Summary:

- U.S. Steel's (X, Financial) rating downgraded by J.P. Morgan, reflecting economic and demand concerns.

- Analysts foresee limited upside potential based on current price targets.

- GuruFocus estimates suggest a significant downside based on the calculated GF Value.

U.S. Steel (X) maintains its footing amidst market fluctuations following a downgrade from Overweight to Neutral by J.P. Morgan. The firm decreased its price target from $43 to $38, citing uncertainties over the Nippon Steel deal and a revised outlook for steel prices. Investor focus has shifted towards macroeconomic difficulties and potential demand obstacles.

Wall Street Analysts Forecast

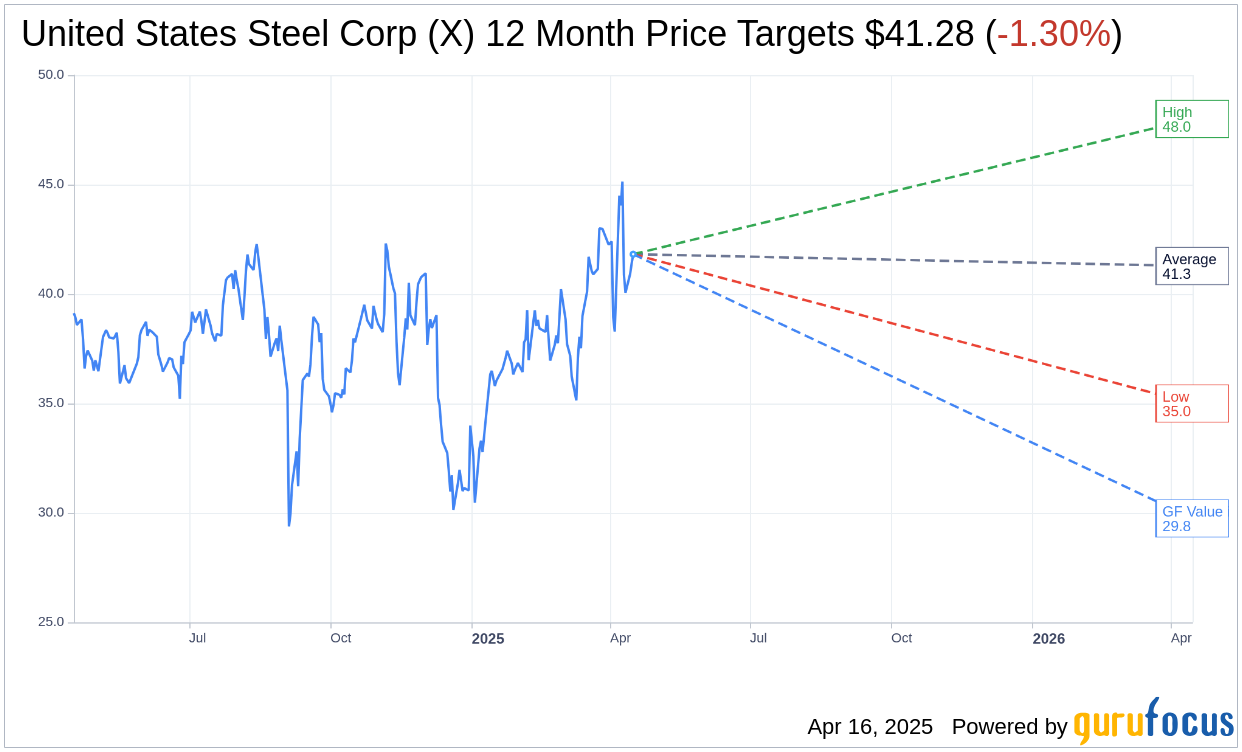

According to predictions from eight analysts, the average target price for United States Steel Corp (X, Financial) stands at $41.28. This projection ranges from a high of $48.00 to a low of $35.00. At the current price of $41.82, the average target suggests a downside of 1.30%. Detailed estimates are available on the United States Steel Corp (X) Forecast page.

Eleven brokerage firms provide a consensus recommendation for U.S. Steel Corp, averaging at 2.3, categorizing the stock as "Outperform." This rating system operates on a scale from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell.

The GF Value for U.S. Steel Corp (X, Financial), as estimated by GuruFocus, is predicted to be $29.75 in one year. This implies a potential downside of 28.86% from the current price of $41.82. The GF Value is GuruFocus's assessment of the fair price at which the stock should trade. It is derived from historical trading multiples, past business growth, and future performance estimates. Further details can be accessed on the United States Steel Corp (X) Summary page.