Summary:

- WELL Health Technologies Corp. will announce its Q4 and full-year 2024 financial results on April 14, 2025.

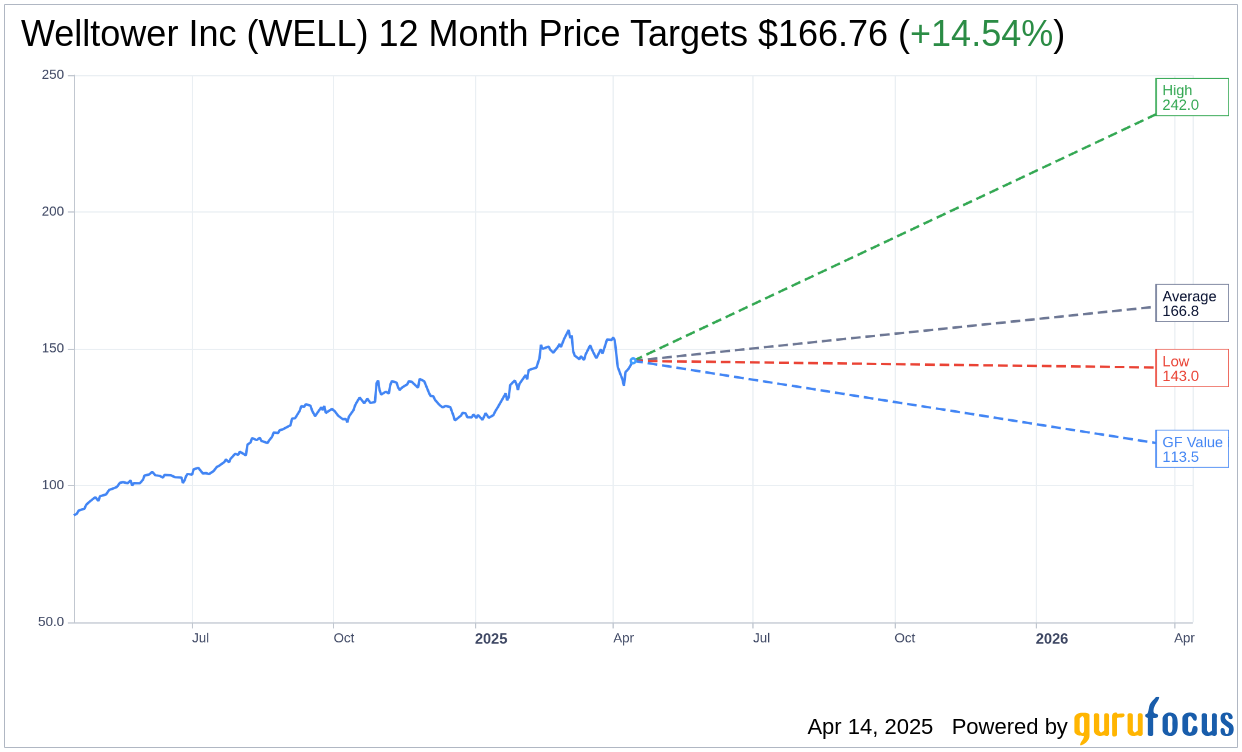

- Analyst consensus reveals a price target of $166.76, suggesting a potential increase from current levels.

- GuruFocus estimates indicate a possible downside based on the GF Value metric.

WELL Health Technologies Corp. (WELL, Financial), a pivotal player in the digital healthcare space, is gearing up to publish its financial performance figures for the fourth quarter and full-year 2024 on April 14, 2025, post-market close. Investors should mark their calendars for the subsequent day, April 15, when the company will hold a detailed conference call to delve into these results.

Wall Street Analysts Forecast

Currently, 17 seasoned analysts have weighed in on Welltower Inc (WELL, Financial), presenting a one-year average target price of $166.76. This target suggests a promising upside of 14.54% from the present trading price of $145.59. The projections range from a high of $242.00 to a low of $143.00, reflecting diverse perspectives on the stock's potential. For a deeper look into these estimates, you can visit the Welltower Inc (WELL) Forecast page.

Furthermore, the consensus from 19 brokerage firms places Welltower Inc (WELL, Financial) at an average brokerage recommendation of 1.8. This indicates an "Outperform" status on a scale where 1 represents a Strong Buy and 5 a Sell, underscoring the positive sentiment surrounding the stock.

Turning to proprietary metrics, GuruFocus estimates project a GF Value for Welltower Inc (WELL, Financial) at $113.45 in the coming year. This estimation represents a potential downside of 22.08% from the stock’s current market price of $145.59. The GF Value calculation relies on historical multiples, past business growth, and future performance predictions. Detailed insights are available on the Welltower Inc (WELL) Summary page.

As the release date for the financial results approaches, investors should remain vigilant, considering both the bullish analyst forecasts and the cautious GF Value estimates, which together present a nuanced outlook for Welltower Inc (WELL, Financial).