Susquehanna has revised its price target for Nabors Industries (NBR, Financial), reducing it from $45 to $32 while maintaining a Neutral rating on the company's shares. This adjustment comes as the oilfield services sector faces a potentially tougher year than initially anticipated, influenced by various factors.

The firm notes a decline in crude oil prices as a significant concern, coupled with economic uncertainties driven by geopolitical tensions and governmental policies. These factors are likely to affect customer spending patterns, either altering or postponing planned investments.

As the first-quarter earnings season approaches, Susquehanna highlights that the combination of increased economic risks and lower crude prices, alongside minimal improvements in industry activities, contributes to a more bearish outlook. This scenario presents more downside risk than upside potential for U.S. and international spending forecasts for the remainder of the year.

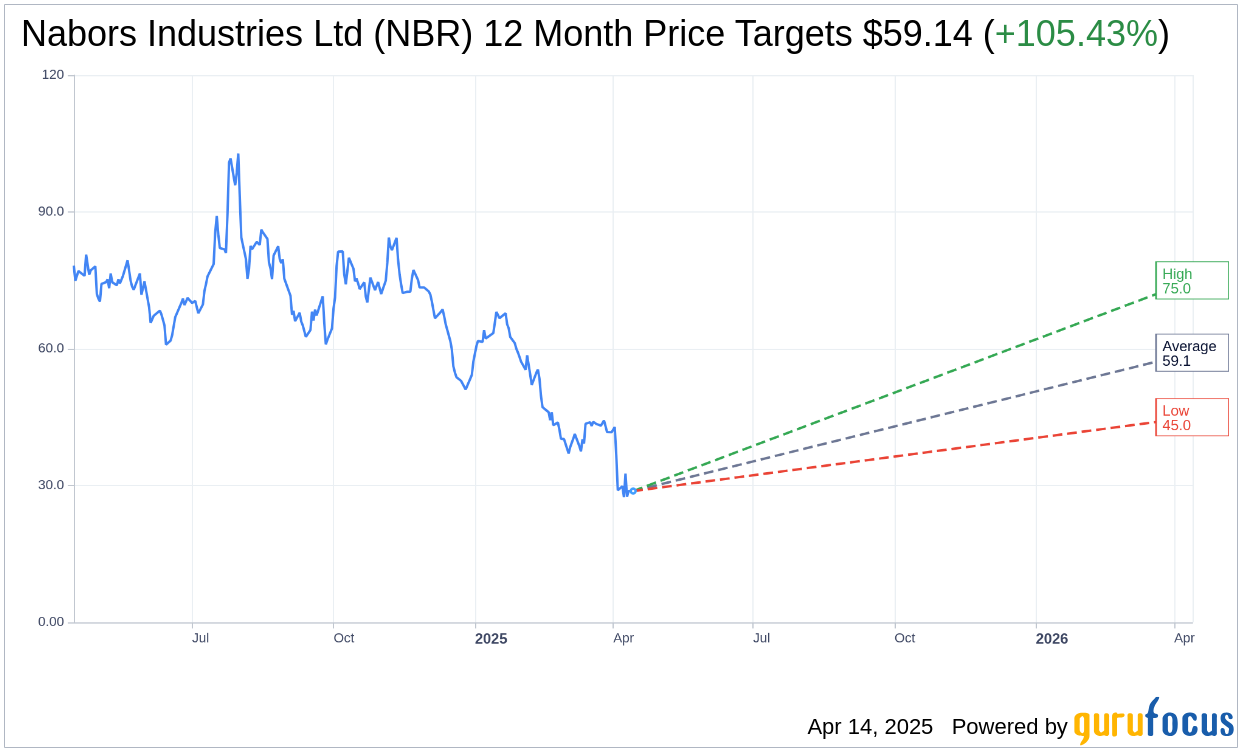

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Nabors Industries Ltd (NBR, Financial) is $59.14 with a high estimate of $75.00 and a low estimate of $45.00. The average target implies an upside of 105.43% from the current price of $28.79. More detailed estimate data can be found on the Nabors Industries Ltd (NBR) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Nabors Industries Ltd's (NBR, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Nabors Industries Ltd (NBR, Financial) in one year is $122.08, suggesting a upside of 324.04% from the current price of $28.79. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Nabors Industries Ltd (NBR) Summary page.