Tapestry Inc. (TPR, Financial) received an upgrade from BWG Global, moving its outlook from "Mixed" to "Positive." This change is driven by reports of improved sales growth and strategic plan execution for Coach, one of Tapestry's prominent brands.

The upgrade is primarily attributed to a significant uptick in Coach's performance in China during the third fiscal quarter. Sales growth in this key market has been robust, showcasing Coach's successful strategies and market appeal. Additionally, strong sales at U.S. outlets further contribute to the brand's positive momentum.

This positive revision in outlook reflects a strengthened confidence in Tapestry's ability to leverage Coach's growth opportunities, particularly in two of its crucial markets. The evolving consumer trends and improved execution have positioned Tapestry favorably in the luxury goods sector.

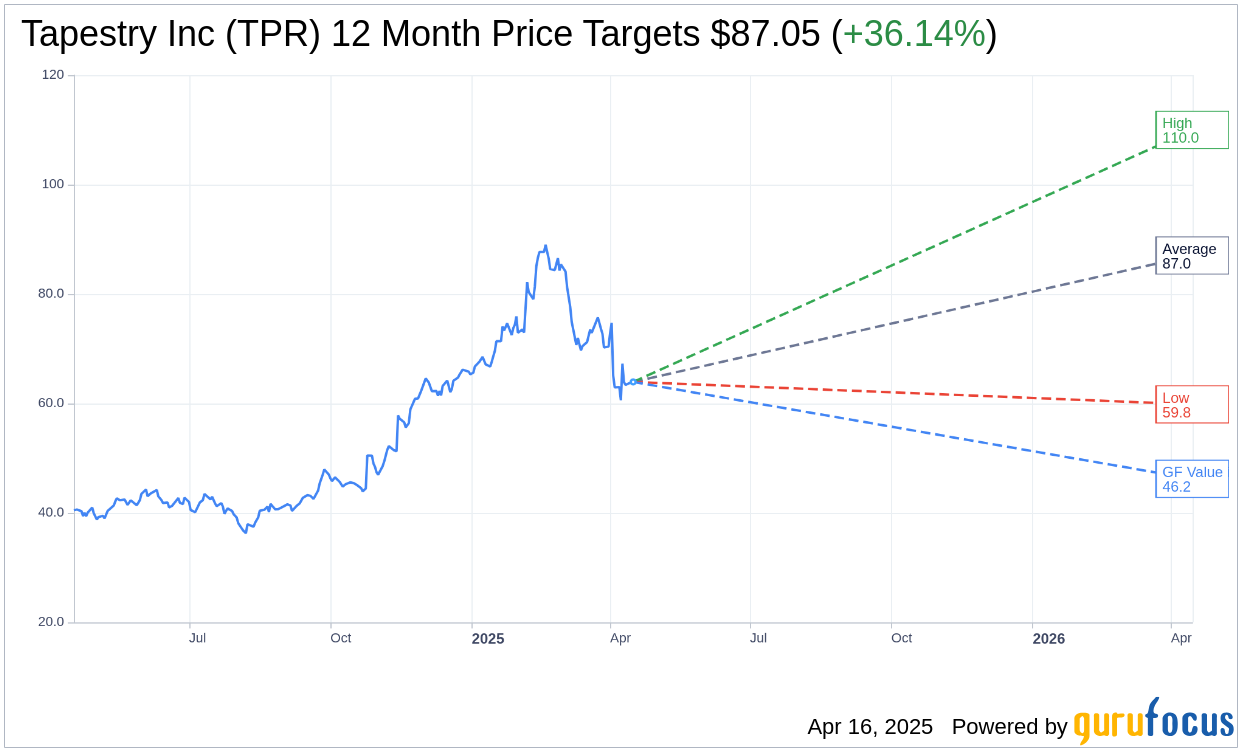

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Tapestry Inc (TPR, Financial) is $87.05 with a high estimate of $110.00 and a low estimate of $59.84. The average target implies an upside of 36.14% from the current price of $63.94. More detailed estimate data can be found on the Tapestry Inc (TPR) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Tapestry Inc's (TPR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Tapestry Inc (TPR, Financial) in one year is $46.23, suggesting a downside of 27.7% from the current price of $63.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Tapestry Inc (TPR) Summary page.