Progressive Corporation (PGR, Financial) has received a downgrade from Market Outperform to Market Perform by analyst Meyer Shields at Keefe Bruyette. The decision comes with a maintained price target of $288. Despite the unchanged target, Shields points to anticipated challenges in the company's growth trajectory.

The analyst highlights a potential deceleration in the growth of Progressive's personal auto policies in force. This slowdown is likely as competing firms ease up on their rate hikes, affecting Progressive's competitiveness in the market. Furthermore, the company might encounter pressure on its core loss ratio in the near term. This can be attributed to a reduction in earned rate increases, which might impact financial metrics if the recent decline in personal auto physical damage claim frequencies levels out.

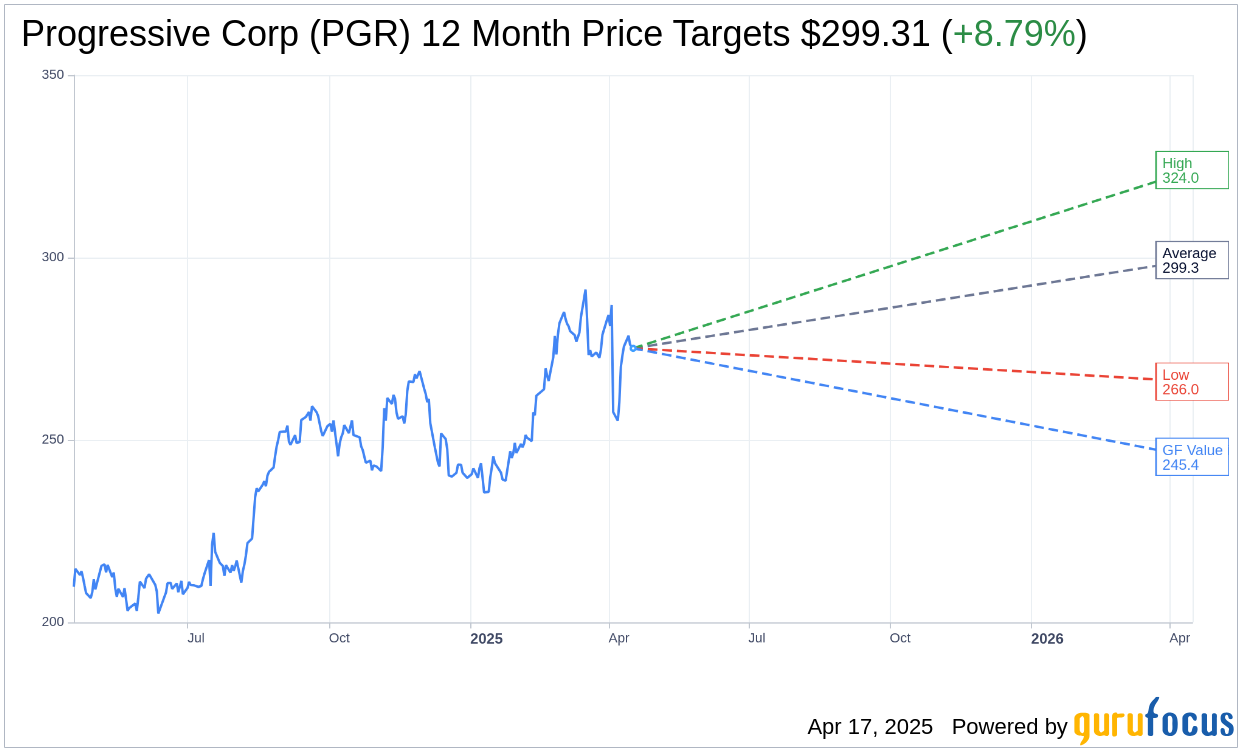

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Progressive Corp (PGR, Financial) is $299.31 with a high estimate of $324.00 and a low estimate of $266.00. The average target implies an upside of 8.79% from the current price of $275.13. More detailed estimate data can be found on the Progressive Corp (PGR) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Progressive Corp's (PGR, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Progressive Corp (PGR, Financial) in one year is $245.40, suggesting a downside of 10.81% from the current price of $275.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Progressive Corp (PGR) Summary page.