Bank of America analyst Andrew Obin has revised the price target for Rockwell Automation (ROK, Financial), reducing it from $305 to $250. Despite maintaining a Neutral rating on the stock, this adjustment reflects increased caution due to prevailing uncertainties and tariff concerns.

The analysis comes in the context of BofA’s broader outlook for its Industrials/Multi-Industry sector coverage. The firm anticipates that first-quarter earnings will either meet or exceed expectations. However, given the ongoing volatility and the complexities surrounding tariffs, even with the recent 90-day suspension of reciprocal tariffs announced on April 9, the firm has preemptively adjusted its earnings estimates.

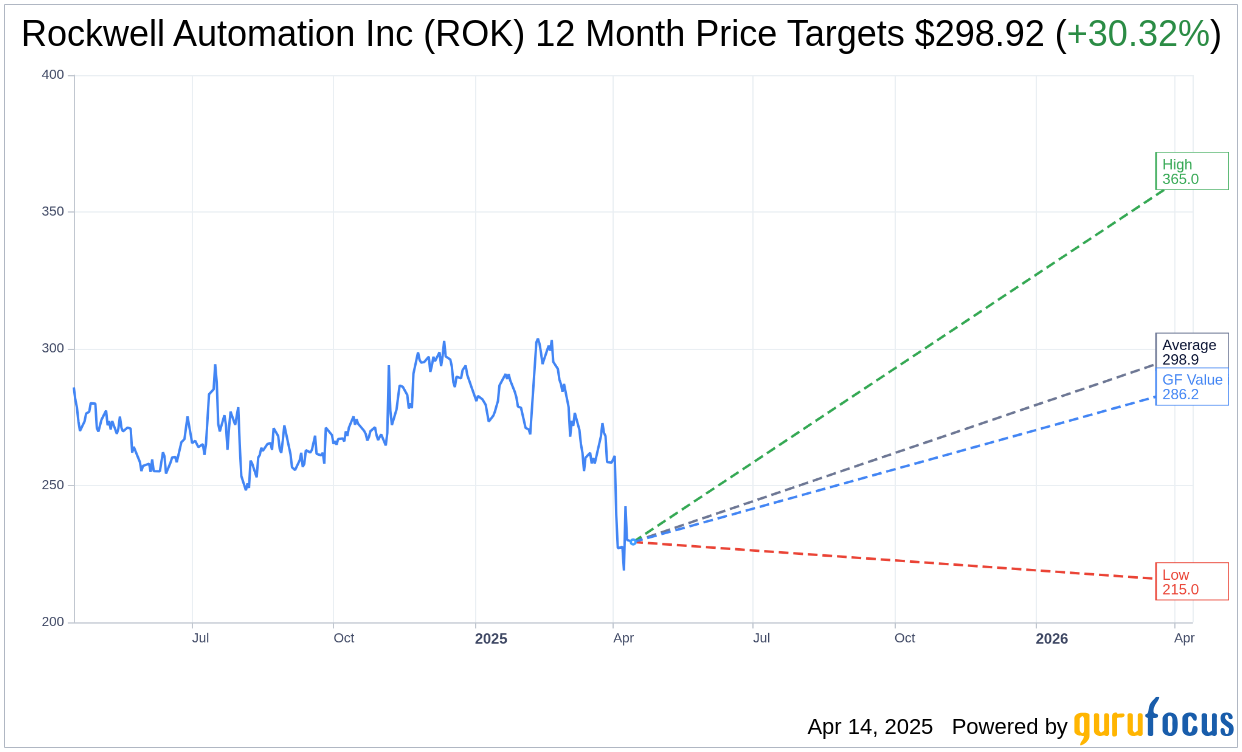

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for Rockwell Automation Inc (ROK, Financial) is $298.92 with a high estimate of $365.00 and a low estimate of $215.00. The average target implies an upside of 30.32% from the current price of $229.38. More detailed estimate data can be found on the Rockwell Automation Inc (ROK) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, Rockwell Automation Inc's (ROK, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rockwell Automation Inc (ROK, Financial) in one year is $286.20, suggesting a upside of 24.77% from the current price of $229.38. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rockwell Automation Inc (ROK) Summary page.