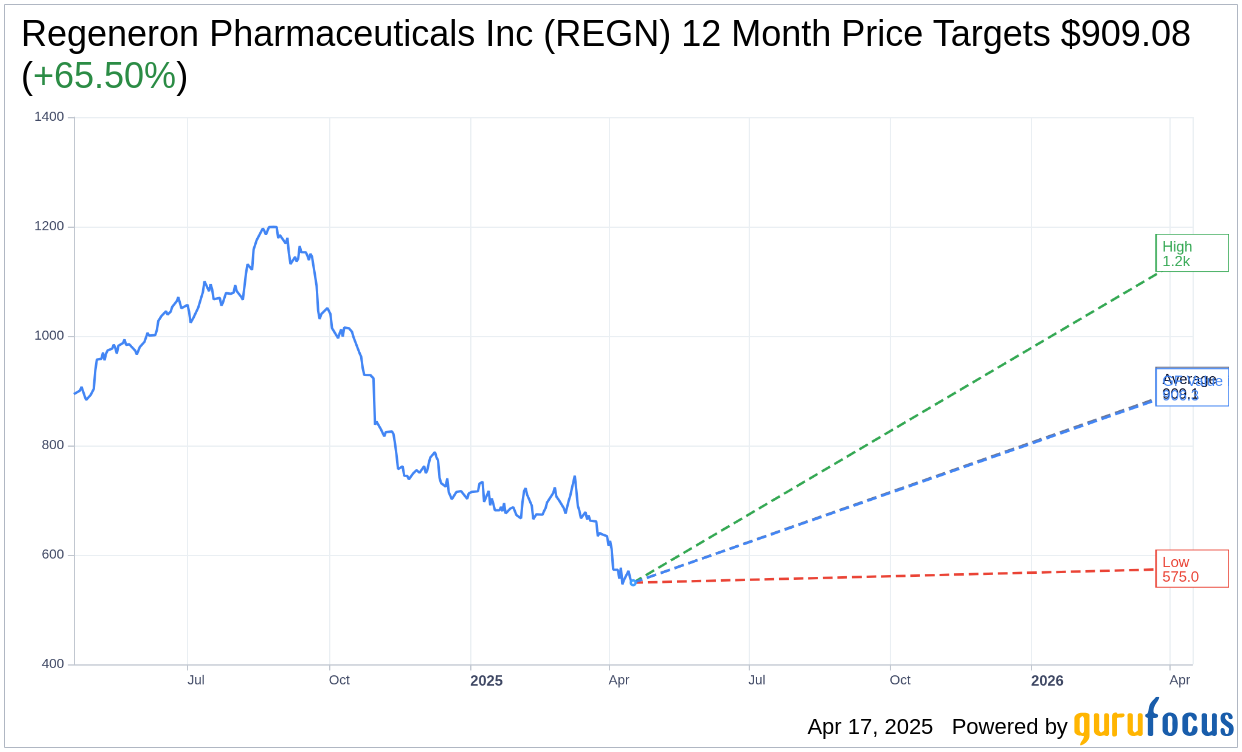

Wall Street Analysts Forecast

Based on the one-year price targets offered by 25 analysts, the average target price for Regeneron Pharmaceuticals Inc (REGN, Financial) is $909.08 with a high estimate of $1,152.00 and a low estimate of $575.00. The average target implies an upside of 65.50% from the current price of $549.28. More detailed estimate data can be found on the Regeneron Pharmaceuticals Inc (REGN) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Regeneron Pharmaceuticals Inc's (REGN, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Regeneron Pharmaceuticals Inc (REGN, Financial) in one year is $906.31, suggesting a upside of 65% from the current price of $549.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Regeneron Pharmaceuticals Inc (REGN) Summary page.