Key Takeaways:

- Chevron's stock rating downgraded from 'Outperform' to 'Neutral' by BNP Paribas Exane, with a price target reduction to $140.

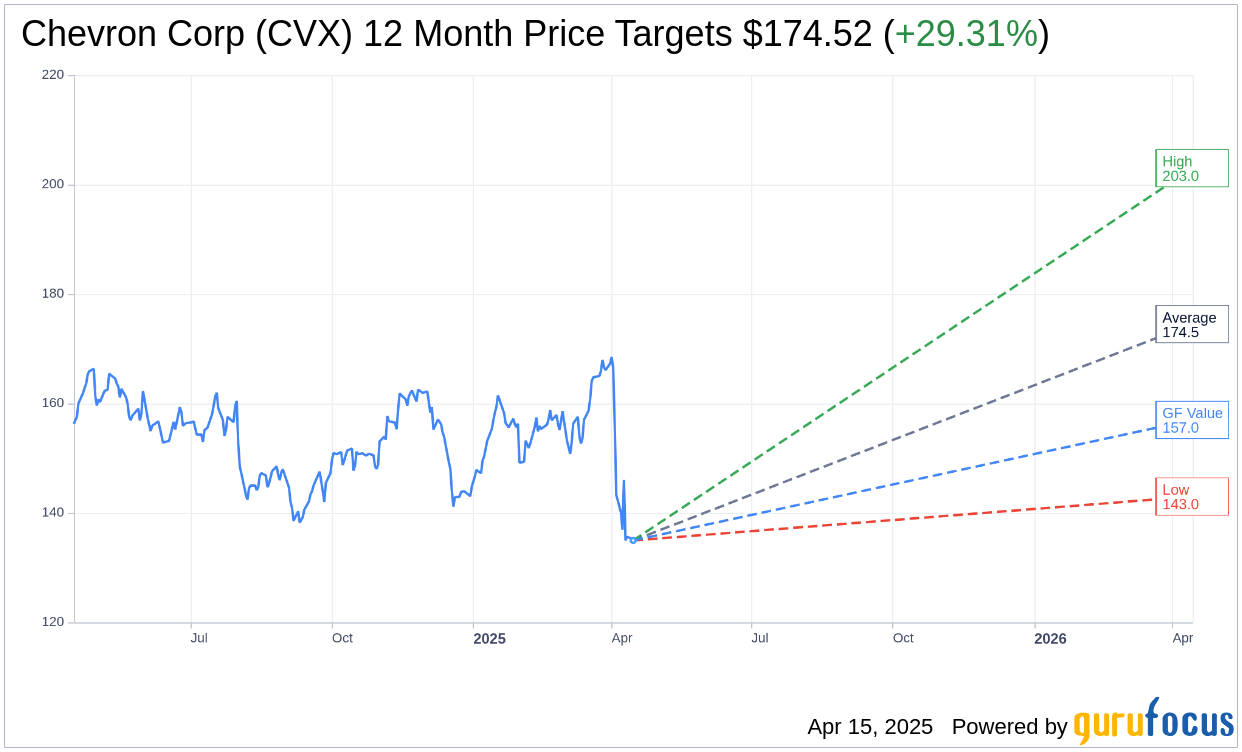

- Analysts still project an average upside potential of 29.31% over the current price.

- GuruFocus GF Value estimate suggests a 16.33% increase from the current stock price.

Chevron's Latest Stock Downgrade: Market Impact and Future Insights

Chevron (CVX, Financial) recently navigated through stock volatility following a downgrade by BNP Paribas Exane. The financial institution adjusted its rating from 'Outperform' to 'Neutral', revising the price target down to $140. This cautious stance stems from uncertainties in oil price trends and potential challenges to Chevron's cash flow, notably concerning its new investment in Hess.

Analyst Predictions: Understanding Market Expectations

Despite the downgrade, Wall Street analysts paint an optimistic picture. From 22 analysts' one-year projections, Chevron Corp (CVX, Financial) carries an average target price of $174.52, with estimates reaching as high as $203.00 and as low as $143.00. This average price target suggests a substantial upside potential of 29.31% from its current position at $134.97. For further insights, visit the Chevron Corp (CVX) Forecast page.

Chevron maintains an "Outperform" status overall, according to 25 brokerage firms, with a consensus rating of 2.1. This scale operates from 1 (Strong Buy) to 5 (Sell), indicating a generally positive market sentiment.

GuruFocus Perspective: Chevron's Valuation Estimate

According to GuruFocus estimates, Chevron Corp (CVX, Financial) exhibits a projected GF Value of $157.00 after one year. This assessment implies a potential increase of 16.33% from its current stock price of $134.965. The GF Value is determined by historical trading multiples, previous business growth, and future performance predictions. For a comprehensive analysis, explore the Chevron Corp (CVX) Summary page.