Insteel Industries, Inc. (IIIN, Financial) reported a significant improvement in its second-quarter financial performance, with revenues rising to $160.7 million compared to $127.4 million the previous year. The company's earnings per share were slightly affected by $0.7 million in restructuring and acquisition-related charges, resulting in a 3-cent reduction.

CEO H.O. Woltz III expressed optimism about the growing demand for Insteel's products, attributing the positive momentum to better business conditions and increased customer confidence. These improving trends, however, are not fully reflected in broader economic indicators used to gauge the construction industry's health.

The recent changes in tariff policies introduced by the Trump Administration have been beneficial for Insteel. The inclusion of derivative products, like PC strand, in the Section 232 steel tariff has helped eliminate a competitive disadvantage that previously affected the company. This change is expected to mitigate the impact of low-priced PC strand imports in the U.S. market. Additionally, the reinstatement of Section 232 tariffs on shipments from Canada and Mexico is anticipated to elevate costs in the U.S., along with reduced capacity in domestic steel wire rod production.

Despite the potential for increased expenses from reciprocal tariffs on offshore purchases of capital equipment and supplies, Insteel remains confident. The company plans to adopt a disciplined approach to pricing and managing its tariff exposure, viewing the expansion of the Section 232 tariff as a positive development due to its long-standing presence and the lack of reciprocal tariffs on steel.

Wall Street Analysts Forecast

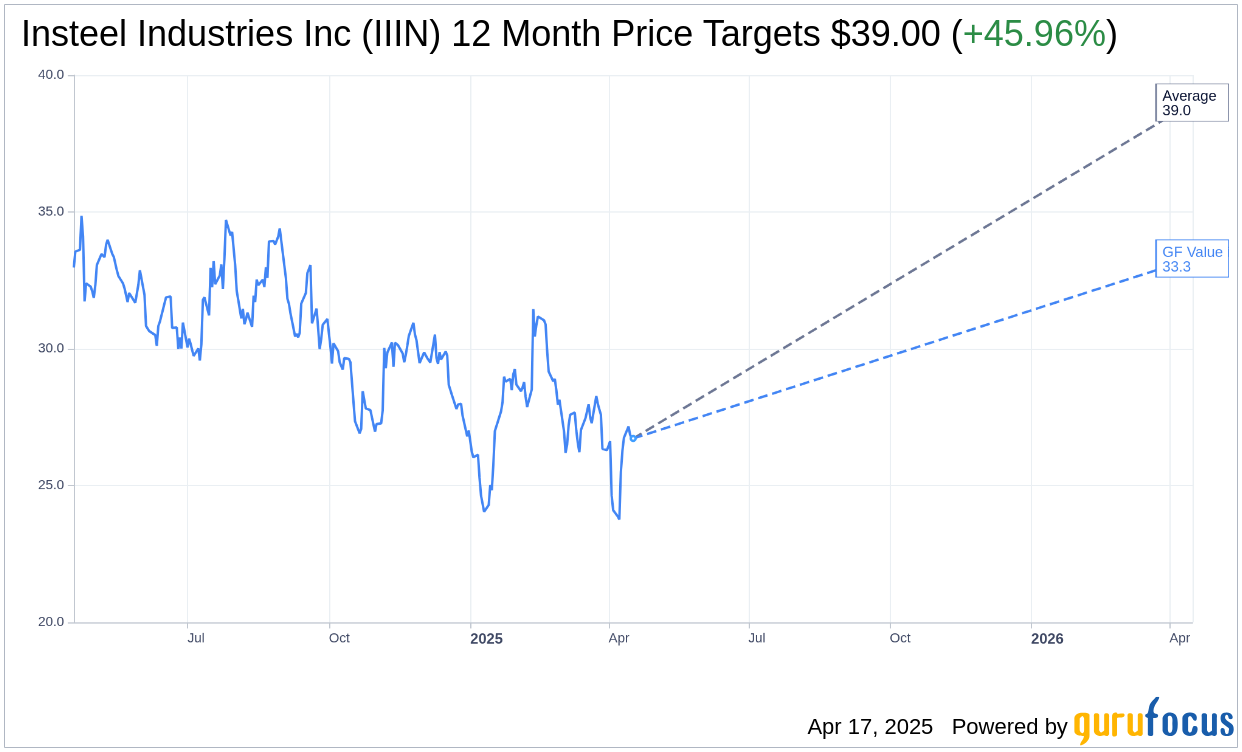

Based on the one-year price targets offered by 1 analysts, the average target price for Insteel Industries Inc (IIIN, Financial) is $39.00 with a high estimate of $39.00 and a low estimate of $39.00. The average target implies an upside of 45.96% from the current price of $26.72. More detailed estimate data can be found on the Insteel Industries Inc (IIIN) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Insteel Industries Inc's (IIIN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Insteel Industries Inc (IIIN, Financial) in one year is $33.30, suggesting a upside of 24.63% from the current price of $26.72. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Insteel Industries Inc (IIIN) Summary page.