On April 16, 2025, Alcoa Corp (AA, Financial) released its 8-K filing detailing its first quarter 2025 financial results. The company reported significant improvements in net income and adjusted EBITDA, driven by favorable market conditions and strategic initiatives.

Company Overview

Alcoa Corp (AA, Financial) is a leading vertically integrated aluminum company, engaged in bauxite mining, alumina refining, and aluminum production. As the world's largest bauxite miner and alumina refiner, Alcoa's financial performance is closely tied to commodity prices in the aluminum supply chain.

Financial Performance and Challenges

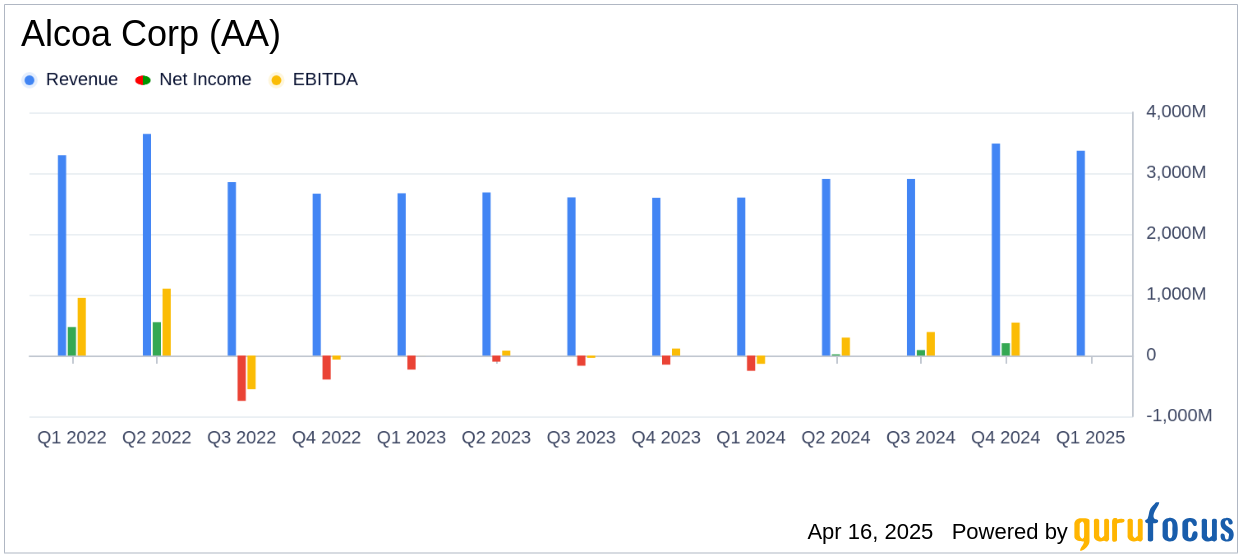

Alcoa Corp (AA, Financial) reported a net income of $548 million, or $2.07 per share, for the first quarter of 2025, a substantial increase from $202 million in the previous quarter. This performance exceeded analyst estimates of $1.85 per share. The company's revenue for the quarter was $3,369 million, slightly below the estimated $3,527.71 million. However, it was still a notable improvement from $2,599 million in the same quarter last year.

The company's performance was bolstered by increased aluminum prices and a net benefit from lower alumina prices. However, challenges such as tariff costs on imported aluminum and lower shipments posed potential risks to future profitability.

Key Financial Achievements

Alcoa's adjusted net income rose to $568 million, or $2.15 per share, marking a 106% sequential increase. Adjusted EBITDA excluding special items reached $855 million, a 26% increase from the previous quarter. These achievements underscore Alcoa's ability to capitalize on favorable market conditions and manage operational efficiencies.

Income Statement and Balance Sheet Highlights

| Metric | 1Q25 | 4Q24 | 1Q24 |

|---|---|---|---|

| Revenue | $3,369 million | $3,486 million | $2,599 million |

| Net Income | $548 million | $202 million | $(252) million |

| Adjusted EBITDA | $855 million | $677 million | $132 million |

Alcoa ended the quarter with a cash balance of $1.2 billion, reflecting strong cash management and strategic debt repositioning. The company's total assets stood at $14,574 million, with liabilities amounting to $8,656 million.

Operational Insights and Strategic Initiatives

Alcoa's alumina production decreased slightly to 2.35 million metric tons, while aluminum production was 564,000 metric tons. The company managed its exposure to tariffs through active engagement with policymakers and formed a joint venture to support its San Ciprián operations.

“A positive aluminum market led to stronger results for the first quarter, while we continued to focus on safety, stability, and operational excellence amidst economic uncertainty,” said Alcoa President and CEO William F. Oplinger.

Conclusion

Alcoa Corp (AA, Financial) demonstrated resilience and strategic agility in the first quarter of 2025, achieving significant financial improvements despite market challenges. The company's focus on operational excellence and strategic initiatives positions it well for future growth in the metals and mining industry.

Explore the complete 8-K earnings release (here) from Alcoa Corp for further details.