Insights from the First Quarter 2025 13F Filing

Robert Olstein (Trades, Portfolio) recently submitted the 13F filing for the first quarter of 2025, providing insights into his investment moves during this period. Robert A. Olstein is the Chairman and Chief Investment Officer of the Olstein Financial Alert Fund (OFALX). He is considered to be an expert in corporate financial disclosure and reporting practices. In 1971, he co-founded the "Quality of Earnings Report" service, which pioneered the concept of using inferential financial screening techniques to analyze balance sheets and income statements to alert institutional portfolio managers to positive or negative factors affecting a company's future earnings power and value of a company's stock. Robert Olstein (Trades, Portfolio) selects stocks by looking behind the numbers. He emphasizes a detailed look behind the numbers of a company's financial statement to assess the company's financial strength and assess potential downside risk. He believes that the Fund's objectives are best met by a "defense first" approach - an approach aimed at minimizing investment errors as opposed to finding companies with the highest appreciation potential without regard for downside risk. To qualify for his selection, a company must generate more cash flow than necessary to sustain the business, avoid aggressive accounting practices, demonstrate balance sheet fundamentals that are consistent with his defense first approach, and be selling at a discount to the private market value. Robert Olstein (Trades, Portfolio) sells a stock when the stock appreciates to his appraised value.

Summary of New Buy

Robert Olstein (Trades, Portfolio) added a total of 3 stocks, among them:

- The most significant addition was PepsiCo Inc (PEP, Financial), with 21,000 shares, accounting for 0.58% of the portfolio and a total value of $3.15 million.

- The second largest addition to the portfolio was Chubb Ltd (CB, Financial), consisting of 9,000 shares, representing approximately 0.5% of the portfolio, with a total value of $2.72 million.

- The third largest addition was Progyny Inc (PGNY, Financial), with 21,000 shares, accounting for 0.09% of the portfolio and a total value of $470,000.

Key Position Increases

Robert Olstein (Trades, Portfolio) also increased stakes in a total of 39 stocks, among them:

- The most notable increase was Avantor Inc (AVTR, Financial), with an additional 212,000 shares, bringing the total to 568,000 shares. This adjustment represents a significant 59.55% increase in share count, a 0.63% impact on the current portfolio, with a total value of $9.21 million.

- The second largest increase was ON Semiconductor Corp (ON, Financial), with an additional 78,000 shares, bringing the total to 154,000. This adjustment represents a significant 102.63% increase in share count, with a total value of $6.27 million.

Summary of Sold Out

Robert Olstein (Trades, Portfolio) completely exited 3 of the holdings in the first quarter of 2025, as detailed below:

- Mastercard Inc (MA, Financial): Robert Olstein (Trades, Portfolio) sold all 4,000 shares, resulting in a -0.37% impact on the portfolio.

- Johnson Outdoors Inc (JOUT, Financial): Robert Olstein (Trades, Portfolio) liquidated all 54,000 shares, causing a -0.31% impact on the portfolio.

Key Position Reduces

Robert Olstein (Trades, Portfolio) also reduced positions in 45 stocks. The most significant changes include:

- Reduced The Middleby Corp (MIDD, Financial) by 32,500 shares, resulting in a -45.77% decrease in shares and a -0.77% impact on the portfolio. The stock traded at an average price of $156.88 during the quarter and has returned -5.31% over the past 3 months and -2.61% year-to-date.

- Reduced SS&C Technologies Holdings Inc (SSNC, Financial) by 34,719 shares, resulting in a -35.43% reduction in shares and a -0.46% impact on the portfolio. The stock traded at an average price of $82.77 during the quarter and has returned 0.62% over the past 3 months and 2.40% year-to-date.

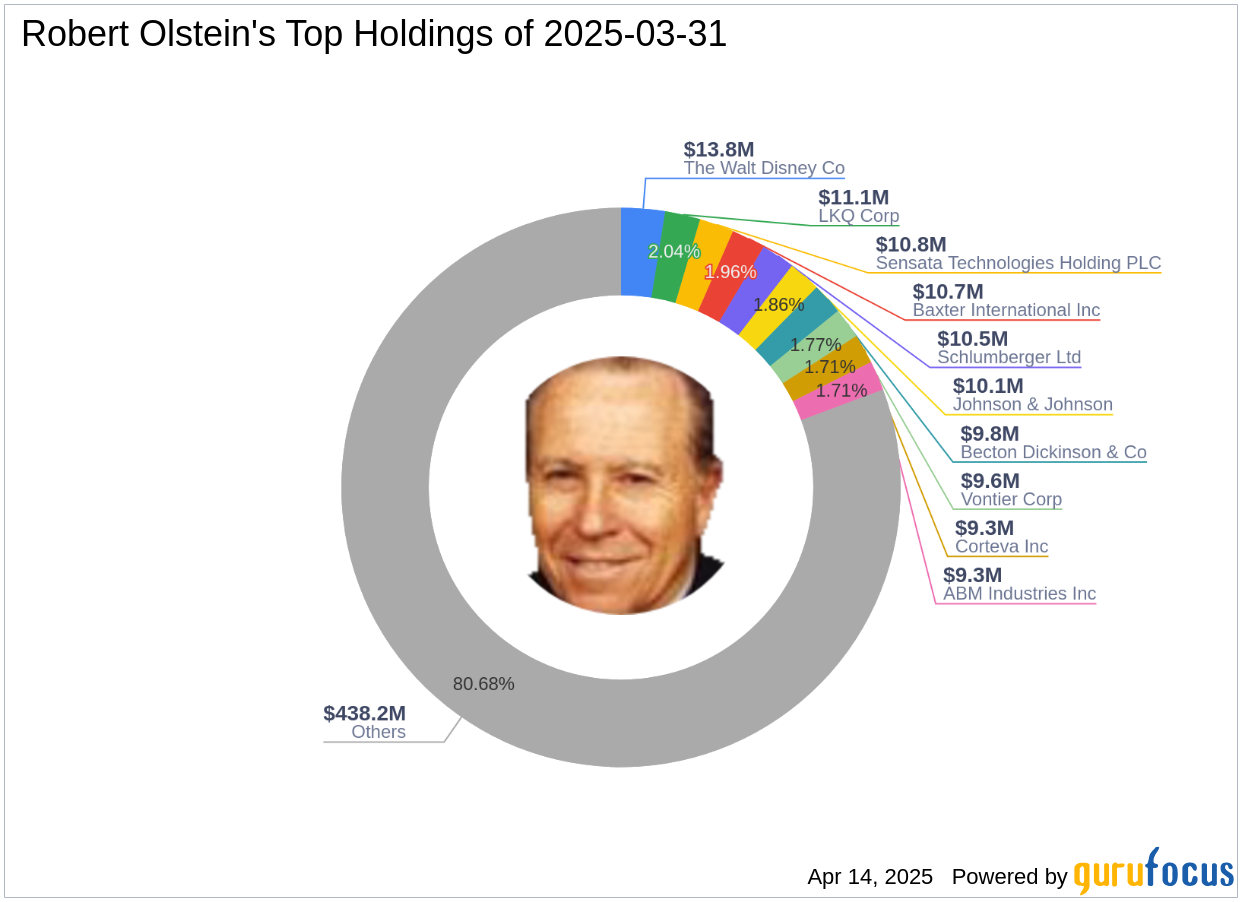

Portfolio Overview

At the first quarter of 2025, Robert Olstein (Trades, Portfolio)'s portfolio included 98 stocks, with top holdings including 2.53% in The Walt Disney Co (DIS, Financial), 2.04% in LKQ Corp (LKQ, Financial), 1.99% in Sensata Technologies Holding PLC (ST, Financial), 1.96% in Baxter International Inc (BAX, Financial), and 1.94% in Schlumberger Ltd (SLB, Financial).

The holdings are mainly concentrated in 10 of all the 11 industries: Industrials, Healthcare, Technology, Financial Services, Consumer Cyclical, Communication Services, Consumer Defensive, Basic Materials, Real Estate, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: