Bank of America (BofA) has revised its price target for Red Rock Resorts (RRR, Financial), lowering it from $57.50 to $50 while maintaining a Neutral rating on the stock. This adjustment arises as part of the firm's broader overview of the gaming sector for the first quarter.

The company anticipates a more reserved approach from industry operators, particularly due to ongoing tensions between the United States and China, leading it to place its estimates 5% below the consensus in Macau. Despite this, BofA notes that there is no visible decline in Las Vegas operations from management perspectives. However, it asserts that investors are keeping a close watch on any potential changes in visitor numbers, booking patterns, cancellations, or consumer behavior, especially at the close of March and into early April.

In terms of regional performance, BofA observed a stable visitation trend, with some improvements in March, attributed to more favorable weather conditions. However, they have revised their gaming sector EBITDA estimates for 2025 to sit 2% below the market consensus, reflecting broader consumer and economic concerns.

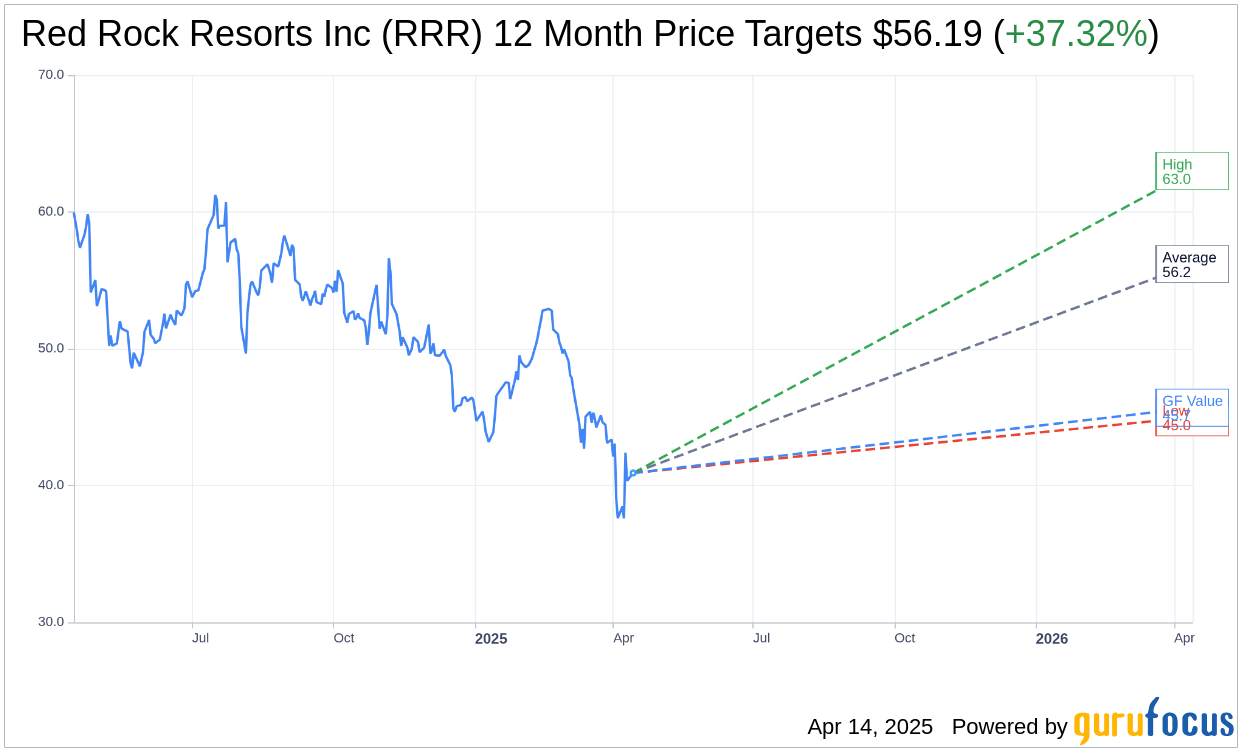

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Red Rock Resorts Inc (RRR, Financial) is $56.19 with a high estimate of $63.00 and a low estimate of $45.00. The average target implies an upside of 37.32% from the current price of $40.92. More detailed estimate data can be found on the Red Rock Resorts Inc (RRR) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Red Rock Resorts Inc's (RRR, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Red Rock Resorts Inc (RRR, Financial) in one year is $45.69, suggesting a upside of 11.66% from the current price of $40.92. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Red Rock Resorts Inc (RRR) Summary page.