Morgan Stanley has revised its price target for Cheesecake Factory (CAKE, Financial), decreasing it from $40 to $39. The firm's analyst, Brian Harbour, has maintained an Underweight rating on the stock, indicating a cautious outlook ahead of the company’s first-quarter earnings announcement.

While the upcoming quarterly results are not the main focus, Morgan Stanley has adjusted its forecast for U.S. industry demand growth to 4.1% year-over-year. This represents a decline from the previous estimate of 4.8% made in January. The revision comes in light of recent developments, including a pause in tariff actions.

Investors will be closely watching how Cheesecake Factory navigates these industry conditions during its earnings report, with Morgan Stanley's updated projections serving as a notable backdrop.

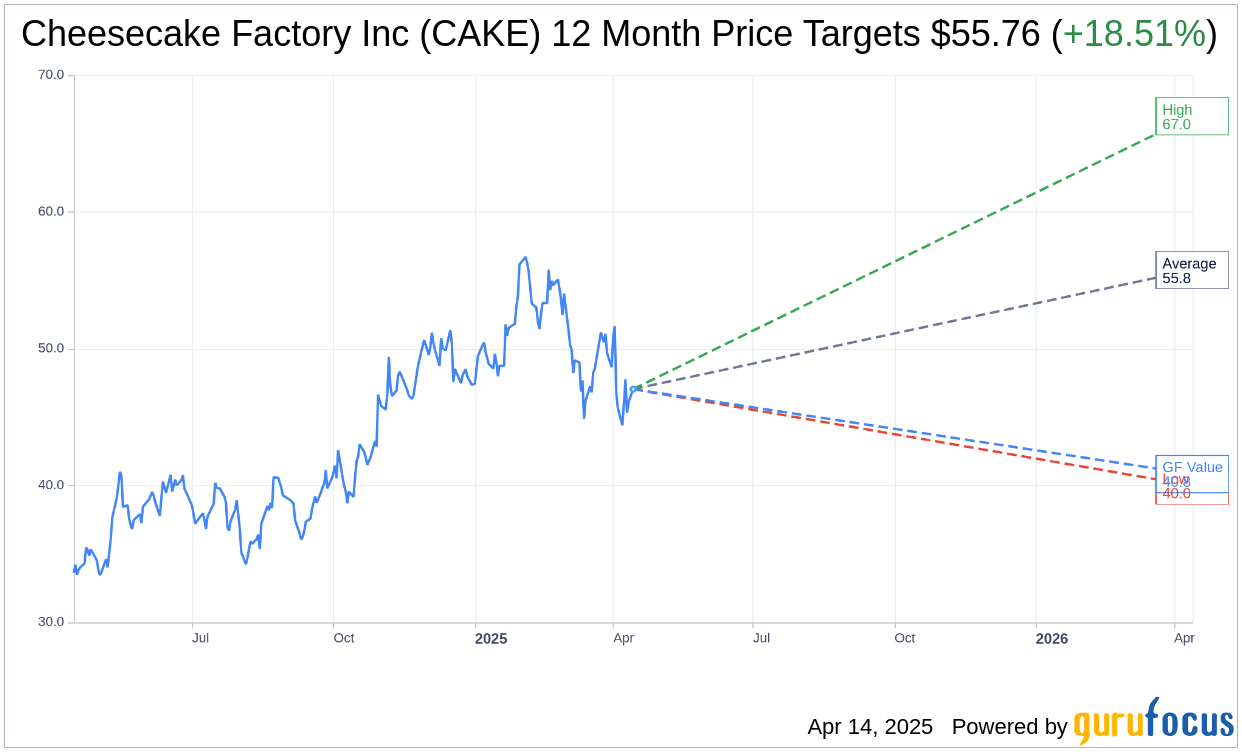

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Cheesecake Factory Inc (CAKE, Financial) is $55.76 with a high estimate of $67.00 and a low estimate of $40.00. The average target implies an upside of 18.51% from the current price of $47.06. More detailed estimate data can be found on the Cheesecake Factory Inc (CAKE) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Cheesecake Factory Inc's (CAKE, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cheesecake Factory Inc (CAKE, Financial) in one year is $40.84, suggesting a downside of 13.21% from the current price of $47.055. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cheesecake Factory Inc (CAKE) Summary page.