Barclays has revised its rating for Visteon (VC, Financial), adjusting it from Overweight to Equal Weight. The financial institution also lowered Visteon's price target significantly from $110 to $82. This shift is part of a broader reassessment involving several companies in the autos and mobility sector, driven by the anticipated earnings impact of ongoing tariff issues.

In a comprehensive evaluation, Barclays has shifted its industry outlook for the entire sector to Negative, citing a difficult environment. The firm highlights multiple immediate pressures that pose challenges for investors, including earnings vulnerabilities and potential risks to consumer financial health. Moreover, there is increasing uncertainty surrounding investments in automotive technology.

Particularly, Barclays points out that auto tariffs seem to be a fixture in the current market climate, and the firm argues that current valuations may not fully account for this tariff risk. The downgrade of Visteon is specifically tied to concerns about the slower expected adoption rate of automotive technology, which is increasingly seen as under threat.

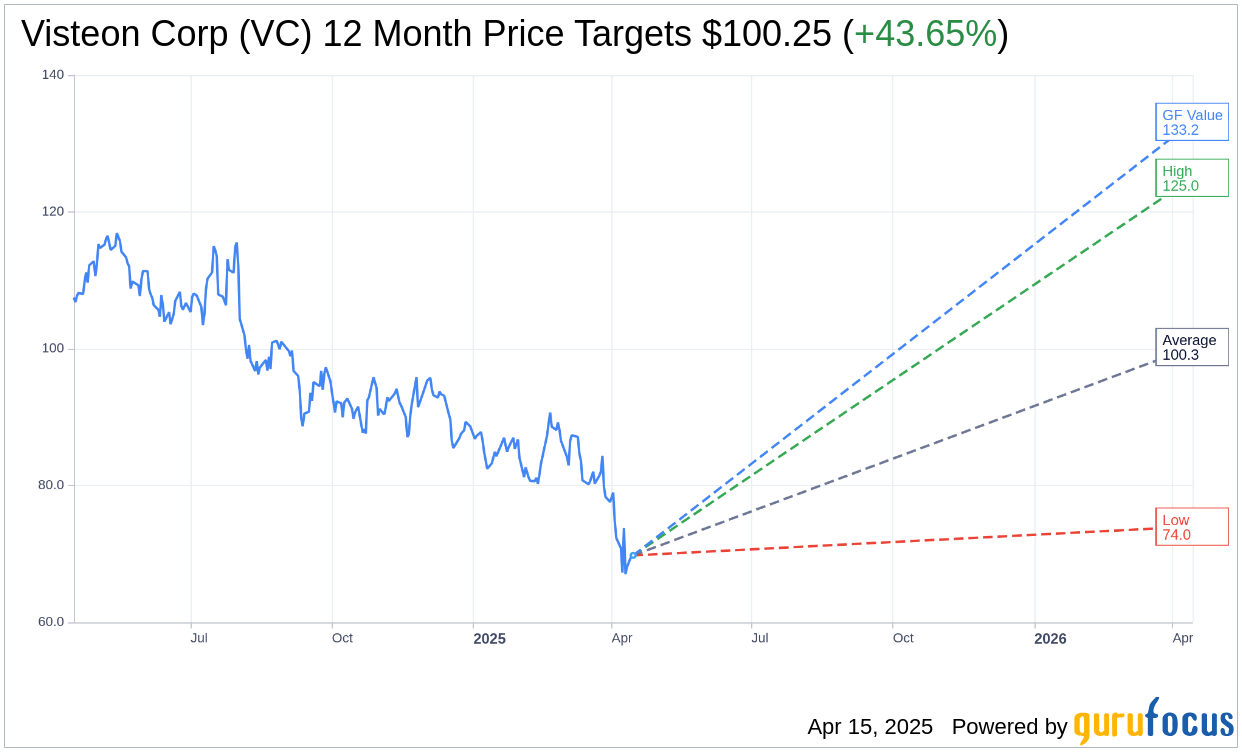

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Visteon Corp (VC, Financial) is $100.25 with a high estimate of $125.00 and a low estimate of $74.00. The average target implies an upside of 43.65% from the current price of $69.79. More detailed estimate data can be found on the Visteon Corp (VC) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Visteon Corp's (VC, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Visteon Corp (VC, Financial) in one year is $133.18, suggesting a upside of 90.83% from the current price of $69.79. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Visteon Corp (VC) Summary page.