Bank of America (BofA) has revised its price target for Revvity (RVTY, Financial), decreasing it from $143 to $116. Despite this adjustment, the bank maintains a Buy rating on the stock. The life sciences and diagnostics sector, including contract research organizations, is experiencing a notably pessimistic outlook as earnings reports approach.

The cautious sentiment is largely attributed to a series of policy shifts originating from the Trump Administration, which are impacting these companies. Key challenges include reductions in the National Institutes of Health (NIH) budget, international tariffs, and broader macroeconomic issues, particularly concerning China. These factors are contributing to an uncertain business environment for Revvity and its peers as they navigate the intersection of these policy changes.

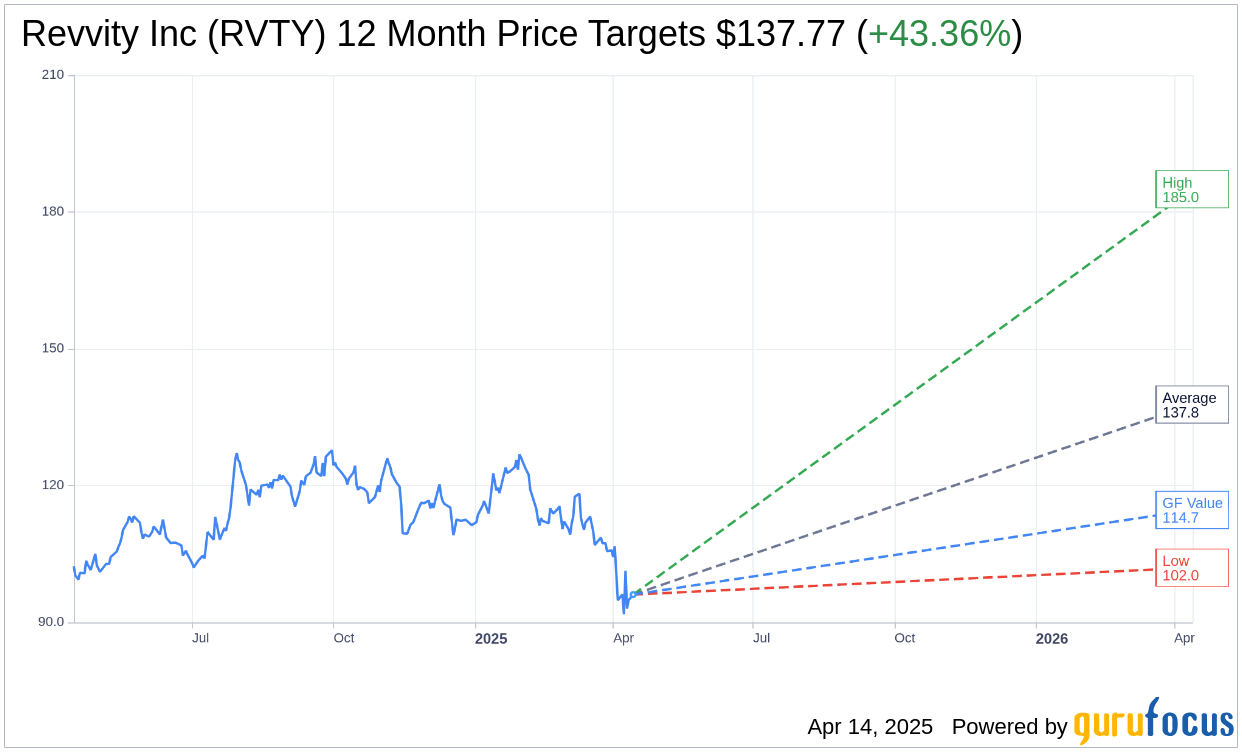

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Revvity Inc (RVTY, Financial) is $137.77 with a high estimate of $185.00 and a low estimate of $102.00. The average target implies an upside of 43.36% from the current price of $96.10. More detailed estimate data can be found on the Revvity Inc (RVTY) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Revvity Inc's (RVTY, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Revvity Inc (RVTY, Financial) in one year is $114.65, suggesting a upside of 19.3% from the current price of $96.1. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Revvity Inc (RVTY) Summary page.