BMO Capital has reinstated its coverage of Royal Gold (RGLD, Financial) with a Market Perform rating and set a price target of $196. The investment firm notes that Royal Gold has excelled in expanding its streaming and royalty portfolio, outperforming its peers in this regard. This strong growth trajectory is expected to benefit the company in the short term, particularly as assets like Pueblo Viejo, Goldrush, and Khoemacau begin to ramp up their operations.

Despite these positive developments, BMO Capital highlights that Royal Gold exhibits the lowest forward-looking growth prospects among the companies within its analyst's coverage. This factor tempers the otherwise optimistic outlook for the company's near-term performance.

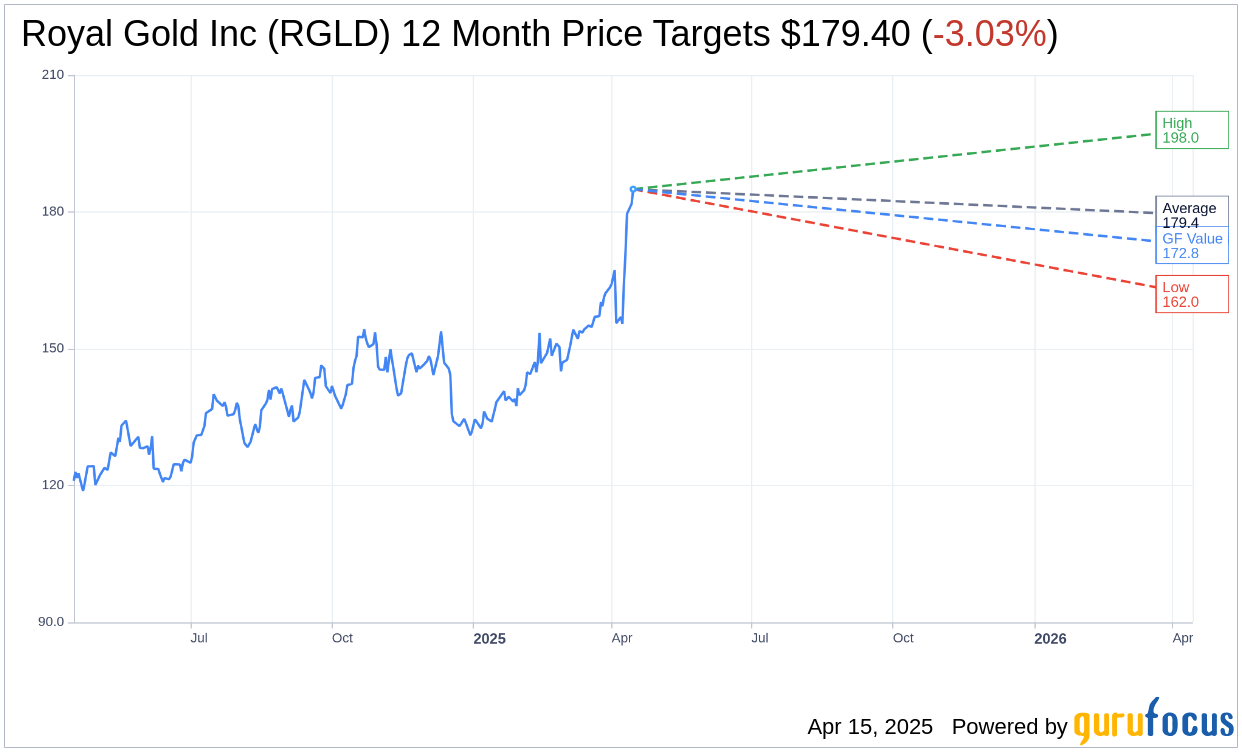

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Royal Gold Inc (RGLD, Financial) is $179.40 with a high estimate of $198.00 and a low estimate of $162.00. The average target implies an downside of 3.03% from the current price of $185.00. More detailed estimate data can be found on the Royal Gold Inc (RGLD) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Royal Gold Inc's (RGLD, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Royal Gold Inc (RGLD, Financial) in one year is $172.77, suggesting a downside of 6.61% from the current price of $185. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Royal Gold Inc (RGLD) Summary page.