Morgan Stanley analyst Alain Gabriel has slightly adjusted the price target for ArcelorMittal (MT, Financial), reducing it from EUR 29.80 to EUR 29.70. Despite this minor adjustment, the firm maintains an Equal Weight rating on the company's shares.

The revision reflects ongoing evaluations and market considerations pertinent to ArcelorMittal's performance and outlook. Stakeholders may interpret this as a signal of Morgan Stanley's consistent view on the company's current valuation and its future market position.

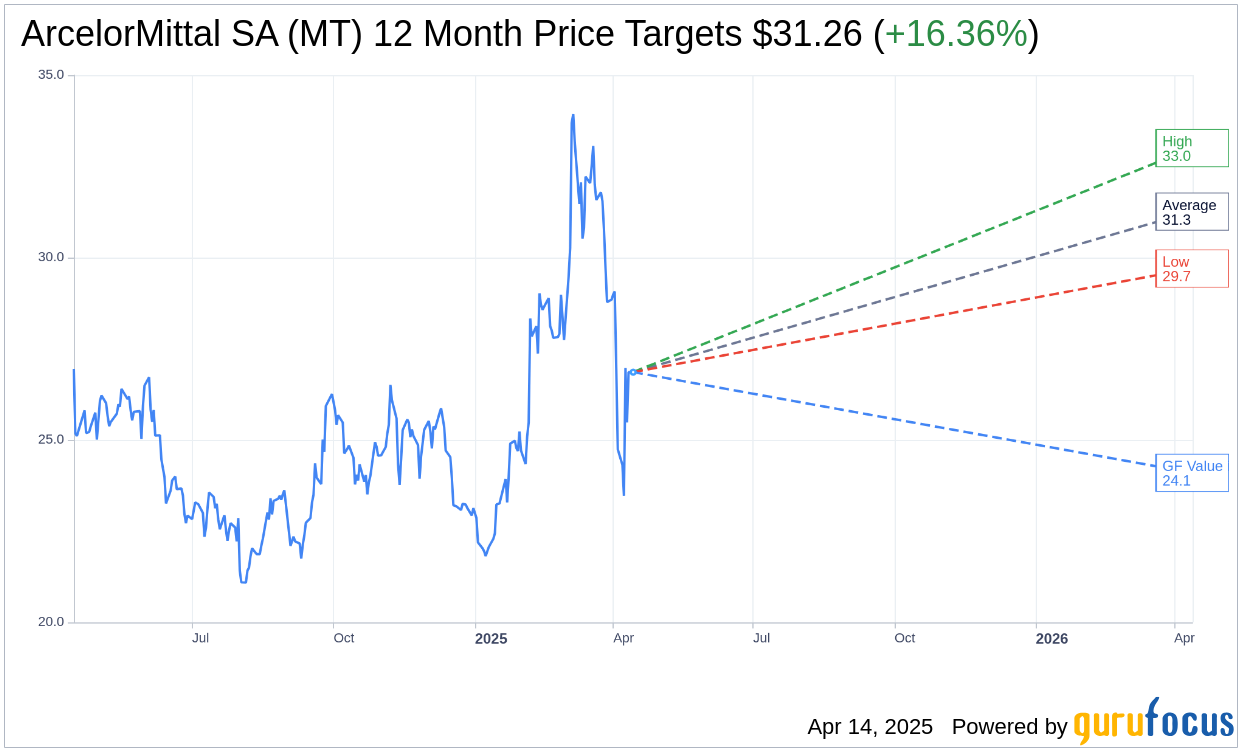

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for ArcelorMittal SA (MT, Financial) is $31.26 with a high estimate of $33.00 and a low estimate of $29.70. The average target implies an upside of 16.86% from the current price of $26.75. More detailed estimate data can be found on the ArcelorMittal SA (MT) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, ArcelorMittal SA's (MT, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ArcelorMittal SA (MT, Financial) in one year is $24.10, suggesting a downside of 9.91% from the current price of $26.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ArcelorMittal SA (MT) Summary page.