Insights from the First Quarter of 2025 N-PORT Filing

Steven Romick (Trades, Portfolio) recently submitted the N-PORT filing for the first quarter of 2025, providing insights into his investment moves during this period. Steven Romick (Trades, Portfolio) joined FPA in 1996, serving as one of several Portfolio Managers for the FPA Crescent Fund. Prior to joining the firm, Steven was Chairman of Crescent Management and a consulting security analyst for Kaplan, Nathan & Co. Steven earned a Bachelor’s degree in Education from Northwestern University.

The FPA Crescent Fund's portfolio consists of both long and short equity positions. The fund seeks value in all parts of a company's capital structure, including common and preferred stocks, as well as corporate and convertible bonds.

FPA Crescent invests in securities "that the consensus does not wish to own," searching for stocks and convertible bonds that reflect low cyclically-adjusted price-earnings ratios and trade at discounts to private market value. Corporate bonds with yields substantially higher than those of government securities are also considered. The FPA Crescent Fund's investing process stems from several pillars. Absolute value investors: The fund seeks genuine bargains rather than relatively attractive securities. Alignment of interests: The fund invests its money alongside its clients, and act as stewards of its shared capital. Broad mandate: The fund invests across the capital structure, asset classes, market caps, industries and geographies. The fund is also willing to hold cash. Long-term focus: The fund believes the best way to accomplish its goals is to accept short-term underperformance in exchange for long-term success.

Key Position Increases

Steven Romick (Trades, Portfolio) also increased stakes in a total of 8 stocks, among them:

- The most notable increase was Vail Resorts Inc (MTN, Financial), with an additional 170,646 shares, bringing the total to 513,932 shares. This adjustment represents a significant 49.71% increase in share count, a 0.48% impact on the current portfolio, with a total value of $82,239,400.

- The second largest increase was Fortune Brands Innovations Inc (FBIN, Financial), with an additional 354,252 shares, bringing the total to 516,890. This adjustment represents a significant 217.82% increase in share count, with a total value of $31,468,260.

Summary of Sold Out

Steven Romick (Trades, Portfolio) completely exited 1 of the holdings in the first quarter of 2025, as detailed below:

- MAC Copper Ltd (MTAL, Financial): Steven Romick (Trades, Portfolio) sold all 55,123 shares, resulting in a -0.01% impact on the portfolio.

Key Position Reduces

Steven Romick (Trades, Portfolio) also reduced positions in 21 stocks. The most significant changes include:

- Reduced Holcim Ltd (XSWX:HOLN, Financial) by 581,255 shares, resulting in an -18.72% decrease in shares and a -0.9% impact on the portfolio. The stock traded at an average price of CHF 94.1 during the quarter and has returned 4.43% over the past 3 months and 1.99% year-to-date.

- Reduced Kinder Morgan Inc (KMI, Financial) by 1,975,676 shares, resulting in a -40.74% reduction in shares and a -0.87% impact on the portfolio. The stock traded at an average price of $27.69 during the quarter and has returned -9.40% over the past 3 months and -0.60% year-to-date.

Portfolio Overview

At the first quarter of 2025, Steven Romick (Trades, Portfolio)'s portfolio included 52 stocks, with top holdings including 5.05% in Meta Platforms Inc (META, Financial), 4.85% in Analog Devices Inc (ADI, Financial), 4.79% in Alphabet Inc (GOOGL, Financial), 4.74% in Holcim Ltd (XSWX:HOLN), and 4.6% in Citigroup Inc (C, Financial).

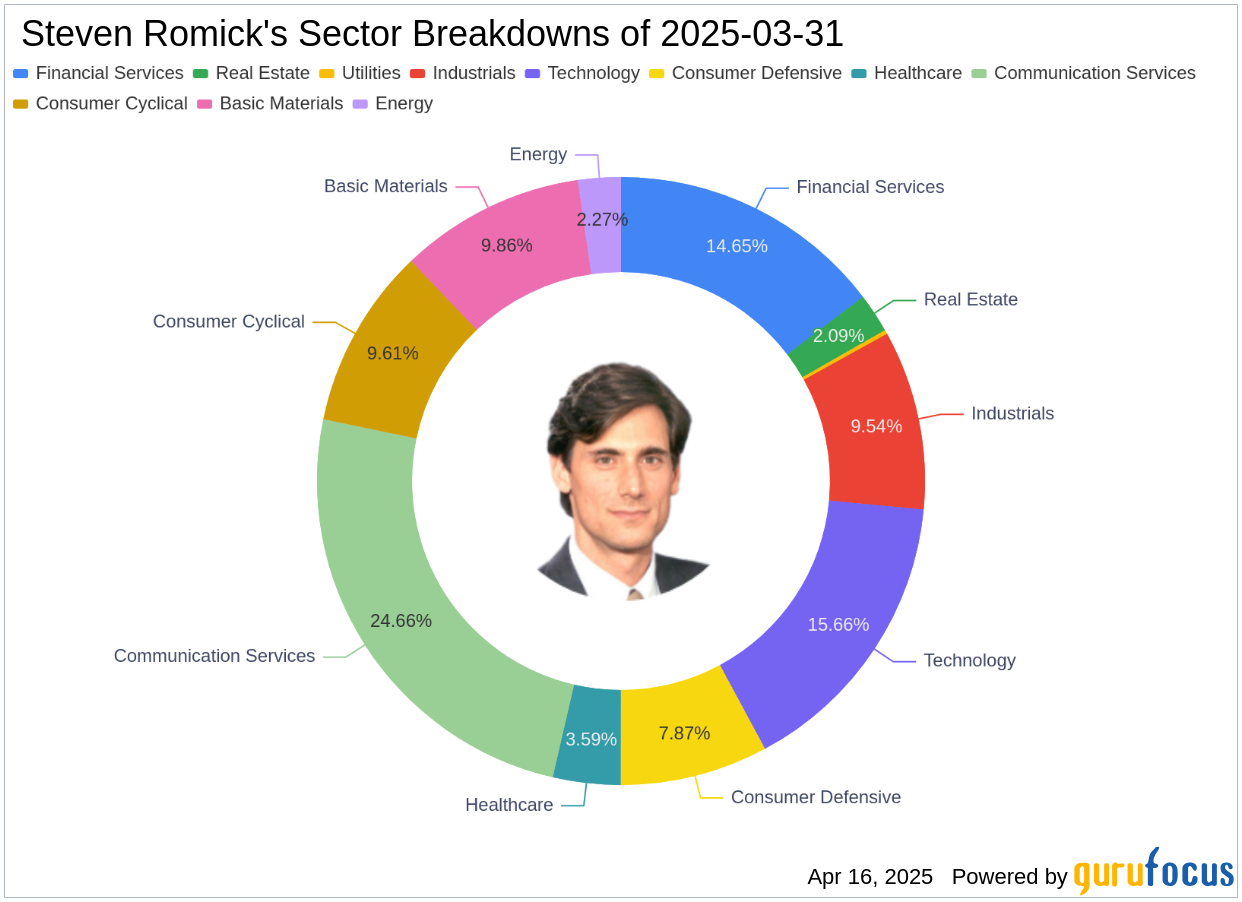

The holdings are mainly concentrated in 11 industries: Communication Services, Technology, Financial Services, Basic Materials, Consumer Cyclical, Industrials, Consumer Defensive, Healthcare, Energy, Real Estate, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.